There’s lots of talk about the top 7 tech stocks (AAPL, MSFT, GOOGL, META, AMZN, TSLA, NVDA) being responsible for most of the market’s gains…and therefore we should not get overly excited about the forward prospects.

Given that we don’t want to accept the things we hear, let’s check out the broad industry groups to see if there’s strength elsewhere. If most of the gains come from the top 7 stocks, fine. But let’s check it out for ourselves.

How well the market is supported? Is strength broad based or concentrated?

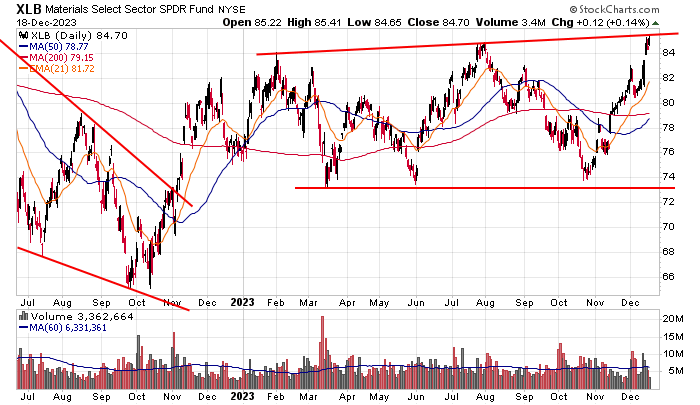

XLB – Materials have rolled up and down in a range this year but have recently printed a 52-week high. I’m going to still call it neutral. When a group can go from a 52-week low to a 52-week high in such a short time, the trendless overall movement is more telling than anything else.

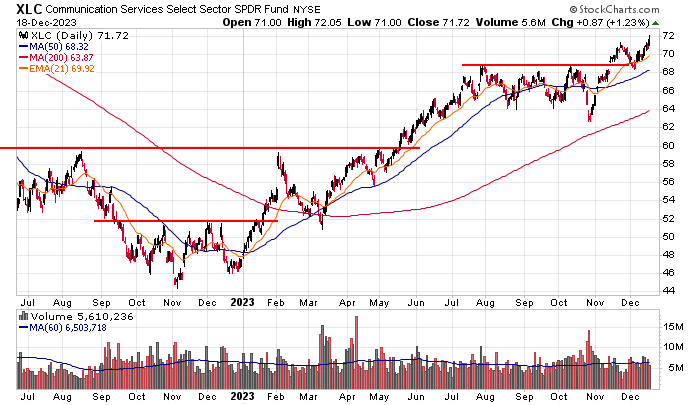

XLC – Communications is dominated by META and GOOGL, both of which have had great years. There have been a few dips, but with the trend in place, you can’t argue with new highs.

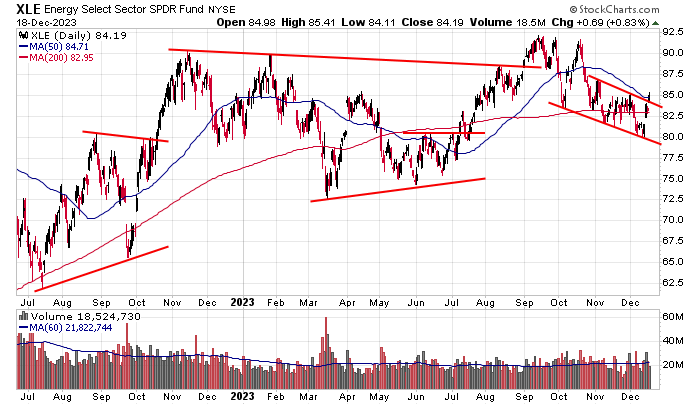

XLE – Energy has been lackluster. Sitting right here in the mid 80’s is a good place for XLE – not too high, not too low. A lower price would imply economic weakness. A high price might hint at stubborn inflation. Somewhere in the middle is perfect.

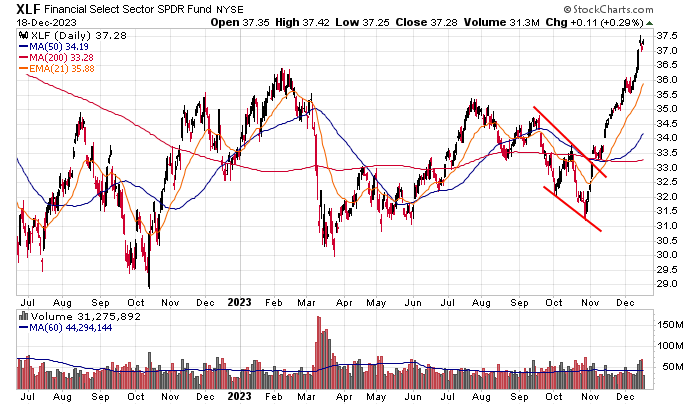

XLF – Financials were dead money for a long time but are now in stealth mode. Many banks have posted solid gains, and the group chart is at a new high.

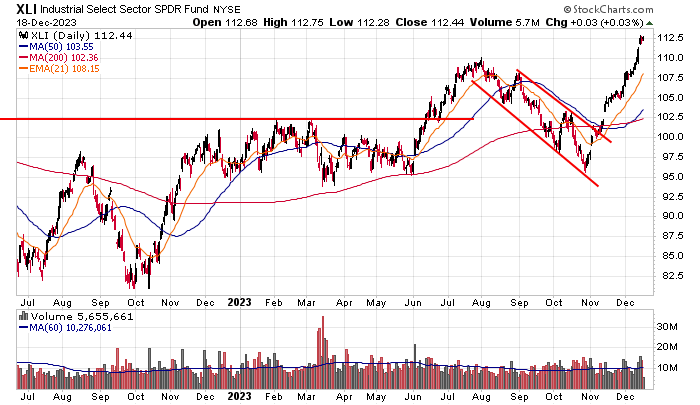

XLI – Industrials broke out in June and ran up some…but gave it all back (plus some) when the market dropped Aug-Oct. But that selling is long gone. New highs are in place.

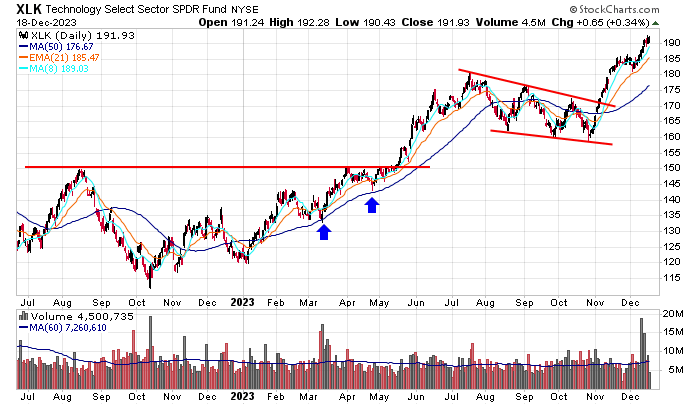

XLK – Tech is dominated by MSFT and AAPL. This is a clean and orderly chart. A breakout and rally was followed by a few months of consolidation which then resolved up.

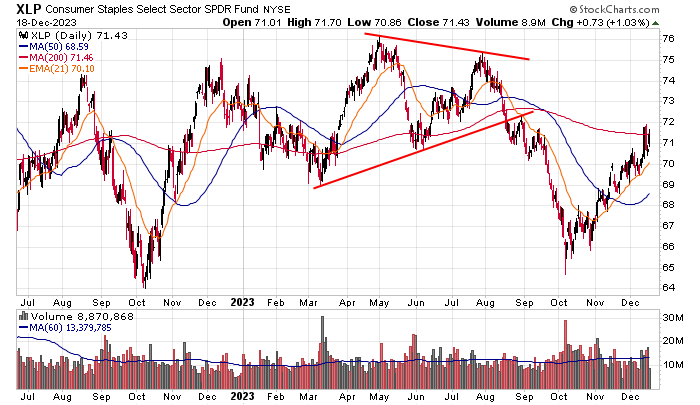

XLP – Consumer Staples have swung in both directions, but nothing has lasted. That’s okay. If the market is healthy, investors should not be excited about toothpaste and toilet paper.

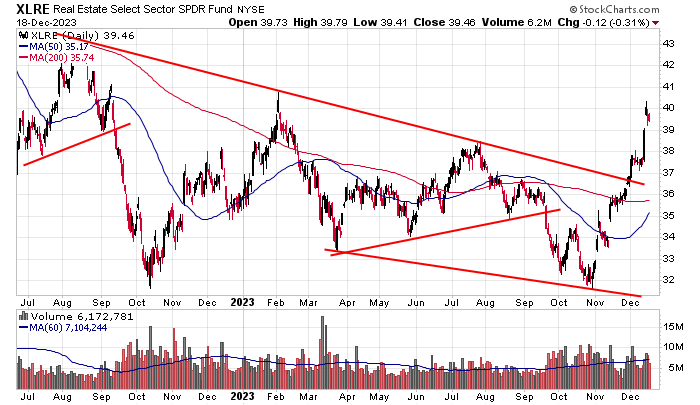

XLRE – Real Estate has gone vertical since printing a new low in October. Believe it or not, real estate tends to be a leading group at the beginning stages of an economic recovery. Given the headwind of high rates and issues in the commercial real estate market, it’s encouraging to see this group doing so well.

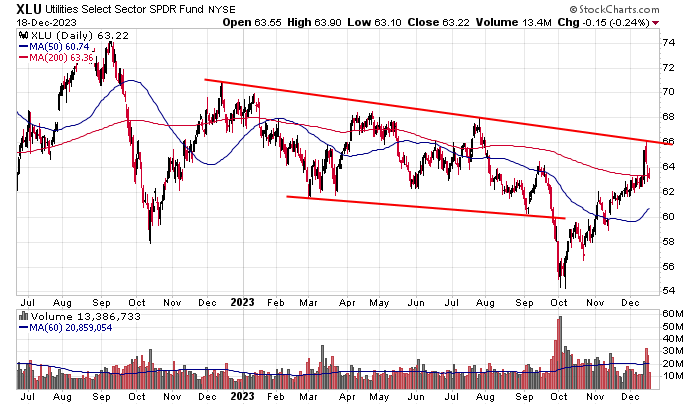

XLU – Utilities caught a bid off the October low. The prospect of lower rates helps. Eventually the dividends will be attractive again…but not yet.

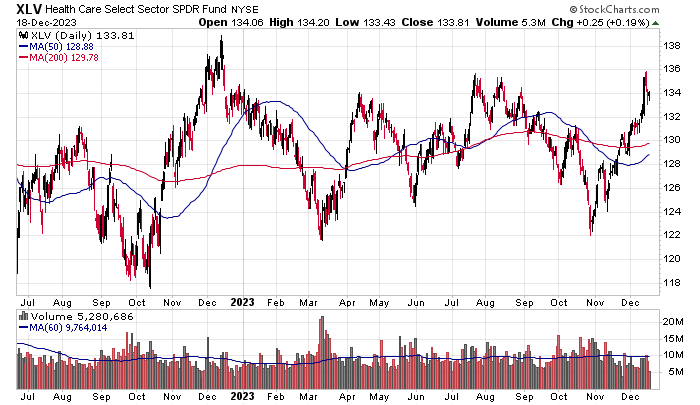

XLV – Health Care continues to be dead money.

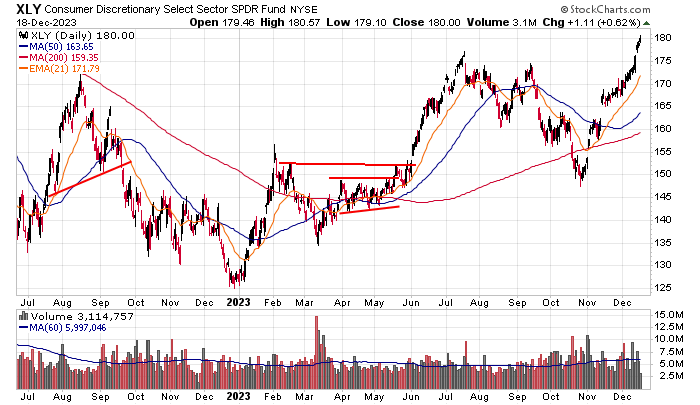

XLY – Consumer Discretionary, which is dominated by AMZN and TSLA, is at a new high. It hasn’t been a smooth ride, but there it is, thanks to a nearly-vertical run the last two months.

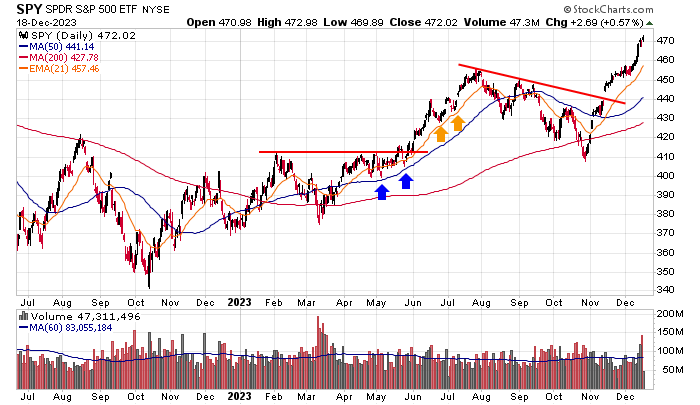

SPY – the S&P 500: The net of the above is a market that’s trended up for 14 months and is at a new high. And if you included dividends, it’s at an all-time high.

Overall Observations

Oil is the only group that has not fully participated in the rally off the October lows. The market has gone vertical, and nearly all of these groups have done the same.

Materials, communication, financials, industrials, tech and discretionary are at 52-week highs.

Yes, the biggest 7 stocks have done well this year and carry an outsized influence, but many other stocks and several other groups are doing great too.

Breadth is solid. The market’s highs are supported. This is not a market being dragged higher by a small number of stocks.

This market is not thin. Participation is very good. There are trades to be had in many parts of the market.