Good morning. Happy Friday.

The Asian/Pacific markets mostly did great. Japan, South Korea, India, Taiwan, Australia, Indonesia, Singapore, Thailand and the Philippines did well; China and Hong Kong were weak. Europe, Africa and the Middle East are doing well. Russia is weak, but Poland, France, Germany, Greece, South Africa, Switzerland, Spain, the Netherlands, Italy, Portugal, Sweden and Saudi Arabia are doing well. Futures in the States point to a moderate positive open for the S&P but a down open for the Russell 2000.

————— VIDEO: State of the Market —————

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are down.

Stories/News from Seeking Alpha…

Getting the job done

Earnings season made splashy headlines this week, with notable tech giants front and center in the latest round of quarterly results. See more on those below as investors continue to size up the state of the market and the companies helping power the AI revolution. Eyes were also on the latest statements from Fed Chair Jerome Powell (who will appear again on 60 Minutes this Sunday), but central bank watchers will have one more big data point to digest before then with the release of non-farm payrolls at 8:30 AM ET.

Jobs Day: Policymakers need more evidence that the labor market is softening and wage gains are moderating before choosing the next step for monetary policy. Right now, things are in wait-and-see mode as Fed officials take a more measured approach. It’s a delicate balancing act as the central bank strives to achieve a so-called soft landing, where inflation returns to the 2% level without causing a recession.

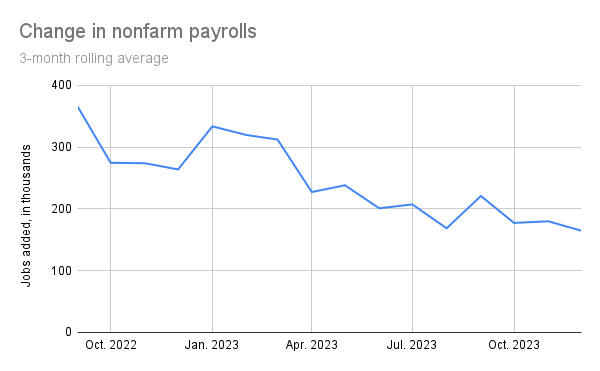

If it fulfills the central bank’s wishes, the number of jobs seen this morning will continue to subside through January. Economists are expecting just that, with the consensus at 170K, down from 216K reported in December and the outsized 504K reported in January 2023. The unemployment rate is expected to tick up to 3.8% from 3.7% in December, which would be another welcome sign. While there have been some surprises in the past, and the numbers can be choppy from month to month, the overall 3-month rolling average for nonfarm payrolls growth has been declining fairly steadily as seen in the chart below.

SA commentary: “The labor market is still in imbalance – the labor demand exceeds the labor supply,” according to analyst Damir Tokic. “There is a labor shortage, and it has to do with demographics and politics, but further analysis shows there are structural issues.” See January Payrolls Preview: The Labor Market Is Still Tight, And That’s A Problem (5 comments)

First dividend

Meta Platforms (META) soared 15.2% AH on Thursday to a record $454.81/share as Q4 earnings smashed expectations. An announcement of the company’s first-ever dividend also stunned investors, while the social media giant increased its stock buyback authorization by $50B and guided to the upside for Q1 revenues. “We had a good quarter as our community and business continue to grow,” CEO Mark Zuckerberg declared. “We’ve made a lot of progress on our vision for advancing AI and the metaverse.” SA analyst Steven Fiorillo followed up on the results by saying that “Meta is setting up for a record-breaking year” and he “wouldn’t be surprised if it follows Amazon (AMZN) and Alphabet (GOOGL) in splitting its shares sometime in 2024.” (143 comments)

iEarnings

Apple (AAPL) was also in the spotlight as concerns about the tech behemoth’s presence in China outweighed the end of four straight quarterly sales declines. The stock fell 2.9% to $181.45/share in extended trading, though Apple’s Services revenue hit an all-time high. “I remain very optimistic about China over the long term,” CEO Tim Cook countered on an earnings call when asked about the market. The report comes just a day before Apple launched its first new major product in a decade – Vision Pro. “Apple announced a decent set of Q1 results, but the company overall just isn’t growing that fast right now,” noted SA analyst Bill Maurer. (85 comments)

Robust revenue

AI was also a theme at Amazon (AMZN), with a new shopping assistant called Rufus that uses generative artificial intelligence to help search for products. Meanwhile, Q4 operating income came in above expectations, while the firm set strong Q1 guidance, sending AMZN shares up 7.1% to $170.60. “AWS’ continued long-term focus on customers and feature delivery, coupled with new Gen AI capabilities like Bedrock, Q, and Trainium, are starting to be reflected in our overall results,” said CEO Andy Jassy. CFO Brian Olsavsky noted that revenues are accelerating rapidly across all three layers in the Gen AI stack, despite being in relatively early days. (49 comments)

Today’s Economic Calendar

Auto Sales

8:30 Non-farm payrolls

10:00 Consumer Sentiment

10:00 Factory Orders

1:00 PM Baker Hughes Rig Count

What else is happening…

EU overcomes threat of Hungary veto to seal $54B aid for Ukraine.

NY Community Bancorp (NYCB) slides further after two downgrades.

Plug Power (PLUG) ramps up hydrogen production; peers surge.

DocuSign (DOCU) sinks as banks eye funding potential $13B buyout.

Palantir (PLTR) partners with Australian retailer Coles Supermarkets.

Intel (INTC) delays construction timetable for $20B Ohio chip facility.

Qualcomm’s (QCOM) share loss at Samsung puts damper on results.

Twilio pares gain as messaging startup Bird considers takeover offer.

Mattel (MAT) moves: Activist calls for sale of Fisher Price, American Girl.

Peloton (PTON) hits all-time low after CEO outlines ongoing challenges.

—————

Good morning. Happy Thursday.

The Asian/Pacific markets were split. Hong Kong and South Korea moved up; Japan, China and Australia moved down. Europe, Africa and the Middle East lean to the upside. Denmark, Poland, Turkey, Hungary, Austria, Sweden and Saudi Arabia are up; France, South Africa, Finland, and Israel are down. Futures in the States point to a moderate gap up open for the cash market.

————— VIDEO: State of the Market —————

The dollar is up. Oil is up; copper is down. Gold and silver are down. Bonds are up.

Stories/News from Seeking Alpha…

Reality check

All eyes are on technology earnings this afternoon as Amazon (AMZN), Apple (AAPL) and Meta (META) report the last slate of Big Tech results. Apple investors have an additional reason to be on the lookout, with the company’s first major product release since the Apple Watch came to market in 2015. It’s a big deal for a tech giant that’s been pulling levers to boost its revenue growth, which has now declined for four straight quarters, though fiscal 2024 looks slightly better, with sales growth expected to rise 3.4% Y/Y.

Era of spatial computing? Called the Vision Pro, Apple’s mixed reality headset will launch in the U.S. tomorrow, just hours after shareholders see the company’s latest financials (expect some conference call comments). The device starts at $3,499, meaning it could be a “very niche product for a while,” and while skepticism exists in some circles, others are more optimistic. “Two years from now we see this being a $1,500 device that will resemble sunglasses,” Wedbush Securities analyst Dan Ives told Seeking Alpha. “This is just the first version of a broader strategy.”

Popular features can make users feel like Tony Stark, with the ability to type without a keyboard, gesture in midair to control the interface, and the presence of apps that can float in their workspace. The Vision Pro also uses EyeSight technology that reveals a user’s eyes and alerts others to know when a person is using apps or immersed in an experience, alleviating the feeling of isolation often associated with other headsets. An R1 chip is on board to help the device’s M2 chip process input from 12 cameras, five sensors and six microphones, but similar to the Meta (META) Quest Pro, the Vision Pro only has about two hours of battery life before needing an outlet.

Outlook: The global headset market is expected to hit roughly $12.5B this year before reaching $57.2B by 2029, according to Precedence Research. Assuming Apple had 50% of the market by 2029 (it has 53% of the U.S. smartphone market), that would be worth slightly more than $28B in annual revenue. The degree of success of Apple’s new headset will also heavily depend on third-party developer support and the time needed to build apps and features. Is this the next iPhone moment for the company? See what WSB subscribers think about Apple’s Vision Pro.

March madness

It’s settled – there will likely be no interest rate cut next month, although Fed Chair Jerome Powell signaled it could happen at some point this year. “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that,” he said after the Fed maintained its policy rate at 5.25%-5.50% yet again. “We need to see more evidence that tells us we are on a sustainable path to 2% inflation.” Such confirmation and other hawkish comments pushed stock markets and yields lower. “Powell is concerned that the timing of the cut has to be immaculate,” noted Yimin Xu, on behalf of Investing Group Leader Cestrian Capital Research. “Cutting too soon risks a return of inflation, but cutting too late can trigger an economic downturn.” (79 comments)

Disney vs. DeSantis

Federal Judge Allen Winsor has dismissed Disney’s (DIS) lawsuit against Florida Governor Ron DeSantis and other state officials, saying the company lacked legal standing to sue the defendants on a claim that they violated its free speech rights. The saga began with a controversy over the Parental Rights in Education Act, commonly referred to as the “Don’t Say Gay” law, but quickly escalated to other areas. DeSantis’ press secretary Jeremy Redfern hailed the ruling, saying “the days of Disney controlling its own government and being placed above the law are long gone.” Disney, on the other hand, plans to press forward with its case, saying if the ruling was left unchallenged, it would “set a dangerous precedent.” (8 comments)

Regional scare

New York Community Bancorp (NYCB) sank nearly 38% on Wednesday after the bank swung to a surprise Q4 loss as it prepared for stricter capital requirements due to the acquisition of Flagstar Bank in 2022 and Signature Bank in 2023. NYCB added to its reserves and cut its dividend as its assets crossed the $100B threshold, while commercial real estate concerns compounded the worries. Note that NYCB had an SA Quant Dividend Safety Grade of D+. The disappointing results reignited regional bank fears, with the SPDR S&P Regional Banking ETF (KRE) sliding 5.9%. Investing Group Leader Trapping Value believes it will take at least six quarters to rebuild confidence in NYCB. (224 comments)

Today’s Economic Calendar

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Productivity and Costs

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:30 EIA Natural Gas Inventory

4:30 PM Fed Balance Sheet

What else is happening…

Another great call by SA Alpha Picks: Powell Industries (POWL) soars 45%.

Boeing (BA) suspends 2024 guidance amid safety issues with 737 MAX.

Tesla hopes to stay under the radar by keeping CATL at arm’s length.

Lululemon (LULU) extends 2024 share price decline amid new data.

Biogen (BIIB) scraps Aduhelm, will focus on other Alzheimer’s drugs.

Cigna (CI) to sell Medicare business to nonprofit health insurer for $3.3B.

Semi watch: Qualcomm (QCOM) pops as Q1 earnings top expectations.

14.2M block of Albertsons (ACI) shares being shopped by JPMorgan.

Paramount (PARA) gains on report of special independent committee.

House passes bill to enhance child tax credit, revive business tax breaks.

—————

Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets were split. Japan, India and Australia did well; China, Hong Kong, Taiwan and Thailand were weak. Europe, Africa and the Middle East are mostly doing well. Denmark, Poland, Russia, Greece, Hungary, Spain, Italy and Portugal are up nicely; South Africa and Saudi Arabia are down. Futures in the States point to a moderate gap down open for the cash market.

————— VIDEO: State of the Market —————

The dollar is up slightly. Oil is down; copper is flat. Gold is up; silver is down. Bonds are up.

Stories/News from Seeking Alpha…

Keen interest in rates

Get ready for the first Fed meeting of the year. The latest monetary policy announcement from the Federal Open Market Committee will be released at 2:00 PM ET, and many are keeping a watchful eye on the decision that influences mortgages, credit cards and business expansion plans. However, with the central bank likely to hold rates steady for a fourth straight meeting, investors will be focused on tweaks to the language in the Fed’s statement and on Chair Jerome Powell’s post-decision press conference.

Backdrop: As the FOMC jacked up interest rates by 525 basis points in 2022 and 2023 to tame inflation, the cost of borrowing money surged, constraining a range of economic activities, like mortgage originations, mergers & acquisitions, and stock and debt offerings. Inflation has since closed in on the 2% level, while credit card delinquencies and net charge-offs have crept up, prompting expectations that the Fed will act while the labor market and consumer spending are strong. Policy easing will be a popular topic of discussion at today’s meeting following some preliminary talk in December, and markets have continued to embrace that kind of chatter with a focus on when the central bank will start a new cutting cycle.

There are still plenty of developments coming between now and March that could alter that course. Geopolitical tensions have been rising after Iran-backed groups killed three U.S. service members and injured dozens over the weekend. The Houthis in Yemen have meanwhile pledged to continue targeting ships in the Red Sea, and shipping delays worse than the pandemic might mean a resurgence in supply shocks that can halt the progress made on inflation. WSB subscribers see less looser conditions in 2024 than the FOMC, but Powell has emphasized the need to proceed carefully based on incoming economic data.

SA commentary: “The other component of the Fed’s Policy Normalization Plan has been the reduction of the Fed’s balance sheet, or what is more commonly known as Quantitative Tightening (QT),” SA analyst Michael Gray writes in Fed Meeting Preview: The Future Of Quantitative Tightening. “Executing this policy has proven to be more difficult than imagined, with the Fed struggling to reach its targets for reducing its balance sheet.” (6 comments)

Muted reaction

Microsoft (MSFT) shares are largely unchanged after the tech behemoth reported Q2 earnings that topped expectations, aided by strong results from its Azure cloud business driven by new AI features. “We’ve moved from talking about AI to applying AI at scale,” CEO Satya Nadella declared. For the coming quarter, Microsoft expects overall revenue to be $60B-$61B, largely in line with estimates, and Azure revenue growth to be stable compared to Q2. SA Investing Group Leader Livy Investment Research said the results will reinforce Microsoft’s durability in the $3T club. (95 comments)

Not enough

Another tech giant posted impressive earnings after the bell on Tuesday, but they were met with a colder reception. Shares of Alphabet (GOOGL) slid 5.7% AH to $142.70, with some disappointment over advertising sales growth. The Google parent firm also spent heavily on servers and data centers to power AI, with its capital expenditures for the quarter totaling $11B, and the figure will only rise in 2024, CFO Ruth Porat said on an earnings call. Meanwhile, Investing Group Leader Jonathan Weber attributed the negative market reaction to profit-taking, as well as a “sell-the-news” phenomenon. (71 comments)

Voided by judge

Elon Musk’s $55B pay package at Tesla (TSLA) has been rejected after a shareholder lawsuit claimed his hefty compensation plan was unduly approved. “Swept up by the rhetoric of ‘all upside,’ or perhaps starry-eyed by Musk’s superstar appeal, the board never asked: Was the plan even necessary for Tesla to retain Musk and achieve its goals?” Judge Kathaleen McCormick wrote in her opinion. “Never incorporate your company in the state of Delaware,” Musk replied, with Tesla shares sliding more than 3% in premarket trade, continuing a decline seen in the aftermath of earnings and amid threats to develop AI products outside of the company. (337 comments)

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Treasury Refunding Announcement

8:30 Employment Cost Index

9:45 Chicago PMI

10:30 EIA Petroleum Inventories

2:00 PM FOMC Announcement

2:30 PM Chairman Press Conference

3:00 PM Farm Prices

What else is happening…

UPS (UPS) to cut 12K jobs amid higher union costs, slower demand.

AMD (AMD) outlook disappoints; sees sequential decline in three units.

GM leads peers higher on ICE commitment while EV pure plays fall.

Walmart to implement 3-for-1 stock split to ease access for staff.

Byron Allen makes $14.3B offer for Paramount Global (PARA).

Ken Griffin: If China invades Taiwan, U.S. could see ‘a great depression.’

PayPal (PYPL) starts layoffs in cost-cutting drive to boost profit.

Cathie Wood’s ARKK ETF left out of 2024’s early growth rally.

SLB reaffirms outlook, sees ‘significant growth’ in Saudi Arabia.

Starbucks (SBUX) strikes confident tone on store growth and profitability.

—————

Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Indonesia did well, but China, Hong Kong, India and Taiwan were weak. Europe, Africa and the Middle East lean to the upside. The UK, Poland, Hungary, Spain, Italy and the Czech Republic are up; Israel and Saudi Arabia are down. Futures in the States point to a moderate gap down open for the cash market.

————— Online Course: Jason Leavitt’s Masterclass in Trading —————

The dollar is down. Oil and copper are down. Gold is up; silver is down. Bonds are up.

Stories/News from Seeking Alpha…

A cyborg is born

The first human to receive an implant from Neuralink is recovering well, according to Elon Musk, marking the latest milestone for the emerging brain-computer interface industry. BCIs are aimed at helping people with traumatic injuries like paralysis, but if all goes well, Musk hopes to extend this to hearing and vision loss, and eventually merge humans with artificial intelligence. The implants use “ultra-fine” threadlike electrodes to detect and help transmit “neuron spikes,” or the electrical and chemical signals in participants’ brains.

Quote: “The first @Neuralink product is called Telepathy,” Musk wrote on X. “Enables control of your phone or computer, and through them almost any device, just by thinking. Initial users will be those who have lost the use of their limbs. Imagine if Stephen Hawking could communicate faster than a speed typist or auctioneer. That is the goal.”

The FDA gave Neuralink approval for clinical trials on humans in May 2023, prompting the company to start recruiting candidates in September. The neurotech firm has already shown success with extensive tests on primates, such as monkeys that have been able to move cursors or play video games like “Pong” using just their brains. Some of Neuralink’s activities have been criticized for their surgical work, but the in-human clinical trial marks one step closer toward commercialization, especially for a startup that’s reportedly valued at around $5B.

Not the only show in town: The latest development casts another spotlight on Musk’s ability to allocate time to his many ventures at the same time as shoring up social platform X and electric vehicle maker Tesla (TSLA). Most of Neuralink’s competitors are also not publicly traded, including Synchron, Onward, Precision Neuroscience and Blackrock Neurotech. Where Neuralink stands ahead of the pack is the ability for its device to go deeper into the brain, as well as containing far more electrodes that target individual neurons (instead of groups or clusters), with the aim of offering a higher degree of precision. (7 comments)

Tech (or AI) earnings

Super Micro Computer (SMCI) jumped 10.5% AH on Monday to $550/share after its results topped preliminary numbers released earlier this month. The data center hardware maker, which has become an AI darling, will kick off a week full of earnings that will likely include many references to artificial intelligence, with Microsoft (MSFT), Alphabet (GOOG, GOOGL) and AMD (AMD) all reporting this afternoon. Note that Super Micro (SMCI) was added to Seeking Alpha’s Alpha Picks in November 2022 (when it was trading around $85). The stock recommendation tool has also outperformed the S&P 500 (SP500) return by more than 50 percentage points since its inception. (105 comments)

Eye on output

Saudi Arabia has ordered state-owned Aramco (ARMCO) to maintain its oil production capacity, marking a major reversal from the energy giant’s plan to boost capacity. Maximum Sustainable Capacity of the world’s largest crude producer will be maintained at 12M bbl/day, instead of a planned capacity expansion to 13M bbl/day by 2027. The directive comes amid growing oil demand concerns, as well as countries steadily shifting from oil to natural gas and renewables. The International Energy Agency had previously forecast that fossil fuel demand will likely peak before 2030, a prediction that many in the industry – including Aramco head Amin Nasser – have rejected. (2 comments)

Auto crown

Toyota Motor (TM) remained the top-selling automaker in 2023 for the fourth year in a row after registering a record of 11.2M units sold last year, up 7.2% Y/Y. It also marked the ninth year out of the past 10 in which Toyota’s total sales topped 10M units. The milestone came amid fears of a sales slowdown as the automaker’s reputation took a hit from faulty testing procedures at Daihatsu and Toyota Industries (OTCPK:TYIDY), as well as falsified engine emissions data at Hino Motors (OTCPK:HINOY) found in 2022. Toyota also recently issued a “Do Not Drive” advisory for around 50K vehicles in the U.S. involved in the Takata airbag recalls.

Today’s Economic Calendar

FOMC meeting begins

9:00 S&P CoreLogic Case-Shiller Home Price Index

9:00 FHFA House Price Index

10:00 Consumer Confidence

10:00 Job Openings and Labor Turnover Survey

What else is happening…

WSB survey results: Subscribers see fewer rate cuts in 2024 than Fed.

3M (MMM) earplug settlement on track to exceed 98% participation.

iRobot drops as $1.4B sale to Amazon (AMZN) terminated, CEO exits.

Alaska Airlines (ALK) plane left Boeing (BA) factory without key bolts.

ADM pops to top of S&P leaderboard after CEO reassures on probe.

U.S. Treasury cuts Q1 net federal borrowing estimate to $760B.

Northrop Grumman (NOC) enters $1B accelerated buyback deal.

Taylor Swift might just save us from ourselves, AI deepfakes.

Tesla (TSLA) among top 10 most oversold stocks on Wall Street.

Why Are Some Still Buying S&P 500 – Even After Record Highs.

—————

Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets Mostly did well. Japan, Hong Kong, South Korea, India, Taiwan, Malaysia, Indonesia and Thailand posted solid gains; China, Singapore and the Philippines were weak. Europe, Africa and the Middle East are mostly down. Denmark, Turkey and Russia are up, but Poland, Germany, South Africa, Finland, Hungary, Spain, Italy and Portugal are down. Futures in the States point to a flat-to-up open for the cash market.

————— Online Course: Jason Leavitt’s Masterclass in Trading —————

The dollar is up. Oil is down; copper is flat. Gold and silver are up. Bonds are up.

Stories/News from Seeking Alpha…

Property problems

The world’s second-largest economy is in the spotlight again, with the property market standing at the heart of its troubles. Construction accounts for as much as a quarter of China’s gross domestic product, but real estate reverberations are shaking up confidence and many are afraid about knock-on effects for other parts of the economy. Things have also never quite recovered after years of strict zero-COVID controls and a fresh crisis could compound a deflationary spiral.

The latest: China Evergrande (OTCPK:EGRNQ), the world’s most indebted property developer, has been ordered to liquidate by a Hong Kong court after a judge there ruled that it was “time to say enough is enough.” With more than $300B of total liabilities, Evergrande first defaulted in 2021, but court hearings and restructuring talks dragged on as many bet that the Chinese government would eventually offer some kind of bailout. Trading in Evergrande shares was suspended overnight after the stock plunged more than 20%, with a liquidation likely to send another shock wave through Chinese markets and prompt authorities to act to contain a deepening crisis.

Some steps to help may have already been taken as Chinese regulators implemented curbs on short-selling of stocks to firm up the country’s stock market. The Shenzhen and Shanghai exchanges said Sunday that investors who buy shares will not be able to lend them out for short-selling outside of a lockup period. Another item in the Evergrande saga that will have to be hashed out is the repayment rank of offshore bondholders. It’s expected to be a thorny process and will determine how China treats foreign creditors.

SA commentary: “It appears that China is following the same path that Japan has been through in the late 1980s,” wrote SA analyst Ploutos Investing. “Japan spent about three decades to fix its household and corporate balance sheets. We think China’s problem is even more severe than Japan because, at the time of Japan’s bubble burst, Japan’s population was still growing. In contrast, China’s population is already in a decline. iShares MSCI China ETF (MCHI) has declined by nearly 60% since early 2021 due to China’s weakening economic growth momentum [and] it is facing serious long-term structural issues.” (11 comments)

Mideast crisis

Oil prices are volatile after a drone strike by Iran-backed groups in Syria and Iraq killed three U.S. service members in Jordan. Front-month March Brent crude (CO1:COM) rose to as high as $84.80/bbl, while U.S. WTI crude (CL1:COM) climbed to $79.10/bbl. The attack, which also wounded at least 25 service members, marked the first American deaths from enemy fire since the beginning of the Israel-Hamas war. “We shall respond,” President Biden declared. “We will carry on their commitment to fight terrorism. And have no doubt – we will hold all those responsible to account at a time and in a manner of our choosing.” (58 comments)

Nuclear option

The European Union is likely to end funds to Hungary if the country blocks fresh aid to Ukraine at a summit on Thursday. A “nuclear option” of kicking Hungarian Prime Minister Viktor Orban out of the EU voting process may also be in the cards. Boka Janos, Hungary’s EU minister, said the country would not give in to blackmail, but Budapest did send a new proposal to Brussels, in which it signaled readiness to use the budgetary process for aid to Kyiv and even issue debt to finance it (with some caveats). To note, Orban is the only EU leader to maintain close ties with Russia since its invasion of Ukraine in early 2022.

Exploring alternatives

Reports suggest that United Airlines (UAL) has reached out to Airbus (OTCPK:EADSF) after a recent mid-air blowout on a Boeing (BA) 737 MAX 9 raised concerns over the MAX 10’s already delayed certification. United CEO Scott Kirby recently flew to France to discuss a potential deal that focused on buying more A321neo planes, as well as a delayed A350 order. During last week’s earnings call, United CFO Mike Leskinen said the airline is reworking its fleet plant and expects fewer orders and deliveries from Boeing in 2025. However, in a bright spot for the American planemaker, Boeing this weekend delivered the first 737 Max 8 to a Chinese airline since an import ban went into effect in 2019.

Today’s Economic Calendar

10:30 Dallas Fed Manufacturing Survey

What else is happening…

Reddit (REDDIT) reportedly considering at least $5B IPO valuation.

U.S. approves sale of F-16 fighter jets to Turkey and F-35s to Greece.

Vince McMahon resigns from TKO Group (TKO) amid sex trafficking claims.

California playing ‘dangerous game’ with climate policies – Chevron (CVX).

Biden to unveil billions in subsidies for Intel, Taiwan Semi (TSM) and others.

M&A watch: Kioxia trying to revive deal talks with Western Digital (WDC).

Bayer (OTCPK:BAYZF) slapped with $2.25B Roundup cancer verdict.

Big Pharma earnings season in spotlight amid positive sentiment.

Global insurance losses in 2023 exceed $100B for fourth straight year.

Happy Birthday! Apple’s (AAPL) Mac just turned 40. Don’t count it out.

—————