Bitcoin stocks are hot. I’ve profiled them at Leavitt Brothers, on our blog and in videos posted on YouTube. The goal here is to summarize my top ideas.

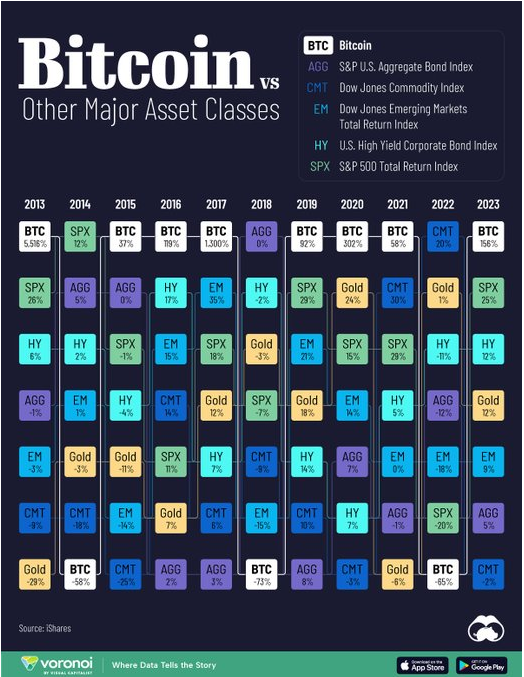

Let’s set the stage first. Here’s a comparison of seven asset classes, which are: bitcoin, commodities, bonds, high-yield bonds, domestic stocks (S&P 500), emerging markets and gold. So it’s stocks, bonds, commodities, gold and bitcoin.

Over the last 11 years, bitcoin has been either first or last. It either posts a solid or huge gain or suffers a big loss. And given how it’s started this year – it’s up more than 40% – we’re on track for another big year.

Because of this, I’ve been profiling bitcoin miners quite a bit at Leavitt Brothers going back to early December. They are volatile. They offer huge upside potential, with a lot of downside risk. They are the ultimate high risk/high reward stocks.

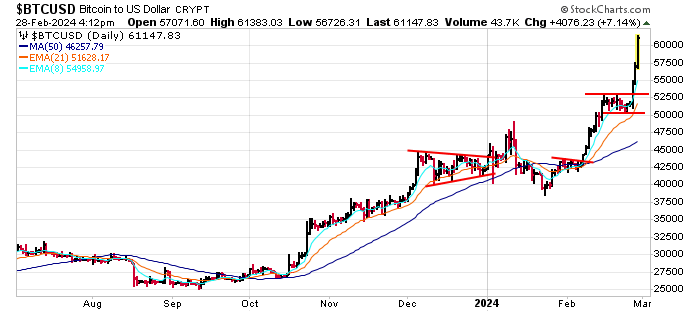

Here’s bitcoin itself. It’s up 50% off the January high, which is an enormous move considering its market cap. If this was a stock, it would be a mega cap.

Backing up, bitcoin doubled topped in 2021 and then dropped 80%, but it’s making a comeback. Testing the high seems inevitable; the bigger question is the path it takes. Will it move straight there, or will there be another sizable dip first? We don’t know. Nobody does.

Here is a summary of my favorite miners. If bitcoin remains a top performer this year, these stocks will do great.

Top Tier…

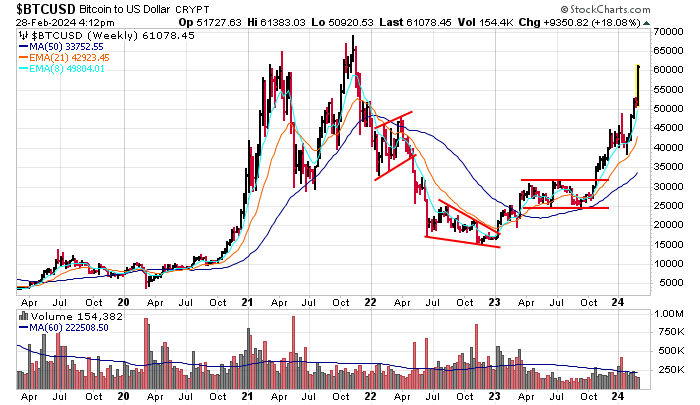

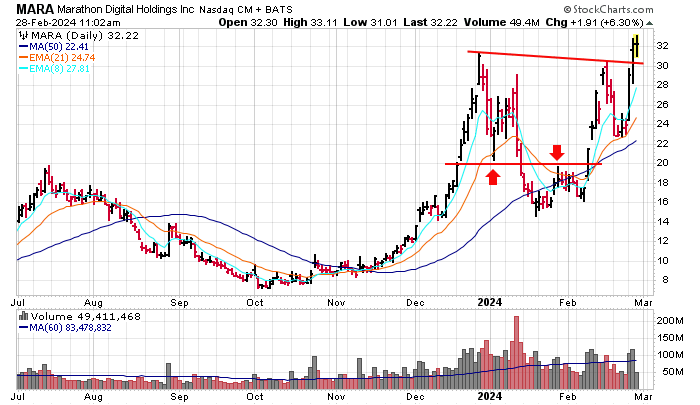

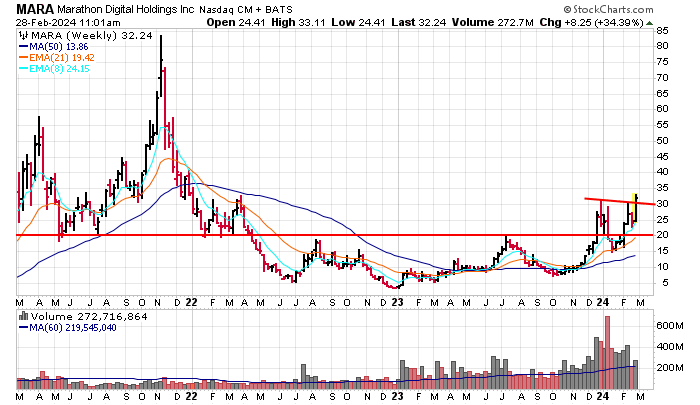

The MARA daily rallied hard in early February…dropped to test its 21…and then rallied to a new high. It’s a super strong stock, but it can move fast in both directions. If bitcoin stays up, it’ll be a huge winner.

Backing up, the weekly suggests tons of upside potential. First it broke out of a base at 20. Now it’s breaking out again.

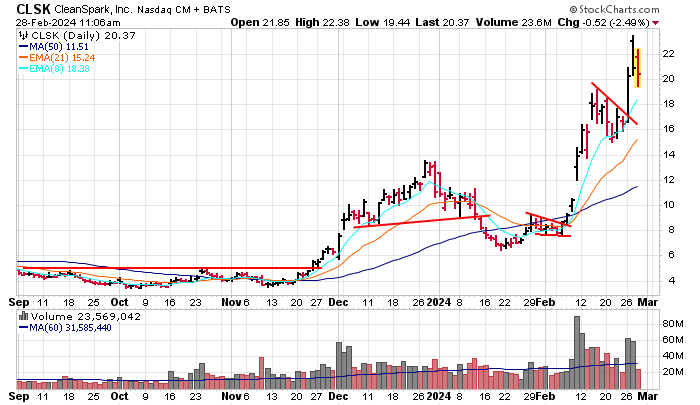

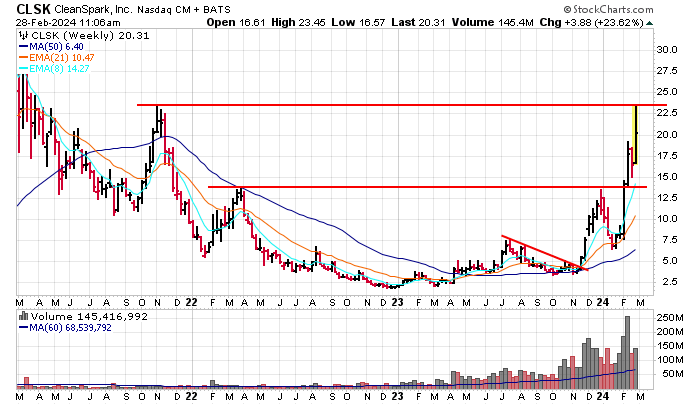

CLSK has been the best performer this year, so purely from a relative strength standpoint, it’s a top pick, even though it has lagged in the past.

The weekly shows it broke out near 13.5 and is now getting rejected by the late-2021 high. Ideally it would be a bit messy for several weeks while it set up again.

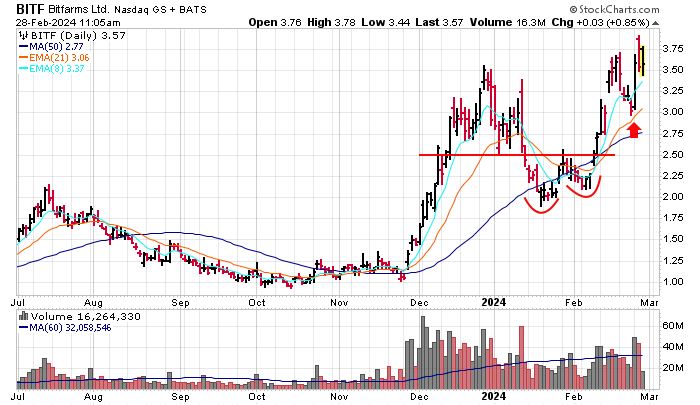

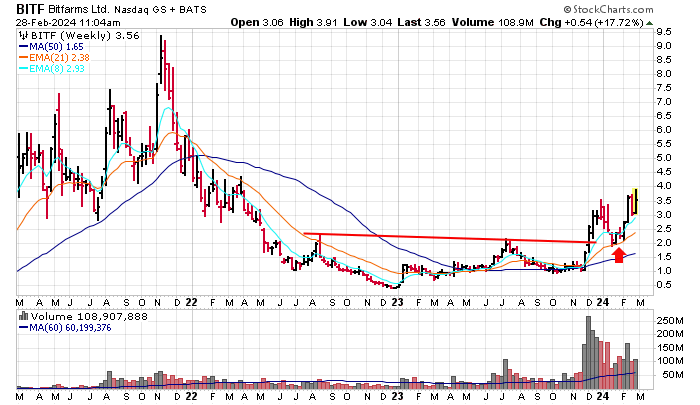

BIFT doubled bottomed in January and February and then ran to a higher high. A drop to the 21 got bought, and a new high printed a few days later. It’s volatile within an uptrend.

Longer term, BITF has big upside potential, having come out of a year-long base and then back-tested the former resistance level and the 21 before moving up to a higher high.

Second Tier…

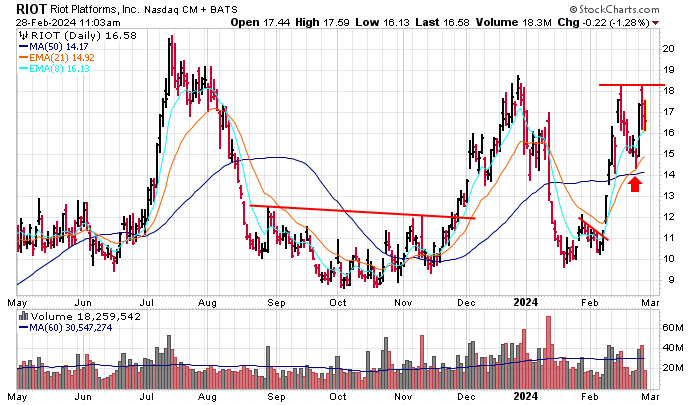

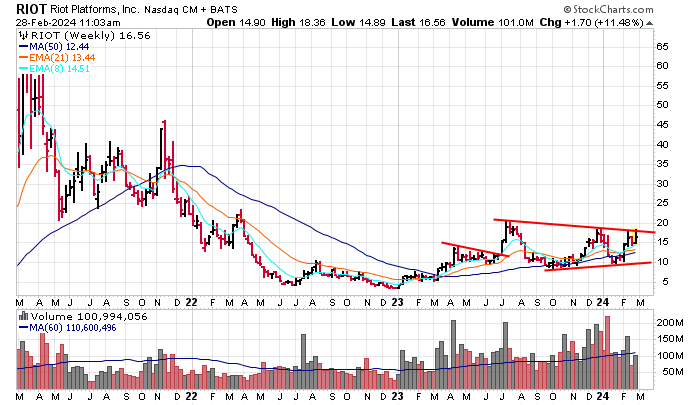

RIOT has been a great trading candidate with three 100% runs the last year, but it hasn’t been able to keep the gains. Trade it until it proves itself.

The weekly shows incredible upside potential, if the stock can clear itself from its 2-year base.

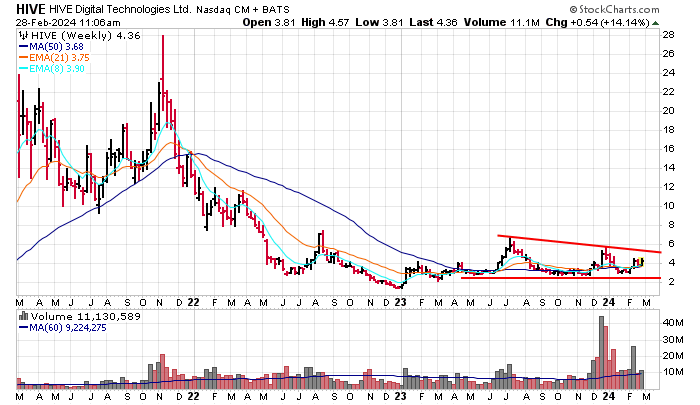

HIVE has rolled up and down at a low level, repeatedly offering solid trades. It matched a high yesterday, having just back-tested its 21. It has short-term potential up to the December high.

Longer term, HIVE will need to break out from this base. Every rally has gotten sold, so until it can break that funk, it’s just a trading candidate, not a potential hold.

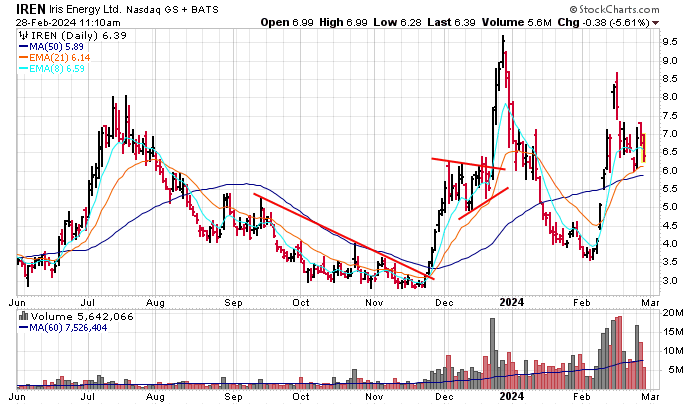

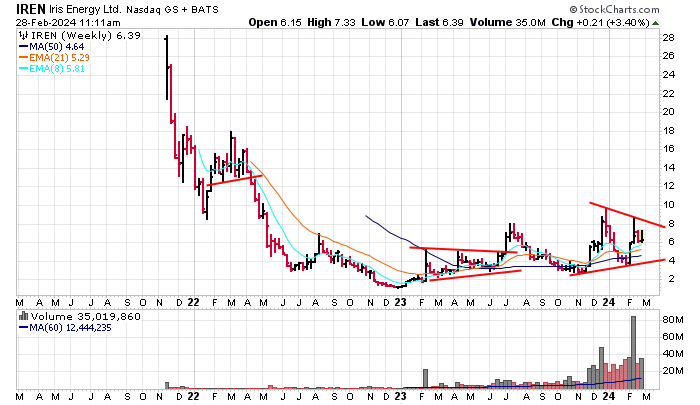

IREN has offered three huge moves the last year – it almost tripled in June/July; it did triple in November/December; and it more than doubled a couple weeks ago. But each got sold hard, so it’s just a trade.

Longer term, the weekly shorts a nearly-2-year base and the potential to double if the top of the recent range can be taken out.

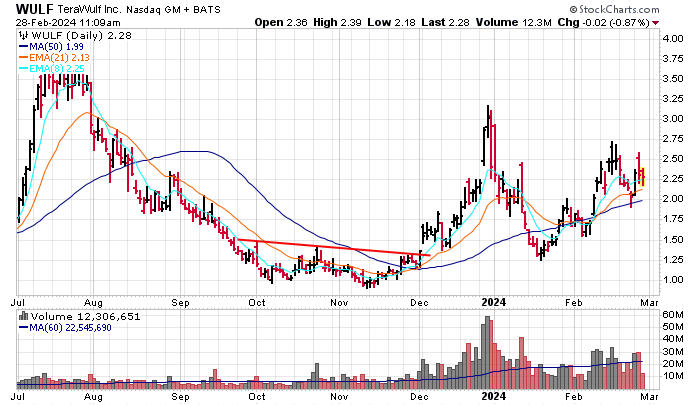

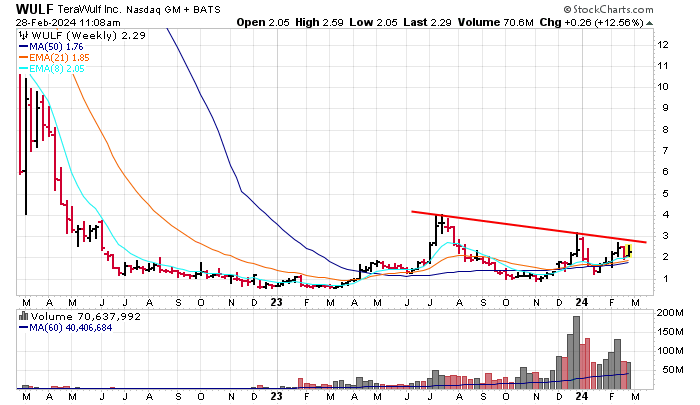

WULF tripled in June/July and then tripled again in November/December. It’s a lower quality name that hasn’t been able to hold its gains, but it’s certainly been a good trading candidate.

The weekly shows a beautiful base with a series of higher lows and lower highs. Pressure is building. There’s huge upside potential if the stock can breakout and gather some momentum.

Third Tier…

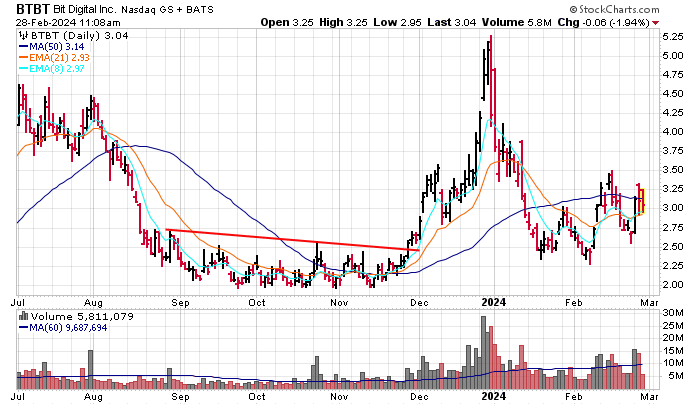

BTBT has spent more time grinding in ranges than trending, but it’s still not bad as a trade. Small moves can be 25-50%.

Longer term, a 2-year base is forming. It has potential, but the stock can’t be trusted until it can get above the last couple highs.

If bitcoin does well this year – and it’s off to a great start – many of these stocks will post big gains, on top of what they’ve already done.

Jason Leavitt