Good morning. Happy Friday.

The market continues to trade well. The SPX is up a couple points for the week and many of the groups we’ve been using as confirmation are also doing well.

We entered the week with the trend being up, but wondering if a rest was needed. Here we are; the market has generally moved sideways. There remains lots of reasons to believe the rally will continue and an equally long list of reasons to believe it will fail soon. But as I stated yesterday … and many time before, we’re much better of going with the flow than trying to guess or predict what will happen next. Trading is a big game of follow the leader, and I’m not the leader. The biggest traders in the world, the ones with gazillion-dollar research departments, leave footprints in the charts when they enter and exit positions. Our job is to find those footprints and follow them.

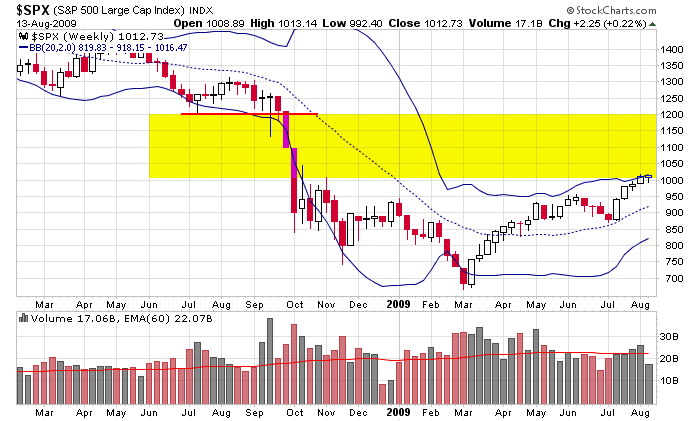

Here’s the weekly SPX. We are not out of the woods and into the clear yet. The thin area is just overhead, but the upper Bollinger Band is proving to be a tough nut to crack.

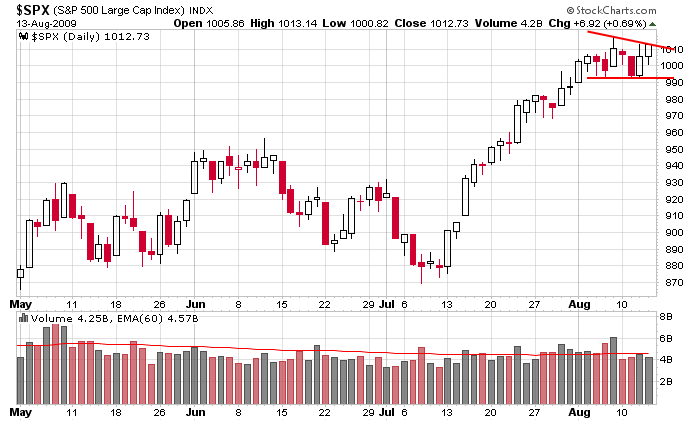

Here’s the daily. Nothing wrong with this picture. A steady move up has been followed by two weeks of sideways movement. I’d prefer another week to allow the pattern to mature more, but I rarely get exactly what I want.

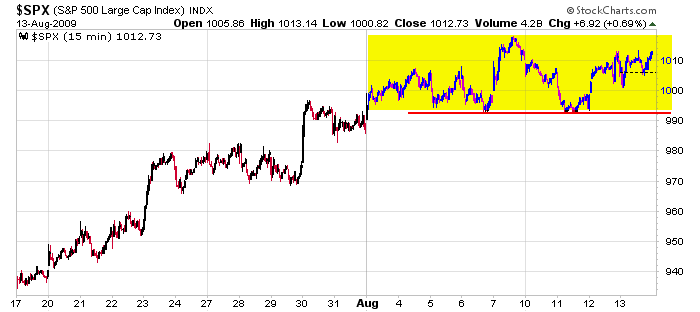

And for the sake of completeness, here’s the 15-min chart. A month of consolidation after a big move up…that’s constructive action.

Manage your positions well. As the rally continues to mature, the strong will leave the week behind. A rising tide raises all ships at first, but sooner or later the weak will stop keeping up.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers