There’s no shortage of gloom-and-doomers out there. Some are calling for a stiff bear market; others fully believe a Dot-Com-like crash is in the works.

But for those of us who were active in the market in 2000, we know the current situation is vastly different than back then.

The biggest difference is the types of stocks that are leading. In 2000, you had small companies with relatively few employes and no business model to speak of worth billions of dollars. It was a house of cards; it was going to crumble eventually.

Today, the best performers are large tech companies that can pass any test thrown its way. Maybe it can be argued they’re overvalued and need to digest gains (NVDA is doing that now). But these are tested companies that have proven track records. And they make money – a lot of money.

The market can correct at any time, but the conditions for a full-blown bear market are not present.

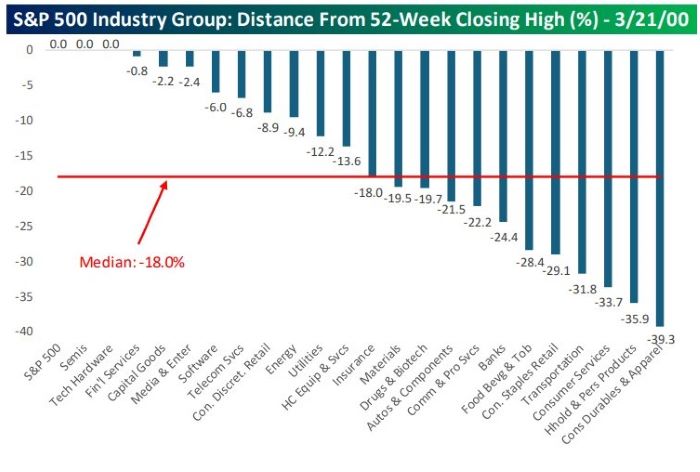

Here are two charts from @bespokeinvest to visually show the under-the-hood difference between 2000 and today. In 2000, at the time the market topped, most groups were already well off their highs, with the median being down 18%.

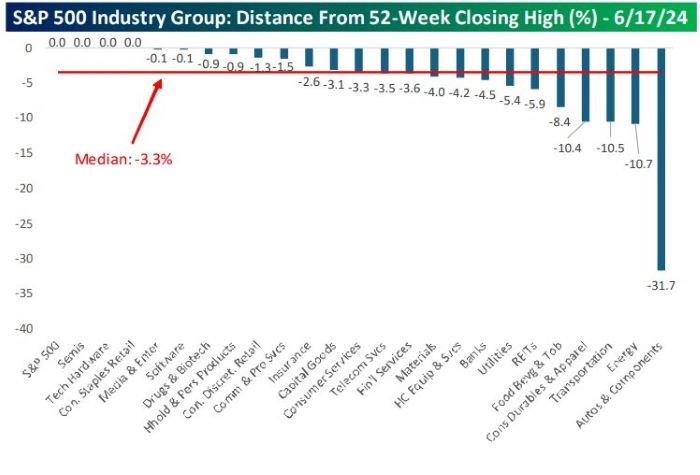

But currently, most groups are only down modestly, with the median being 3.3%.

The conditions in 2000 were combustible. The market internals were horrible. Today, the market has pretty good, across-the-board strength.

Don’t think too hard here. The market is in solid shape. Yes, there are warnings, such as the weak internals and loss of leadership from semiconductors, but overall, the conditions are not present for anything more than a little soft patch.