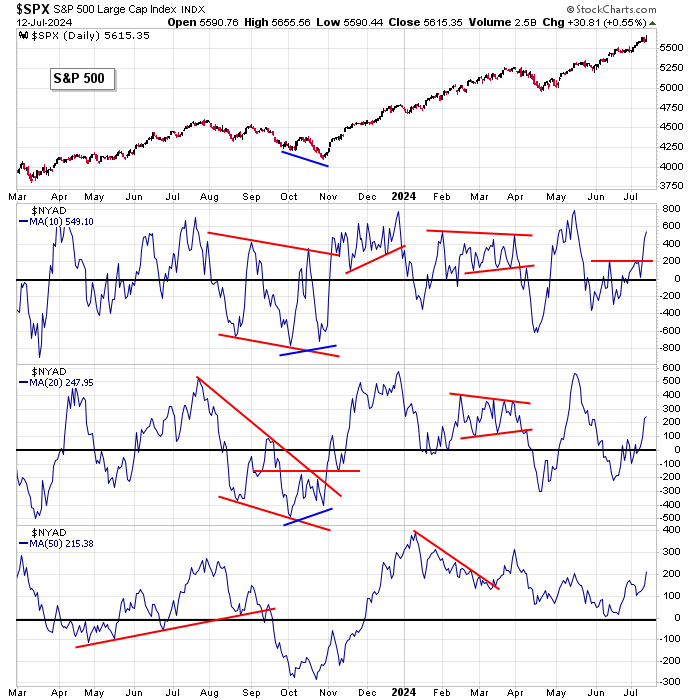

After negatively diverging from the the S&P and Nasdaq, breadth surged last week. Let’s quickly run through a few charts.

The 10, 20 and 50-day MAs of the NYSE AD line are trending up and are at 1-3 month highs.

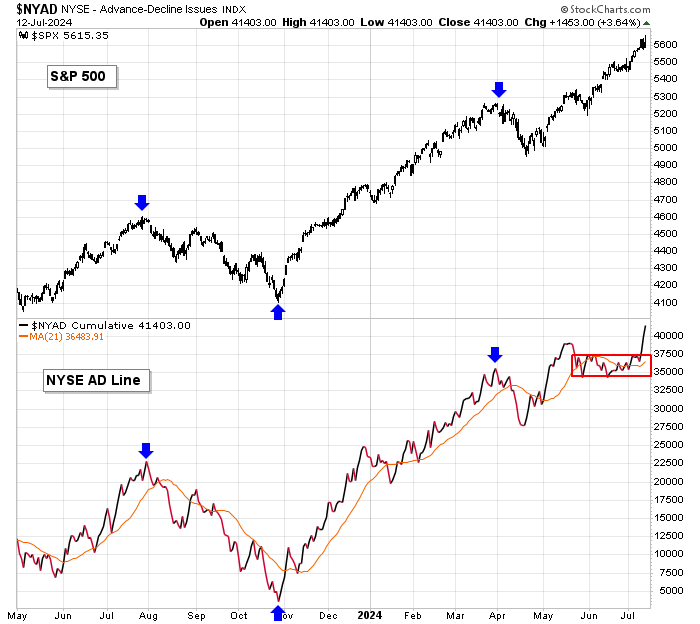

The cumulative AD line broke out and surged to a new high.

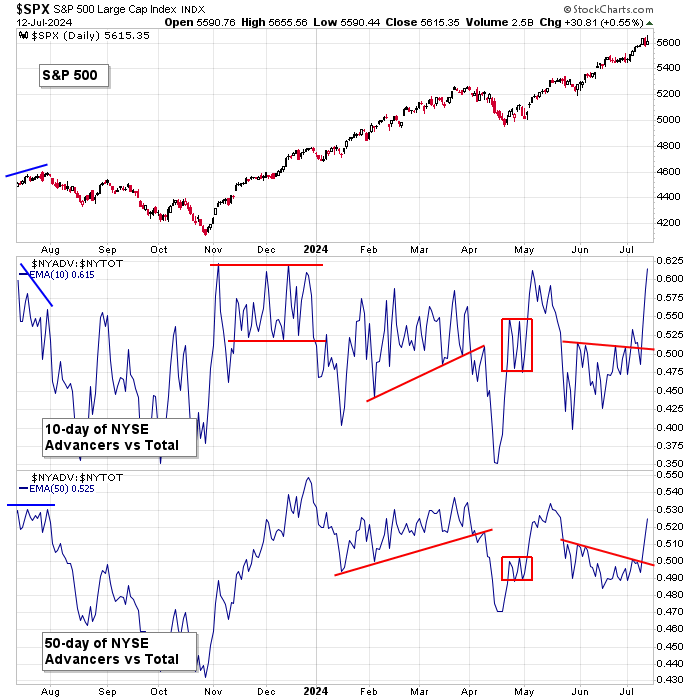

The 10 and 50-day MAs of advancers vs total stocks shot up last week.

The 5-day high-low hadn’t printed above +2000 in nearly four months. Then it printed its highest level of the year.

The 1-month high-low surged.

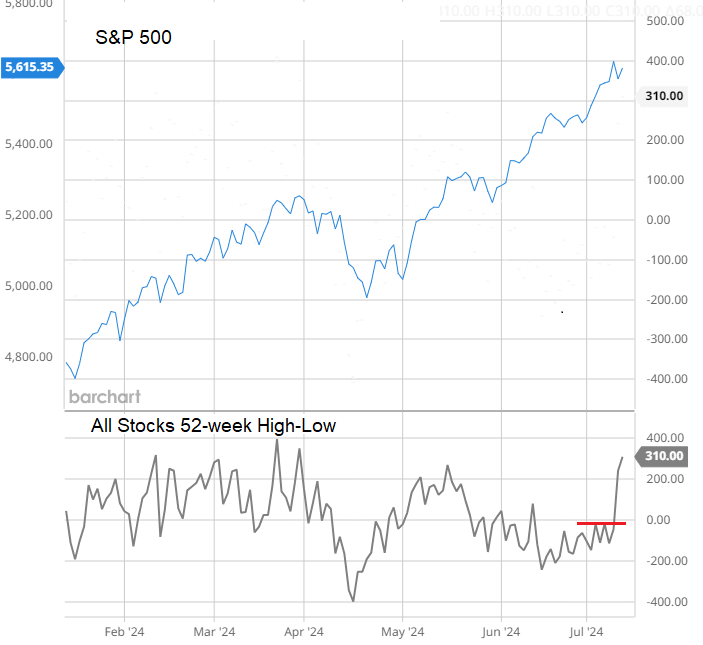

The 52-week high-low sat below zero most of the last six weeks, meaning more stocks were printing 52-week lows than 52-week highs. Then it shot up

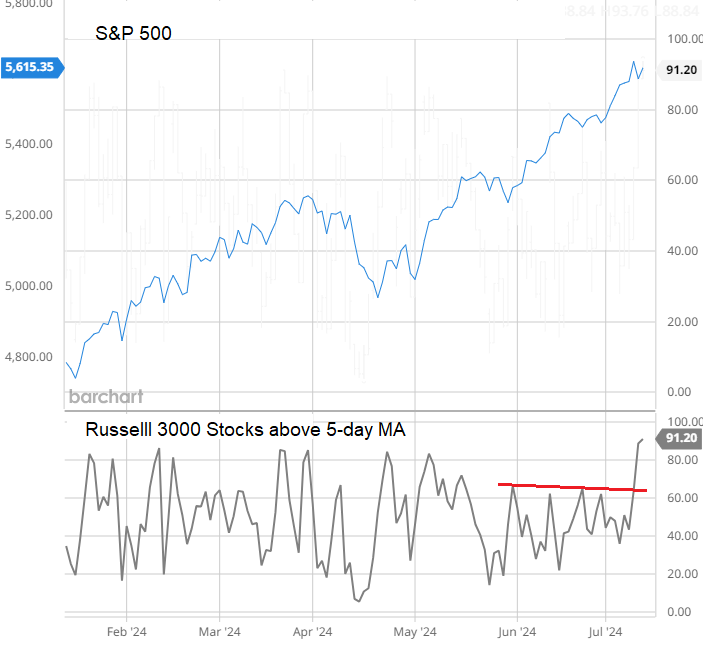

The percentage of Russell 3000 stocks above their 5-day moving averages just shot up to its highest level of the year.

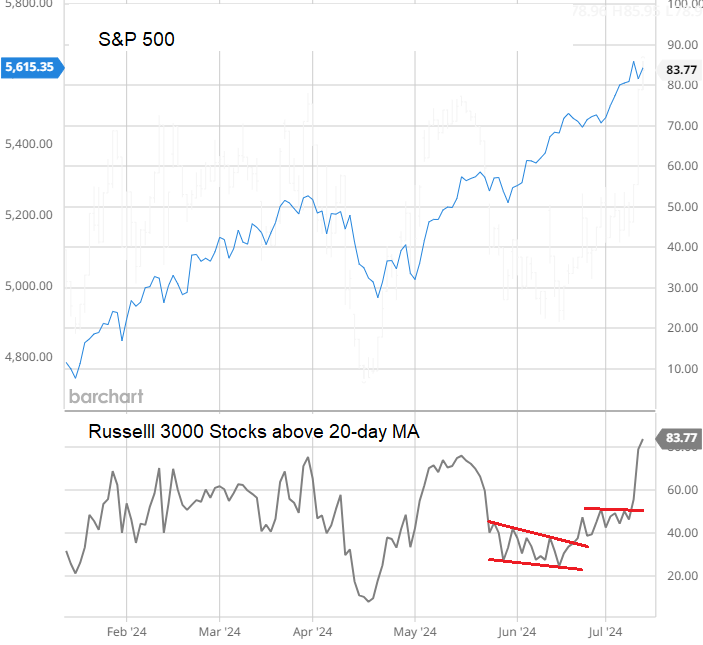

Stocks above their 20’s also shot up.

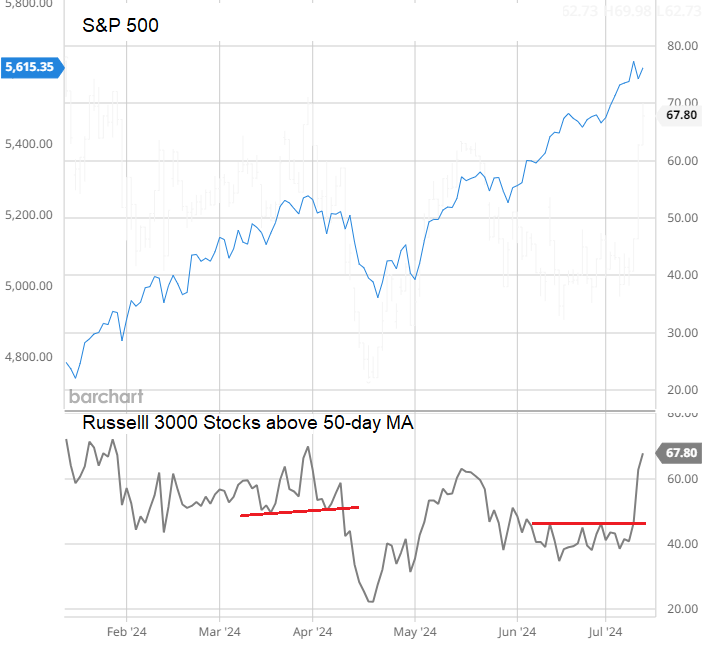

Stocks above their 50’s improved from 40% to 68% last week.

The internals have been weak for two months, but they just shot up. The herd has expanded. Participation has broadened out. The market isn’t thin any more.