Good morning. Happy Monday. Hope you had a nice weekend.

The markets around the world have gotten/are getting clobbered. Every index in Asia/Pacific closed down with especially steep losses in India and China. Europe is currently down across the board – most indexes are down 2-3%. Futures here in the States are getting clobbered. The SPX futures are down 20…Nas 100 down 27…Russell down 13. …

The media says American consumer strength, or questions about the American consumer strength, is the reason for the worldwide selling pressure. Consumption by Americans accounts for almost 70% of the US economy and 20% of the world economy. No recovery can take place with a strong American consumer.

This doesn’t make much sense, but when did the market ever make sense. As of Friday’s close, everything was fine. Now there are worries and the market hasn’t even opened yet. Why the market decided to drop today when the employment situation hasn’t improved and the housing market hasn’t shown any signs of recovery isn’t something I know. For a long time I’ve been saying “this rally doesn’t make sense, but it is what it is, so let’s ride it.”

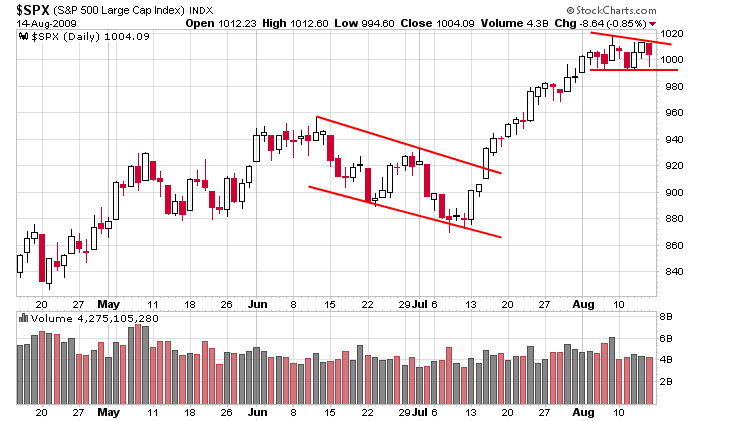

Here’s the SPX daily. Last week was a week of rest within a tight range. Assuming the current futures level holds, the index will gap below the bottom of the pattern. A few days of follow through could easily send the index down to 950. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 17)”

Leave a Reply

You must be logged in to post a comment.

Jason,

If one believes in market manipulation, you can make the case that influential market players (probably Goldman Sachs) decide what the mantra will be for the next couple weeks or months and then feed these soon to be cliches to the financial press. A few months back it was “green shoots.” That was ridden for a while. Then it was “recession ending” or “economy bottoming.” Now it appears it might be “concerns about the consumer.” Somebody starts this stuff and gets the financial press to run with it. You will notice, everybody uses the exact same language. Maybe Goldman Sachs has decided it is time to short. If they have, this could be the C wave taking us back to 6,500 or lower. Like you, I always thought the rally didn’t make sense.

Bruce,

Yeah the market does seem to operate like that…unfortunately.

Instead of 10,000 hedge funds doing their own research and forming their own opinions, you have 10,000 hedge funds which don’t have the confidence to act independently, so they do what everyone else is doing.

10,000 hedge funds with differing opinions should result in many buffers all over the place, but since they all sing the same song, when the ball gets rolling, it’s hard to stop.

As far as the media goes…we’ll they’re just used by the larger players. Simple as that. They cover what’s hot in an attempt to get the best ratings so they can sell commercial space. They are entertainment companies, pure and simple.

This who thing reminds me of Mark Cuban’s forward to The Number (by Alex Brown). Here’s a link. It’s a great read. I’ll post a link in a minute.

Jason

Here’s the forward…a great read IMO

Mark Cuban’s forward for The Number