At the recent Berkshire investor meeting in Omaha, Warren Buffett said he will be stepping down from his CEO duties at the end of the year.

If Buffett isn’t the greatest investor in history, he’s certainly in the top handful, and at that point, it really doesn’t matter.

I want to talk through his bottom line accomplishment and then bring it back to how he made his money.

The Kobeissi Letter posted the following on Twitter…

Since 1964, Berkshire Hathaway has returned over 5,500,000%.

That’s 5.5 MILLION percent.

A $10,000 investment in 1964 would be worth $550 million today.

This compares to a ~39,000% return in the S&P 500.

Buffett has outperformed the S&P 500 by over 140 TIMES.

While this is likely technically true, Berkshire had the advantage of being a teeny tiny company at the beginning. And it was only this very low starting point that paved the way for the extreme outperformance. It’s true Berkshire has done better than the S&P, but if you start counting at a date after 1964, the outperformance is impressive but not other worldly.

It’s legit to ask how Berkshire outperformed by such a wide margin. After all, they own GEICO. Are we to believe it’s significantly better than the other top insurance companies? They also own Coke and Pepsi and many other household names. But the S&P owns those too. How do you outperform the index when the index owns the same stocks? I’m pretty sure wholly owned businesses such as See’s Candies aren’t going to make up the difference.

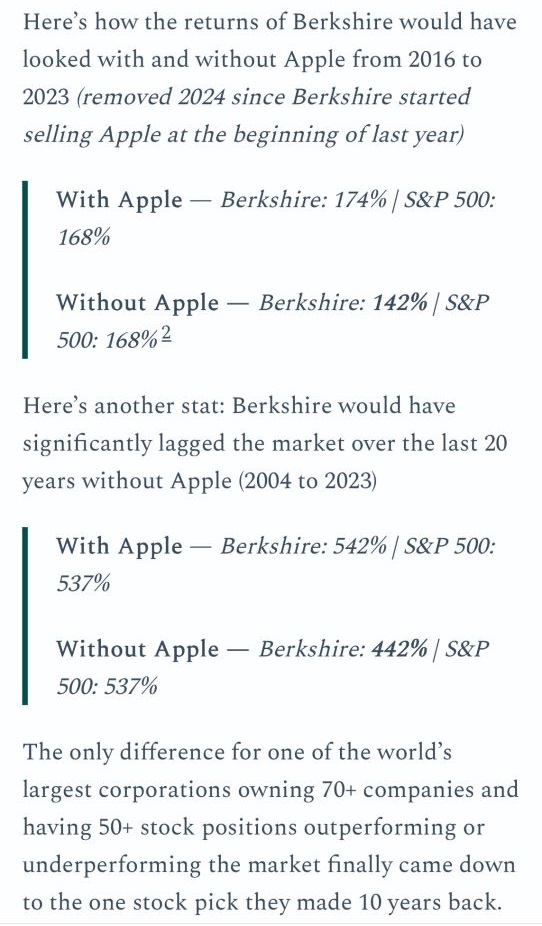

It comes down to position sizing. For example, AAPL is 6.7% of the S&P 500, but it’s 28.1% of Berkshire’s stock holdings. That’s how you get outperformance – by being overweight in the best stocks. Here are some numbers posted by MarketSentiment.

The first calculation suggests Berkshire did much better with AAPL than if it had never bought it. That one stock was the difference between a 174% gain and a 142% gain over the time period. That’s not insignificant.

The second calculation is suspect because they took AAPL out of Berkshire, but they didn’t take AAPL out of the S&P.

But the point remains. One stock made a big difference in Berkshire’s performance. In fact, many have made the case Buffett is good but not necessarily amazing because such a big percentage of his gains have come from a small number of investments. And if you took away several of those, his performance would not be noteworthy.

But this is by design. It’s not an accident. Charlie Munger himself admitted “if you took away our best 10 investments, our performance would be average.”

Buffett didn’t accidentally get lucky and invest in 10 outsized winners. That’s what he set out to do. He has said “concentration builds wealth; diversification preserves wealth.”

He placed concentrated bets on a small number of positions over the last 60 years, and the returns from those positions are the difference between matching the S&P 500 and destroying the S&P 500. It’s the difference between being average and possibly being the greatest ever.

Ten investments. That’s it. Just 10.

It’s one of the reasons I say you only need one good one every once in a while.