Good morning. Happy Thursday.

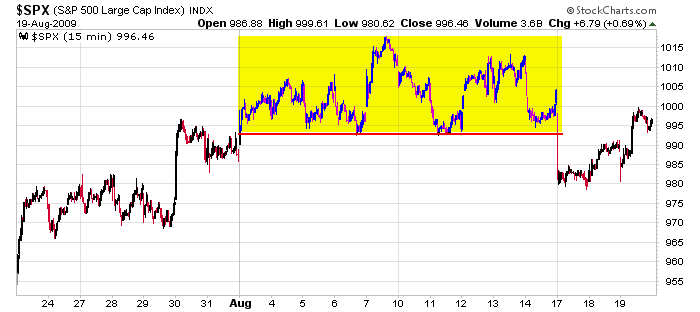

Other than the first couple minutes of trading on Monday, it hasn’t been a bad week. The market traded in a tight range most of Monday…slowly grinded up Tuesday…and moved up yesterday and closed up despite a big opening gap down. …

As the week has gone by, it’s become more and more evident the put open-interest I talked about over the weekend is putting a solid layer of support under the market…at least in the short term. Put OI far out-numbered call OI for Aug, and the market isn’t going to let those put holders make money.

The market often does exactly what the majority thinks but not in a timely manner. If indeed it’s the put OI that’s propping up a market that wants to fall, it would make perfect sense for the sell-off to be a few days late…cause lots of pain…then do as expected.

The Asian/Pacific markets closed mostly up including a 4.5% gain from China. Europe is currently up across the board – better than 1% gains from all the indexes. Futures here in the States suggest a small gap up open.

Given the action over the last two days (grind up Tues, gap down and rally Wed), a gap up today should be sellable…at least for a day trade. The market has already produced lots of pain for put holders; it doesn’t have to move up more. I stated over the weekend an SPY close between 99 and 100 is sufficient to cause lots of pain (the SPY closed right at 100 yesterday).

So this is what I’m thinking…if the market is trading as it is due to OE, then we’d expect a sell-off after, but a sell-off isn’t going to come in a timely manner…it’s not going to happen on Monday. That’s too easy. It’ll either start early (end of today and tomorrow or just tomorrow) or it’ll happen late (late Tues or Wed next week). It would be too easy and obvious for the market to sell-off Monday.

Here’s the 15-min chart. There are lots of traders who got spooked by Monday’s gap down. They’d love a chance to get out even.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers