Good morning. Happy Tuesday.

Sept will begin as Aug ended – on a down note.

The Asian/Pacific markets closed mostly up, but most gains were small. Europe is currently down across the board – a few are down more than 1%. Futures here in the States suggest a gap down open for the cash market. As of now, yesterday’s lows will not be taken out at the open, but obviously a lot can change in the next hour. …

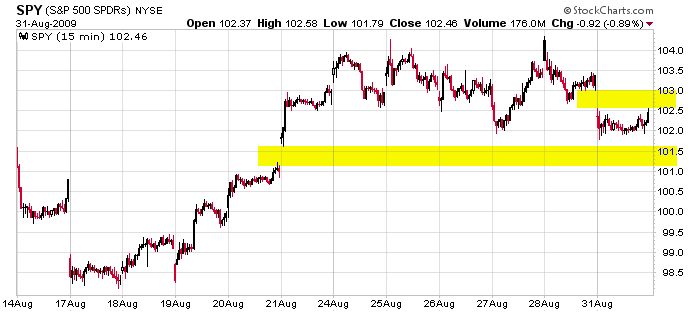

Here’s the 15-min SPY chart. I use it because it shows gaps better than the S&P index chart. The post-options expiration gap up (Aug 21) remains unfilled, and yesterday produced another unfilled gap. It goes without saying the market hasn’t done much the last 7 days, and it gives me a little justification for constantly suggesting to be conservative. The trend is up, but we’re not getting much follow through.

The summer doldrums typically lasts until a couple days after Labor Day which is next Monday.

Rest up if you don’t see many good set ups. This fall should offer great money making opportunities. Maybe we have a blow off top (the S&P could quickly move up to 1100 or higher) or a false move up followed by a stiff move down. In either case, we want movement, and I think we’ll get it.

Trades right now are not obvious, so resist the temptation to be aggressive.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…