Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up – China gained almost 5%.

Europe is up across the board – there are no standout winners.

Futures here in the States indicate a big gap up open that will put the market slightly above yesterday’s high. …

The S&P has fallen 4 consecutive days – this hasn’t happened since mid May.

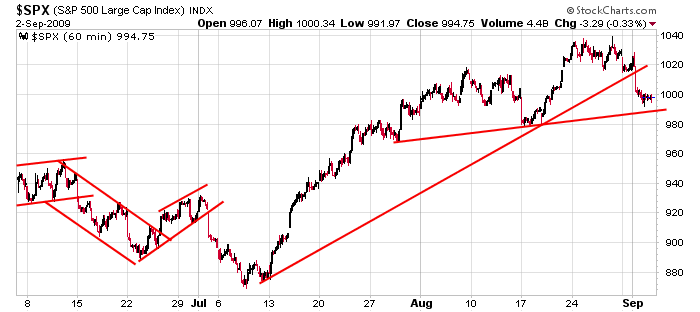

Here’s that 60-min SPX chart. Higher highs and higher lows remain the pattern. The short term trend is down, but the intermediate term trend remains up.

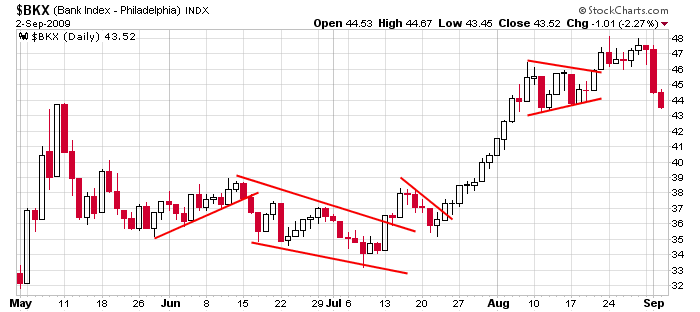

Banks are doing worse than the overall market. This is not a good sign if you’re hoping the market finds a bottom soon.

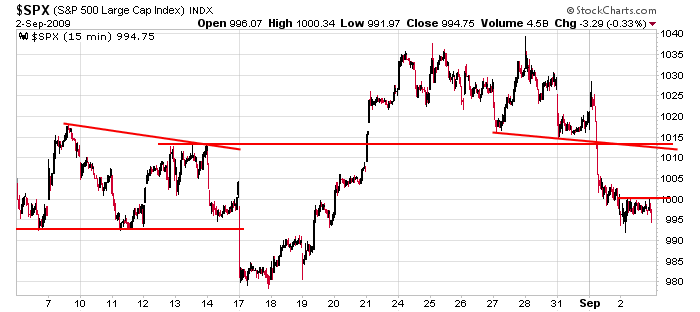

Here’s the 15-min chart. If the market holds its opening gains and builds on them tomorrow after the jobs report is released, my short term upside target is around 1012ish (give or take a point).

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 3)”

Leave a Reply

You must be logged in to post a comment.

Dateline: Friday, September 4th, 2009

A. Gene Young

copyright 2009

The q’z are in for a volatile whipsaw trading session.

The Chinese have been a bit angry with debt ridden Americans and as the world’s leading producer of gold I suspect they want to move their value out of worthless US treasury notes and into gold. If the Hunt brothers had a chance of cornering the world’s silver market I suppose the Chinese can do the same with gold with this one exception. No one is going to force the matter into the courts.

Using the Milken model, the Chinese are going to raid and dismantle the American economy. They’ve been at it for some time with the help of a couple American billionaires who will remain nameless. What the heck, the orifice of Omaha is one of them.