Good morning. Happy Tuesday. I hope you enjoyed your long weekend. I’m a little late returning some emails. I was in the mountains all weekend and told my wife to yell at me if I got on the computer for more than a few minutes each day, so I have a little catching up to do. …

The Asian/Pacific markets closed up across the board – there were a handful of > 1% gainers.

Europe is currently most up – the gains are much smaller.

Futures here in the States suggest a small gap up open for the cash market. Assuming nothing changes before the open, most of last Tuesday’s massive sell-off will have been recaptured by the opening bell.

It typically takes a couple days for all traders to get back to work after Labor Day, but for all practical purposes, summer trading is over and the fall season is under way.

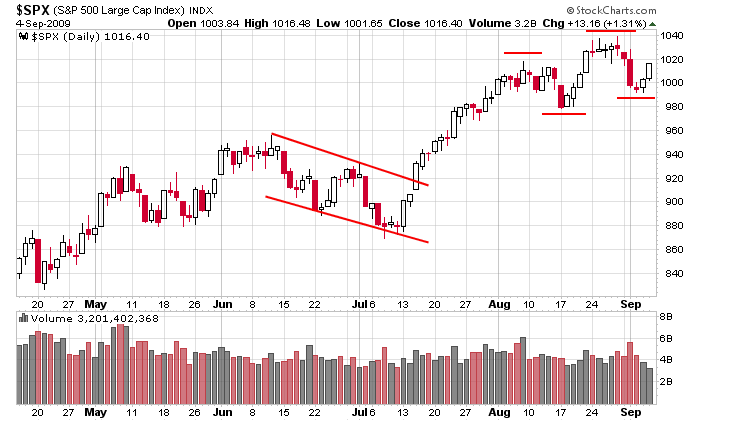

The bulls have gotten a couple scares lately, but the overall trend remains up. Higher highs and higher lows remain in place. Here’s the daily.

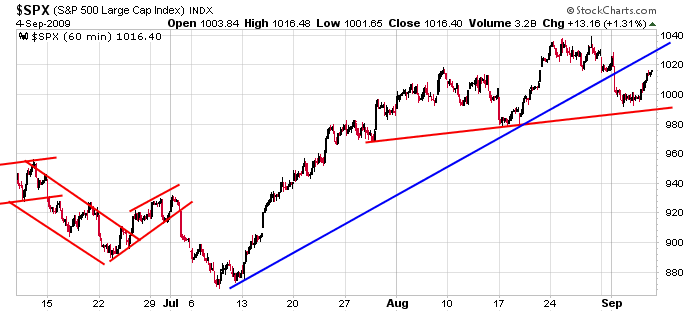

Here’s the 60-min. I’ll be watching 1030 as a possible level the bulls run out of steam. It’s not necessarily an automatic sell for swing trades, but it does present a place day traders could get short for a quick trade.

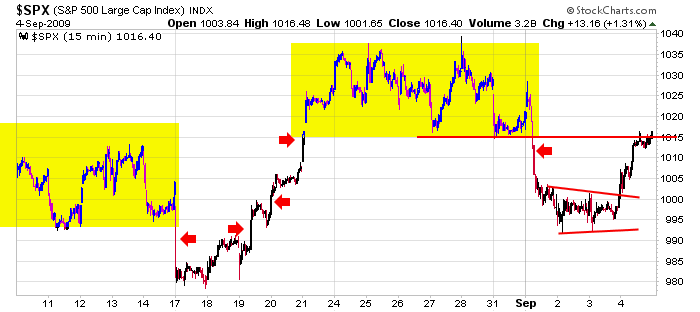

And here’s the 15-min. Lots of churning followed by quick moves in both directions, and after 4 weeks, the index has barely moved.

Very soon the market will make up its mind. The US dollar and LIBOR will offer clues. So will the banking group. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…