Good morning. Happy Friday.

It’s up up and away for the market. After 5 consecutive up days, all the indexes are at or near their highs. This is the longest winning streak for the S&P since the market bottomed in March. The bulls are relentless. They keep defending their turf. They keep buying every dip. This is supposed to be the worst performing month of the year, but the S&P is up almost 24 (2.3%) – not bad….

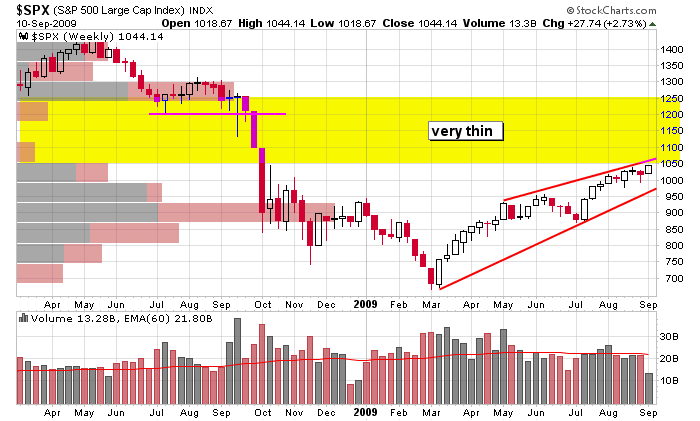

Here’s the weekly. We have a rising wedge into a very thin area, so this area (around 1050) seems significant. Be on your toes for either a mad hysterical squeeze into the thin area noted or a break down.

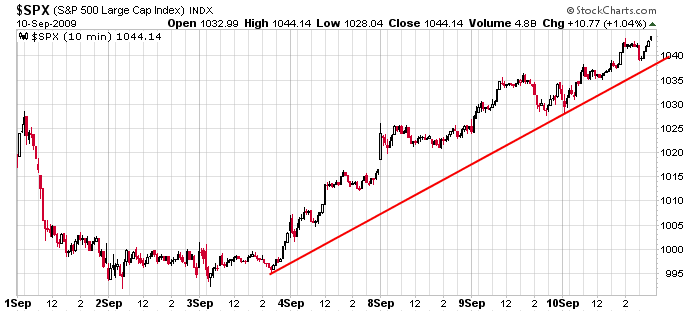

On a much shorter time frame, there isn’t much to chart. Steady buying has pushed the index up almost 50 points in one week.

The Asian/Pacific markets closed mostly up and Europe is currently up across the board. Futures here in the States are up slightly.

Let’s keep watching the US dollar and LIBOR.

All traders should be back from vacation next week. Volume will pick up, and the fall season officially begins. At the current level, the stage is nicely set for lots of movement – exactly what we want to see.

More comments coming after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 11)”

Leave a Reply

You must be logged in to post a comment.

Jason, I think the Thin Zone concept is very interesting. When you make a 1/12 year daily chart with the Price Volume bars and look at the stocks that have done very well from March until now, you can easily identify a bunch of them about to enter that zone.

Thanks,

Bob Michaels

PS: I am subscribing again later today to your service…