Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down. There were several 1% losers.

Europe is currently down across the board. There are a few 1% losers there too.

Futures here in the States points towards a gap down open for the cash market. This comes off a Friday where the indexes made new highs but closed with small losses. …

China is accusing the US of violating WTO rules by raising tariffs on Chinese tires for three years (35% the first year, 30% the second, 25% the third). Two can plan this game. China announced Sunday it’s launching antidumping investigations into imported US auto and chicken products.

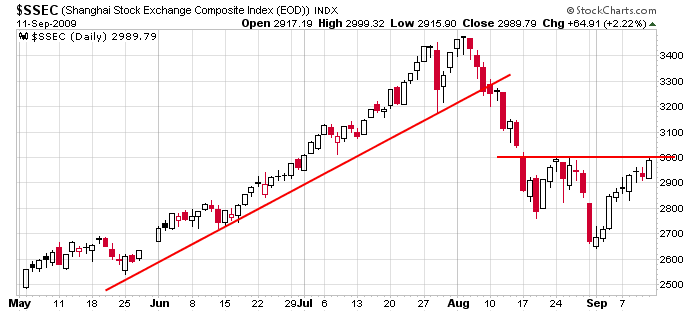

Here’s the China chart. It started underperforming in early August, but overall it hasn’t exerted a negative influence on the US markets.

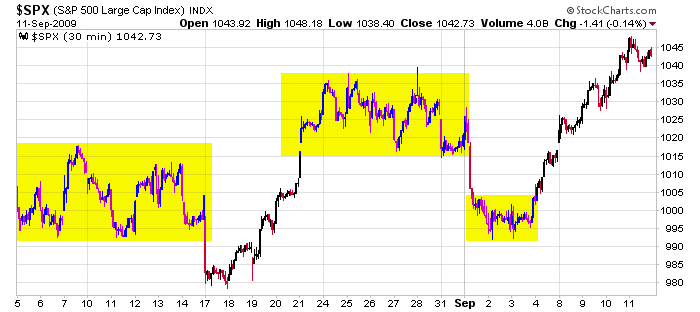

Here’s the 30-min S&P. Over the last 40 days, the action has been highlighted by periods of range-bound trading which resolved into sudden trending moves. Right now we’re in nose-bleed territory. After 50 points without much of a break, a pause is needed.

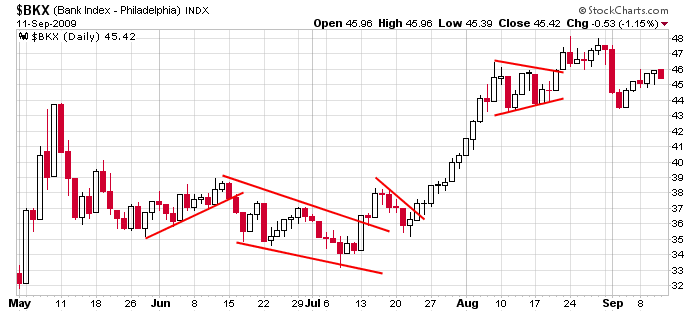

As mentioned the market made new higher highs Friday, but the banking group lagged. It’s something to keep an eye on. The banks got us into the financial crisis and since bottoming in March, they’ve been huge winners. If they start to lag, the indexes will have a tough time moving up.

That’s it for now. Summer trading is over. The fall season is here. We are at a critical juncture with a very thin trading zone just overhead and rising wedges forming on the index. Some very good trading opportunities are ahead. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…