Good morning. Happy Wednesday.

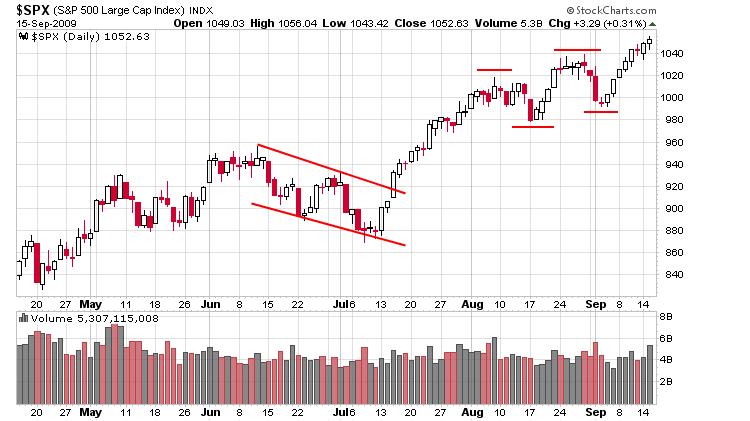

Yesterday was the 8th consecutive day the SPX exceeded its high from the previous day and the 4th consecutive day a new high was registered. The market keeps going and going and going. It hasn’t been exciting, but it’s not worth fighting. And the S&P is not alone. Every index is at a new high. Here’s the daily chart. …

As you can see, yesterday was the index’s highest-volume day in two weeks. In my opinion, high volume at these levels is more bearish than bullish. It’s a sign traders/investors who missed the rally are chasing. It means they may be in panic mode because they wanted to buy a dip that never happened. Now they’re afraid of completely missing the move, so they’re jumping in with reckless abandon. I’m not predicting a top here (a top could take a couple weeks to form), but if volume continues to be strong, to me, it’s a warning sign.

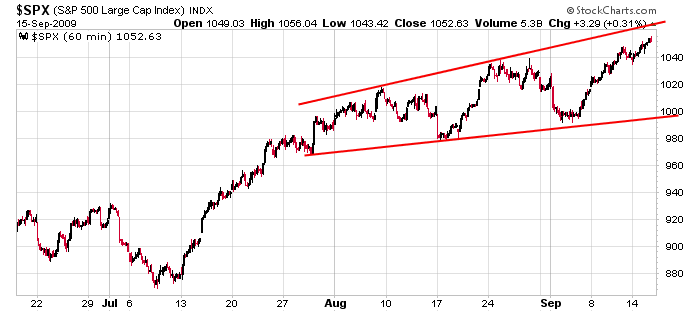

Here’s the 60-min chart. The index is broadening. Dips are shallower than previous dips and rallies are greater. This too isn’t a great sign…especially given the S&P sits right at the bottom of its thin zone (see chart posted yesterday).

But again, I’m not predicting a top…just making an observation. The trend is up, so that’s the way we should continue playing the market. Don’t get complacent. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 16)”

Leave a Reply

You must be logged in to post a comment.

I read somewhere that a lot of Tuesday volume was from Citigroup.

Nice comment on volume. To be honest, I hadn’t considered that interpretation.

It would only apply to one index.

I’m starting to think hedge using the VIX call options. Now to select the strike and time.