Good morning. Happy Thursday.

The market keeps going and going and going. There’s no fear. Every dip gets bought. The winning streak makes you wonder – is something going on behind the scenes? No rational market would act like this, but I’m not complaining. Our Long List is full of very good set ups that have broken out and given us some very nice profits. Luckily we don’t have to figure out why things happen. We just have to be observant enough and objective enough to see what’s happening and then follow along. …Trading is a big game of follow the leader, and we’re not the leader. When the biggest and best traders/investors buy and sell, they leave footprints in the charts. Our job is to notice those footprints and follow them. Simple as that. It’s not always simple, but it’s much easier than answering the Why question.

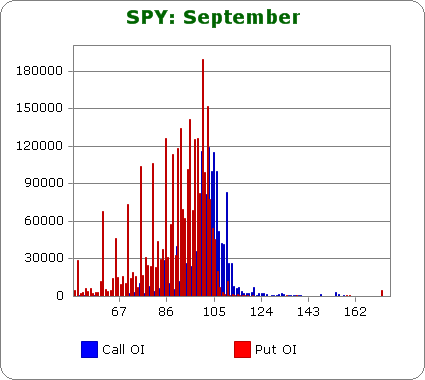

Options expire tomorrow. Once again put open-interest is much greater than call open-interest, so odds favor the current price levels holding. Here’s the OI chart for SPY.

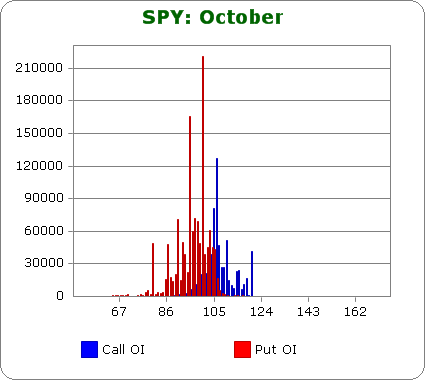

As long as traders continue anticipating a big move down, the market is likely to stay up. When the balance shifts, when there’s as much blue as red, we’ll know the bears have given up, and a top may be near. The chart for Oct has lots more red than blue, but it’s not as lopsided. We’ll have to see what happens next week. What new positions will be opened?

When I think something fishy is going on, I stop drawing trendlines on my charts. If there’s a force working behind the scenes, support and resistance don’t matter much on a short term basis. All I know is the trend is up, but I’m not getting complacent. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 17)”

Leave a Reply

You must be logged in to post a comment.

where can i find the spy option charts you are showing today ty

Here ya go…

http://www.schaeffersresearch.com/streetools/indicators/open_interest_configuration.aspx?ticker=

(not sure if this link will work…might have to copy and paste it)

why not just buy call options on vix out to jan10?

The VIX can stay at low levels for a long long time.

how about call options on DXD or SDS out to Jan10 with a high strike. Good leverage, low cost.

The charts are new and useful to me. They would balance better if the color boxes were reversed to match where those colors are on the chart. I enjoy your evaluations and have lost money on shorts because I think the market has gone too far. Your comments about that are right on. Thank you. Bill Dean

I wish we users could define the scale of the X axis, so we could eliminate the dead space on the right side and spread the graph out.

I’d think the direction would be predisposed by which side of which fence the large lots were on. Are they on the writer/buy side of the CALL or the writer/buy side of the PUT? If the Large Lots were on the write side of the PUT then it would be in their best interests if the underlying was flat or up.