Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mixed – China was a big loser (lost 3.2%).

Europe is currently mixed and little moved from yesterday’s close.

Futures here in the States suggest a flat open for the cash market. …

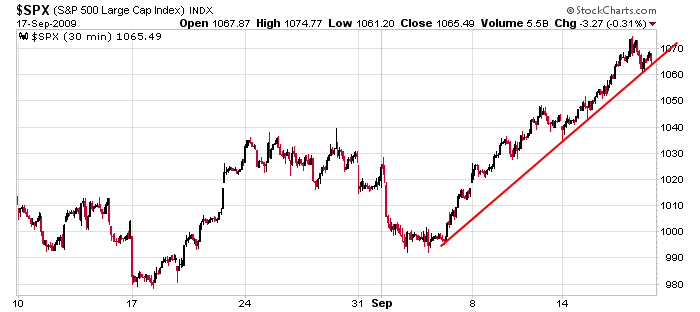

The put open interest once again dominated the call open interest, and here we are near the highs. The bears keep betting on a big move down, and they keep getting burned. When will they learn? Wall St. hasn’t changed in 100 years. When traders/investors are super bullish, it pays to be skeptical. When they’re in panic mode, it pays to look for bargains. Right now there’s no fear. Nobody is worried. Everything is peachy keen. Good times are ahead. Or at least that’s the sentiment. Here’s the SPX 30-min chart. It’s moved about 80 points in just over two weeks. It deserves a break.

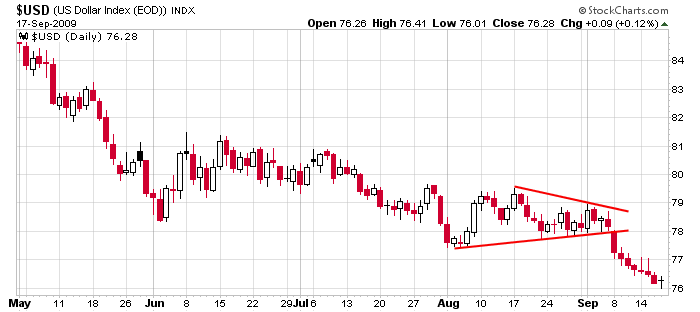

We’ve talked about the US dollar several times the last month. As long as it drops, the market will remain propped up. The large multinational companies which dominate the indexes are able to sell goods overseas at more favorable levels. They make more money, and their stocks respond. Here’s the dollar. I’m not going to call yesterday’s candle a reversal, but it’s something to keep an eye on in the near term.

The trend is up, but we’re in nosebleed territory. Play good defense. Exit laggards to free up cash for new positions. Take a few bucks off the table with trades that have worked well. Repeat, repeat. And don’t try to guess when the market will top. It’ll happen when the bears are thoroughly frustrated. We’re not there yet.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 18)”

Leave a Reply

You must be logged in to post a comment.

heres todays

Jason,

You may not be willing to call yesterday’s action a bottom in the dollar, but it sure was a classic doji reversal candlestick.

Do you not think the bears are totally frustrated yet? You should read the Investor Village message boards. CNBC parading bull after bull out this morning and they are strutting and cocky. S&P 1200 – 1250 seems to be automatic among these guys. The bears are crying manipulation and the bulls are making money. Of course, they only make money if they sell before giving it all back.

Do you still think this is a bear market rally? I’m still in the camp that believes there’s got to be a double bottom for this to be anything other than a classic bear market retrace. If that’s correct, there is pain to come at some point.

how are you getting ready for the pain? How about some calls on SDS out to about jab10?