Good morning. Happy Monday. I hope you had a nice weekend.

The Asian/Pacific markets closed mixed – there were no big winners or losers.

Europe is currently down across the board – there are several markets down more than 1%.

Futures here in the States suggest a gap down open for the cash market. …

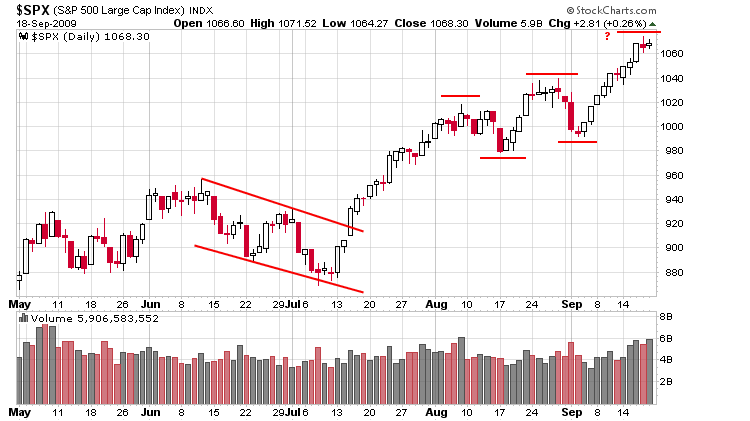

Here’s the SPX daily. You can’t argue with the trend, but you could argue the index is in nosebleed territory and in need of a rest. Last Thursday was a near Doji day – a sign of indecision. Then Friday was an inside day – the high and low were contained within the previous day’s high and low. Such action builds pressure into the market and often results in a trend day.

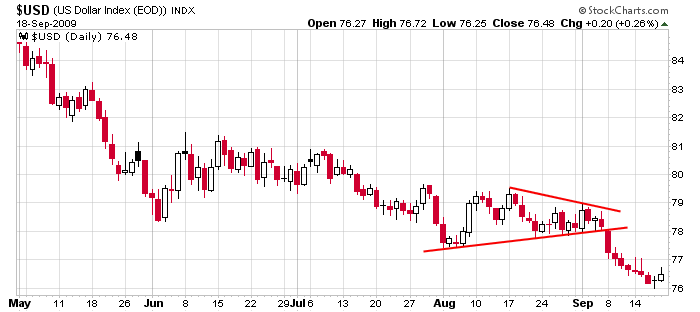

Let’s continue to keep an eye on the US dollar. If it rallies here, odds favor the market pulling back.

Options expiration is over. The bears lost again. You know the routine…the market could unwind to piss off the bears even more. It’s one thing to lose money predicting a sell-off. It’s another to lose money and then see the market drop right after OE.

Also, remember Wednesday is FOMC day. Considering how well the market has done the last 6 months, I wouldn’t be surprised if the Fed kept rates the same but sounded tougher in their statement. Higher rates are coming soon, and it’s unknown how the market will handle the prospect of more expensive money.

That’s it for now. I don’t have much to add to my weekend comments. The trend is up, but a rest is needed.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 21)”

Leave a Reply

You must be logged in to post a comment.

You do really good audio/video presentations about the market. I would really appreciate one that explains how the options influence the market in their last week. Including at what point do the imbalances come into play? at a ratio of 100:110 do they matter? at 100:150 do they matter? at 100:200 ? The imbalance this last time did not move in the direction of the weight of options.

Hi William,

This is definitely not rocket science…and not the holy grail either.

Very simply put, the market likes to cause the most amount of pain for the most amount of people. If too many traders get stacked on one side, the market is likely to move such that those traders are proven wrong. But there is not specific day a move will begin and there’s definitely no guarantee the market will close at a certain place just because the put/call open-interest is stacked a certain way.

As far as the ratios you mention. I have no idea. Again this isn’t rocket science.

How do I use the numbers? I glance at them and say to myself: “Gee there’s a lot more puts that calls. Odds favor the market continuing up or at the very least moving sideways, so my bias is to the upside.” That’s it. Other than helping me form a bias, I don’t use the numbers for anything else.

Jason