Good morning. Happy Tuesday.

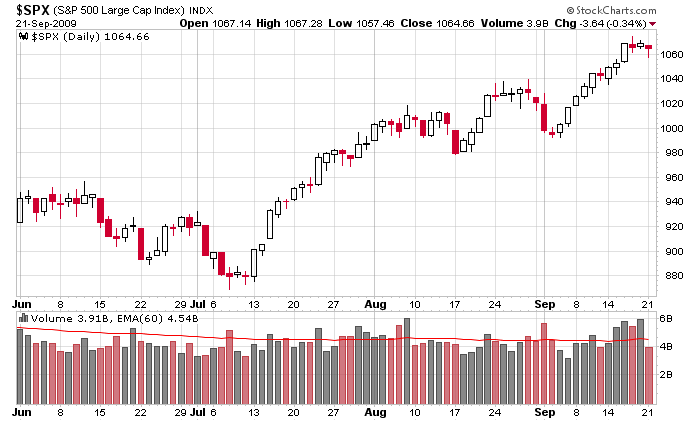

Yesterday the market gapped down and other than a brief late morning pop, prices were stuck in a tight range. Today we’ll get a gap up near the highs.

The Asian/Pacific markets closed mixed – China lost 2.3%.

Europe is currently up across the board – there are a couple 1% winners. …

I was expecting yesterday to be a fairly normal day and today to be very slow, but since yesterday was pretty slow, today might closely resemble pre holiday trading. There’s no doubt tomorrow’s Fed announcement looms large – it’s no longer a given they’ll stand pat and issue a “dovish” statement. They could start talking tough; they could hint at raising rates soon. The market wants to know what the Fed will say before it makes up its mind.

It’s not a given today will be super slow. We’ve see the market surprisingly trend the day before in anticipation. At the very least I’d adopt a defensive posture. There’s no point taking big chances right now.

The best scenario (if you’re bullish) is for the market to be weakish today and then weak tomorrow on news rates are likely to be moved up. Then, in the name of absorbing bad news, the market surprisingly rallies

If you’re bearish, getting a Fed-induced pop is the best case scenario, but otherwise I have no clue why the bears are so bearish. How many times do they have to get burned before they realize it’s much easier trading in the direction of the trend than against it.

Here’s the S&P daily without trendline. We’ve had 3 quiet days. Don’t over-analyze here. The market wants to know what the Fed is thinking before beginning its next move.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…