Good morning. Happy Wednesday. Happy Fed day.

Today’s the day the Fed tickers with interest rates. They don’t do it directly. Instead they target the overnight rate which influences how aggressively banks lend and at what rate they lend. The overnight rate is basically at 0, so it can’t go lower. Although there’s been some chatter the Fed needs to raise rates, it’s unlikely they do it. They tend to be late with all rate moves – waiting too long to raise or lower, not raising or lowering fast enough. They like to be absolutely sure before making an adjustment. They could however change the language in their statement. For many meetings, they’ve let it be known rates will remain low for a long time, but things are better now, right? In fact Bernanke said himself the recession is likely over. If this is the case, shouldn’t they consider raising rates or let it be known rates aren’t likely to stay this low for long?

Anyway, as usual the market will be slow until the 2:15 EST announcement.

The Asian/Pacific markets closed mixed.

Europe is currently most up.

Futures here in the States are up a couple points.

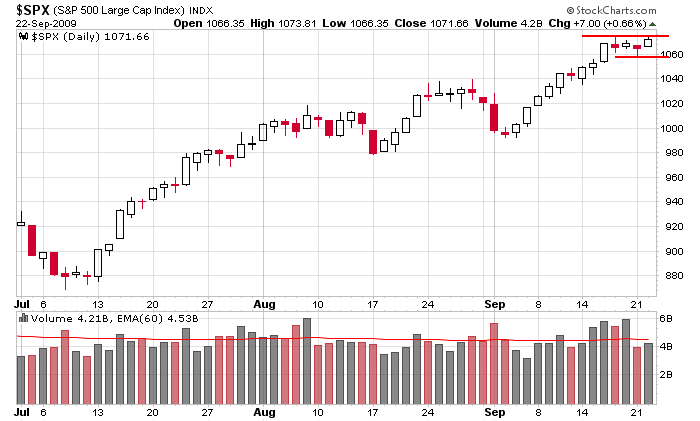

Here’s the daily SPX chart. It’s been a tight range for 4 days. I hate news-induced breakouts, so I’m hope today’s announcement has little effect on the market and tomorrow is when the real move begins.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 23)”

Leave a Reply

You must be logged in to post a comment.

Jason,

We didn’t detect a note of sarcasm, did we? “But things are better now, right?” “The recession is likely over.”

That said, tape fighting has been very unproductive and things can stay like this for a long, long time if the printing presses keep rolling. There has been a direct correlation between money printing……….er…….quantitative easing and the rise of the market. I saw a chart the other day and the two are moving in tandem. Can’t fight this tape even though logically it seems impossible that it keeps going up.

LOL…just a little sarcasm. 🙂 I agree. Even though the rally has come too far too fast, I’m have no desire to fight it. That being said, I’ll go short in a heart beat when this thing tops out.