Good morning. Happy Thursday.

So after an initial pop yesterday after the Fed announcement that pushed most of the indexes to new highs, the market took a big dump. Ugly candles on the daily charts formed across the board. Volume was pretty good. But as I’ve said numerous times, the day after the Fed is more important than Fed day itself. The market has illogically turned about and reversed itself. …

The Asian/Pacific markets were mixed with a bearish bias – Hong Kong lost 2.5%.

Europe is currently mostly down – losses aren’t great.

Futures here in the States are flat.

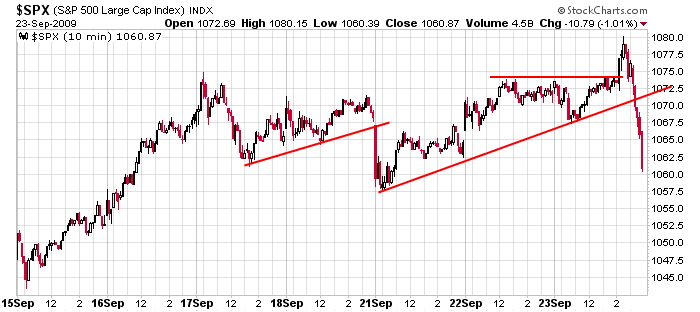

I’d say anything goes today. Here’s the SPX 10-min chart. Early strength could get sold into around 1067.5 or 1072 or early weakness could get bought around 1057.5.

Whatever the case, caution is warranted. Other than a brief dip Monday and a brief pop Wednesday, the market has been range bound. The longer term trend remains solidly in place, but short term, things aren’t so clear.

Make sure you have your time frames in order. If you’re a longer term swing trader, one scary day isn’t cause for concern. You have to sit through pullback in order to ride trends for everything they’re worth. If you focus on the shorter term, follow though is reason to exit longs and look short. Both methods worth, but you can’t do both at the same time. One or the other, don’t be middle of the road.

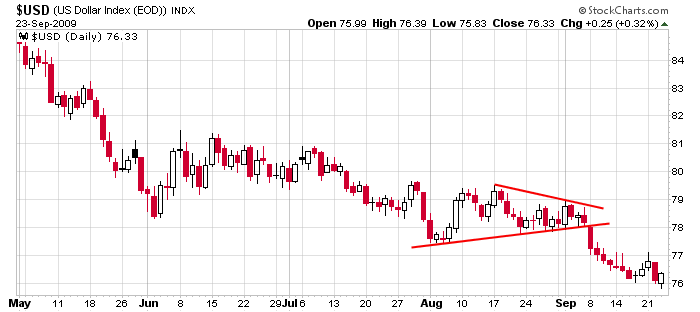

The US dollar formed what might be a reversal candle off a low. The dollar and the market has been inversely correlated, so besides the market itself showing near term topping signs, a move up from the dollar would confirm.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 24)”

Leave a Reply

You must be logged in to post a comment.

The banks are floating the market using your money loaned by the Fed. They are looking for trading profits and finding them.

It is a clear conflict of interest by all involved, and the banks, as usual, are blowing a bubble that is riding on only a few bank traders. The investor has not got much of a chance in this setup.

There’s very little question that this market is being fueled by printed money. But we don’t know how long it can go on. Maybe a long time, despite the selling yesterday and today. Eventually, it implodes, but maybe we miss a 6 or 12 month monster rally positioning ourself for the implosion. There are probably other factors at work propping up the market. Jason has used the word “manipulation,” I believe. I’ll buy that.

“The stock market is the most sophisticated numbers racket ever devised by man” …AGeneYoung

I suppose this market is being driven by people betting there’s a direct relationship between the economy and the market. When people stop betting on the downside then maybe it will happen. Not before then. They need to run out of money or nerve.

My target for the Q’z in the next 3-5 trading days is 42.25 or so. I’m investing in the bears being wrong.

. . . so many numbers to pick; I meant 43.96. 42.25 was the right number but the wrong day. 🙂

A. Gene Young