Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down – Japan lost 2.6%.

Europe is currently mostly up, but gains are small.

Futures here in the States suggest a small gap up open.

Spain has tipped into a depression. Unemployment may peak around 25% and the unsold properties on the market will take at least 6-7 years to absorb. A recovery won’t take place until well into the next decade. They’ll consider themselves lucky if they simply have a lost decade. Here’s the story.

This week may or may not be a turning point. The market was quiet Mon & Tues and has reacted negatively to the Fed with a stiff move down Wed & Thurs – or the market was due for a drop and was just using the Fed as an excuse. Gotta blame someone, right?

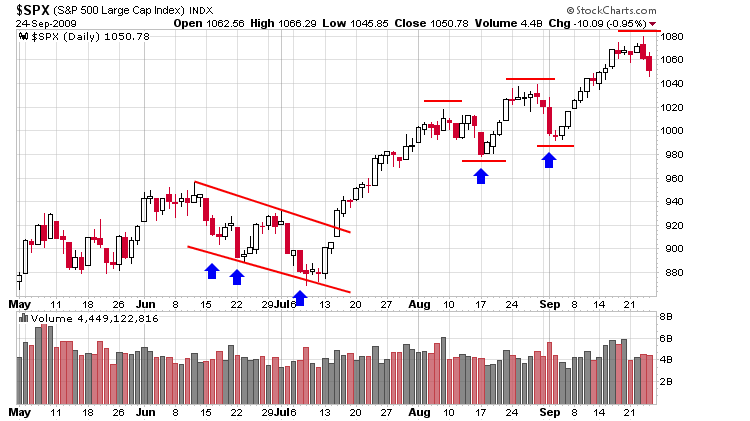

We’ve seen this before. Many times since the market bottomed the bears took over in the short term. Prices were driven lower, people questioned the recovery, the bears got excited, and in each instance, new highs were registered not long after. Whether this time is any different remains to be seen. Maybe a top is indeed in place, and the internet will be filled with bears saying: “I told you so.” Whatever! A stopped clock is correct twice a day. If you keep singing the same tune, eventually you’ll be right. Here’s the SPX daily.

Overall higher highs and higher lows remain in place, and for what it’s worth, volume has been very light this week. Swing traders who trying to ride trends for all their worth can hold stocks with appropriate stops. Shorter term traders should have been out yesterday at the latest. As far as playing the downside, I prefer buying the inverse ETFs. You get less bang for your buck, but there’s also much less risk and very little research time needed.

That’s it for now. I’ll comment more after the open as well as post a few set ups.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 25)”

Leave a Reply

You must be logged in to post a comment.

Where do you find these inverse ETFs?

Ed…here are two links

List of ETFs

ChartBook

Jason

You mean those green jobs initiatives haven’t saved Spain’s economy? Central planning doesn’t work?

A bounce play at 1035 will work for a scalp. Everybody’s talking 1035. The selling hasn’t been spirited enough yet to scare people. Dip buyers still feel empowered although they’ve lost a couple times recently. If 1035 fails to hold, at least your loss is defined. But they might go down and take out the stops at 1034 and 1033.

Date Line: Friday, September 25, 2009 @ 3:08pm

The Q’z are in for some extreme volatility.

.QQQVK otm $37 puts @ $0.08 &

.QQQJS otm $45 calls @ $0.06

Should give a good leg in the market once it moves to sell into a good spread. Just my humble opinion.

A. Gene Young