Good morning. Happy Wednesday.

The last day of the month and quarter will get off to a good start – futures here in the States are up moderately.

The Asian/Pacific markets closed mostly up – there were no standout winners.

Europe is up across the board – no standout winners there either. …

Barring a total meltdown, this will be the 7th consecutive up month for the market. The last time such a winning streak was in place was the end of 2006 and before than, 1995. This time around the point gains were far superior to either of those instances. Not bad and not entirely expected when the market bottomed.

The market is typically strong during the winter months (it was weak), weak during the summer (it was strong) and particularly weak during Sep (it was strong). Tradition hasn’t held.

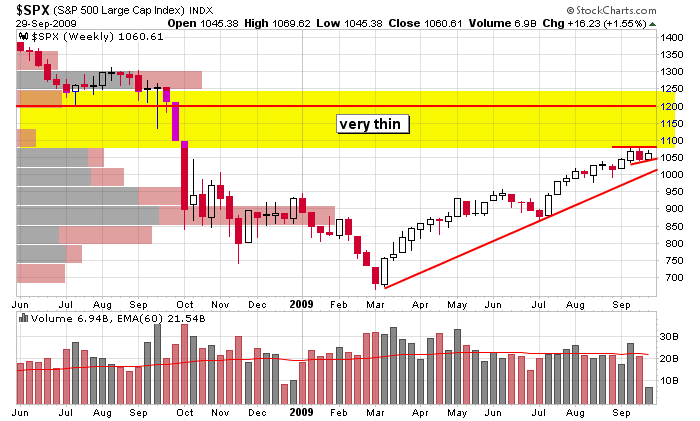

Here’s the weekly SPX. We have a little consolidation pattern forming just under the thin trading area, and so far, all of this weeks movement has been contained within the high and low of last week. The trend is up and pressure is building.

For now I remain in conservative mode. I’m finding more long set ups than short, but not much is jumping off the computer screen at me. I’m a big proponent of taking the easy and obvious trades and letting the others go by. There’s always another day and another trade. Like a baseball player who waits for his pitch, I like to wait for my trade, and if it isn’t there, I wait. Jesse Livermore said: “it was the waiting that made me the money.”

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 30)”

Leave a Reply

You must be logged in to post a comment.

The break even of the position I took up yesterday in the Q’z is 42.63.

There are a lot of desperate pessimists in the market. That was the indication I got the other day. It was through the roof. That combined with some year end profit taking should move the markets sideways to a little up. The market should move up to digest that heavy selling as the makers hand those positions off.

I didn’t expect them to cross the close of yesterday but I have a target of 42.66 at the close. I’m expecting the close to be around 42.66.

I think a lot of people are betting very heavily on the downside. Jessie also said it didn’t matter what you thought of a market; what mattered is what you did in it. I think a lot of desperate people are betting the farm.

Some times you wait to get a position and sometimes you wait in the position. Historically I’ve always sold too soon.

I’m just waiting to see if my speculation pans out.

close: 42.65554

good golly, look at them Q’z.

rocket, man.

no doubt…look at ’em fly

QQQQ 42.44 +0.22 42.43 42.44 42.60 41.60 100,691,186

Quotes as of 9/30/2009 1:38:21 PM ET

I should have sold calls @ 42.60 and not hold out for the final nickle. I knew that but I’m probably never going to learn.

They’re looking like they might head down to 42.22.

Symbol Last Change Bid Ask High Low Volume

QQQQ 42.44 +0.22 42.43 42.44 42.60 41.60 100,691,186

that’s a high volume

I missed the market close by quite a bit. What a heck of a day though. I should have better sense than to call the times some levels will occur. I did come kind of close with the high of 42.60 though. Close to the right level but the wrong time.

Quotes as of 9/30/2009 4:18:48 PM ET

Volume

170,510,287

. . . and they’re not done yet. That’s a respectable volume.

Jason,

I was looking at a chart the other day when I saw the significant positions and then I got a message “data unavailable” and the chart reset. Then I went to google finance and didn’t see the volumes or the levels. That’s when I went to nasdaq and looked at the after market. They were there.

I plan on looking at the Q’z this evening and processing the aftermarket. I’ll post my findings tomorrow here.

A. Gene Young

Great, thanks A. Gene