Good morning. Happy Friday.

It wasn’t a happy day for the market yesterday. So much for laying low in the triangle pattern until after the employment numbers were released. Pressure was building on a short term basis – we knew that, but I didn’t think the bulls or bears would take a strong stand before potentially market-moving data. But things changed slightly this week. … Twice the market has sold off hard on less-that-expected data. This is a change from the previous several months when bad news would get ignored/absorbed. Not any more. Bad news is causing selling – a change in character. The bulls didn’t want to hold knowing they wouldn’t be able to exit some of their positions until the open. This type of selling has happened a few times the last 6 months, and each time the bulls stepped up to defend their turf. The onus is on them once again.

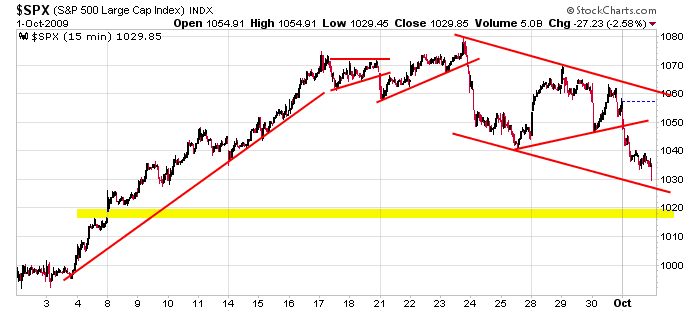

Here’s the 15-min chart. The triangle pattern resolved down. The next two levels I’m keying on are the lower trend line which is drawn through the last reaction low of the pattern and parallel to the upper trendline and the gap shown in yellow.

Here are the quick employment numbers…

Unemployment rate down to 9.8%

Nonfarm payroll levels dropped 263K

The market is selling off hard. Should be a fun day.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Oct 2)”

Leave a Reply

You must be logged in to post a comment.

Target price today in Q’z

42.534448

It might get there sometime today but I’m not calling the close. 🙂

Wow…that would be a massive bounce!

Good morning Jason.

I’d have to review my notes . . . let me look.

9/28/2009 5:16:11 PM ET

One of the most horrendous pessimistic indicators I’ve ever seen.

All those bears couldn’t be right. They were right for a couple of day. Now I think they’ve been mixed with cement and are being used to lay in a level of support.

Just my opinion.

The Q’s are trading ballisticly. Somethings about to happen.

Jason,

May 26 of this year the Q’z traveled up $1.65 in a day. It doesn’t happen often yet isn’t unprecedented.

If that repeated it would put them at $42.32.

Now if they cross $42 I’m going to start selling calls.

green day, nothing but blue skies. Better than expected bad news and the bulls rage. Now if I can just get my timing down a little better.

The Q’z are up .41% from yesterday’s close but they gapped down to open @ 40.72. They’ve traveled 1.18% to the high off that morning open.

buy .GEWJQ @ 0.45 16strike

sell .GEWJR @ 0.17 17strike

10 contracts of the debit spread

$280 plus commission.

if GE closes above 17; $720 less commissions.

just a thought. It did gap down this morning also and hasn’t filled it yet.

I’ll take a harder look at this.

GE’s looking like a potential trading line of 16.50870.

Sometimes a stock moves to the level I imagine and sometimes it runs like crazy away from them. Sometimes it takes a couple of days. I haven’t been able to figure it out yet.