Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed with a slight bearish bias. India and Seoul each lost more than 1%.

Europe is currently up across the board – there are no standout winners.

Futures here in the States suggest a gap up open for the cash market….

I don’t have much to add to my weekend comments. There’s been some definite selling pressure the last week or so. The bulls need to step up as they’ve done several times since the Mar low – otherwise this time will be different.

The banks are underperforming and some key stocks have taken big hits lately. The internal breadth indicators are at or near their lowest levels in many months. One the surface, this isn’t comforting situation, but further weakness could signal a washout and bottom – at least in the near term.

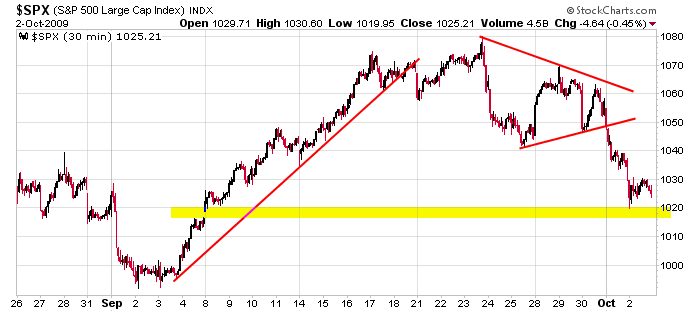

Here’s the 30-min SPX chart. The early Sep gap up is close. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Oct 5)”

Leave a Reply

You must be logged in to post a comment.

I see the Q’z as being in a strong trend continuation from the trend of last Friday with an above average amount of pessimism.

I saw two healthy positions enter the market. One was for 200,000 shares and another was a put of about 25,713,911 shares. A sensible level for those puts to start selling is @ 42.27 in my opinion.

I’m still at this table with the same hand. I have revised the point of where I plan on selling calls. I’m looking to sell 24 contracts around 42.10 or so. I’m not going to hold out for that last nickle.

Two lines that might need to be resolved are 41.76 and 41.87

We’ll see.

on 9-30-09 Thompson-Reuters forcast for next 4 Qtrs beginning with Qtr 3

down 25% down 193% down 34% down 18% (Qtr 2 in 2010)

If Qtr 4 is really down that much it will play hell with the S&P PE by a multiple of more than 7 and cause more than drastic market change. Maybe it’s a typo.

Wow, William, down 193% sounds like bankruptcy. Through the floor.

Buying and selling spreads is a good way to limit loss.

Buying bear puts or selling bear calls is a good way to take advantage of the impending crash on wall street. 🙂

A credit spread can be profitable if the market doesn’t move up through it. If a market moves through a bear call you’ll lose $100 for ever contract you have. If the market ranges at a more or less constant level bear calls (credit spreads) are profitable and bear puts (debit spreads) expire worthless.

I think what I saw this morning is the final leg in a very hedged market. Hedges properly adjusted can be profitable but I think they’re ready to sell hedges in the Q’z.

Time is a hungry bear for option hedges. I think they’re ready to sell hedges and let time do it’s job.

I think October is a good time to sell hedges or calls or puts and let time do its job.

That’s just my opinion.

gld is through the bands.