Good morning. Happy Tuesday.

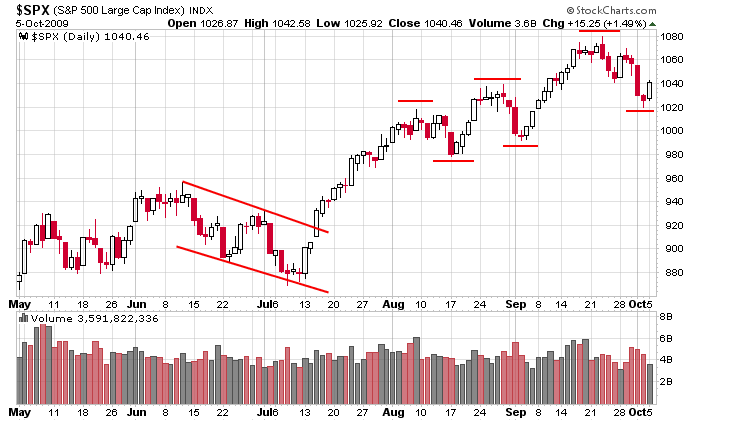

Coming into this week I said the onus was on the bulls. They had to dig their feet in and defend their turf. So far, so good. Yesterday was a solid up day (albeit on light volume) and today we’ll get a big opening gap up (not desirable – I’d prefer a slightly down or flat open followed by a solid move up). Here’s the daily SPX. The current action doesn’t look that much different than the previous couple reaction lows. …

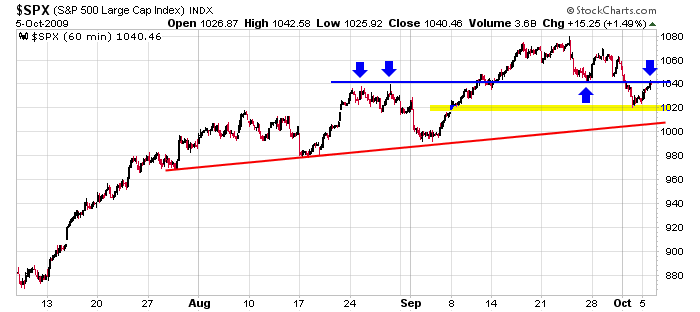

Here’s the 60-min chart. The early-Sept gap up did not fill. 1040 has been resistance and support a few times the last 7 weeks, so watch for it to be support today if the opening gap fills.

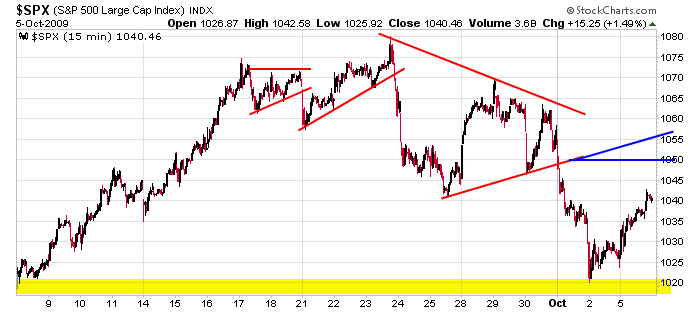

And here’s the 15-min chart. Upside resistance comes in at 1050 (the area of last week’s break down) and then 1056ish (a previous support level turned resistance).

Overall the market isn’t in bad shape. Higher highs and higher lows remain the pattern, but yesterday’s light-volume move followed by today’s gap up isn’t exactly the ideal way to form a bottom.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Oct 6)”

Leave a Reply

You must be logged in to post a comment.

Strong trend continuation coming up to the 41.79 line.

Q’z have busted through the upper YEB band; appear to be @ 41.78 for some trading.

41.87 getting resolved; upper YEB is moving up last look.

I’ve sold a batch of calls. If the 42 line holds and moves up I’ll sell some more.

ge’s looking like it’s headed to $17. I haven’t keep an eye on it. I might review it sometime after lunch.

Nice work A Gene…we had lots of long set ups posted this past weekend.

Thank you Jason.

Did you look at GE? I’m seeing a line @ 19.90541 for trading but it’s so high up there I can’t hardly believe it.

What do you think of GE?

I threw a little more speculation on the table by going long some puts a little while ago @ the 41 dollar level with an expected line @ 40.48917. I’m essentially hedged yet not quite the way I tried it 2 different ways.

Maybe a computer glitch.

Heavy volume at the close in the Q’z. Looks good for those puts tomorrow.