Good morning. Happy Wednesday.

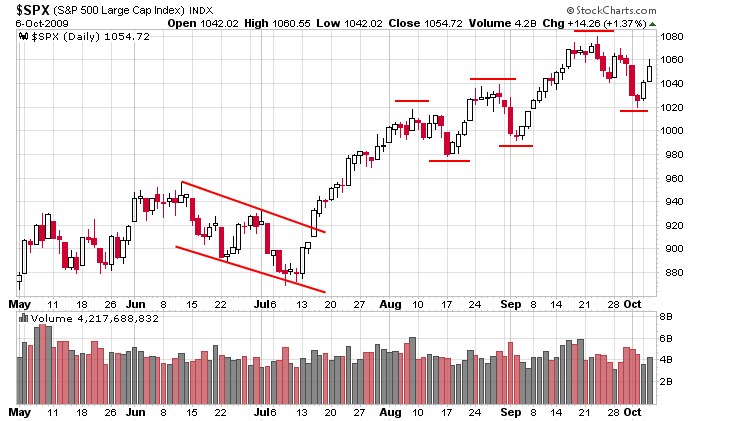

Heading into this week, the bulls had their backs against the wall and as they’ve done several times the last 7 months, they’ve responded. Here’s the daily SPX. Higher highs and higher lows remain the pattern – the intermediate term trend remains up. …

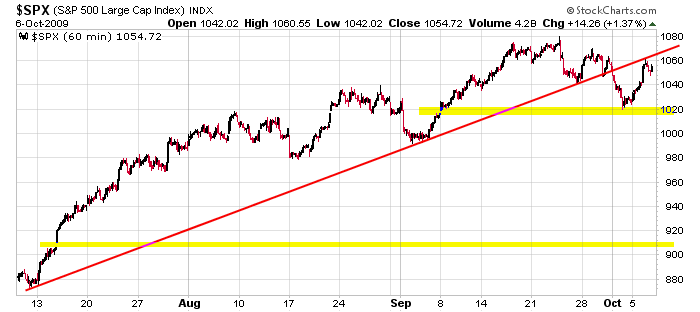

Here’s the 60-min. The uptrending line shown is significant for now. The more touches, the more important. And two gap ups remain unfilled.

I’ve talked about the UD dollar playing a role in the market’s movement. A weak dollar helps; a strong dollar does not. The trend remains down, so for now the market is getting a little boost.

The S&P is down 2 points for the month – not bad considering how the month started. After the close today we’ll look at the put/call open interest for Oct to see if once again the bears have loaded up in anticipation of a big sell-off. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Oct 7)”

Leave a Reply

You must be logged in to post a comment.

all’s quite on the eastern front.

I meant quiet, quite quiet

I think there’s some serious hedging going on in the Q’z. What I noticed from the after/premarket was strong trend continuation with a possible trading/breather line @:

43.43407

however, I wouldn’t recommend long calls unless it pulls back to:

41.77707

or there abouts.

just a hunch.

wow, @ 9:48am it did that! What am I holding these puts for???

anyone have any thoughts?

Well, I guess I’m the only one watching this. Kind of like watching paint dry. Reminds me of old Doc singing:

The sun comes up and the sun goes down

And the hands on the clock go round and roumd

I just wake up and it’s time to lay down,

Life gets teejus, doon’t it.

Big dog’s move it up then a little down

adjustin’ their hedges to the fraction hair

spinning my head like Linda Blair

what do I care it’s only money

Yes it does, Doc. It sure does.