Good morning. Happy Thursday.

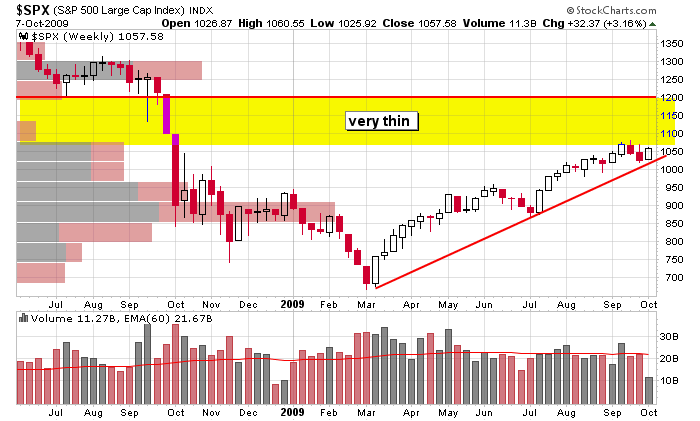

After two solid up days (albeit not always on strong volume), the market rested yesterday. The S&P is now up for Oct – this would be the 8th consecutive up month, but of course it’s very early. Here’s the weekly chart. There’s nothing wrong here. Higher highs and higher lows remain in place. The trend is up….

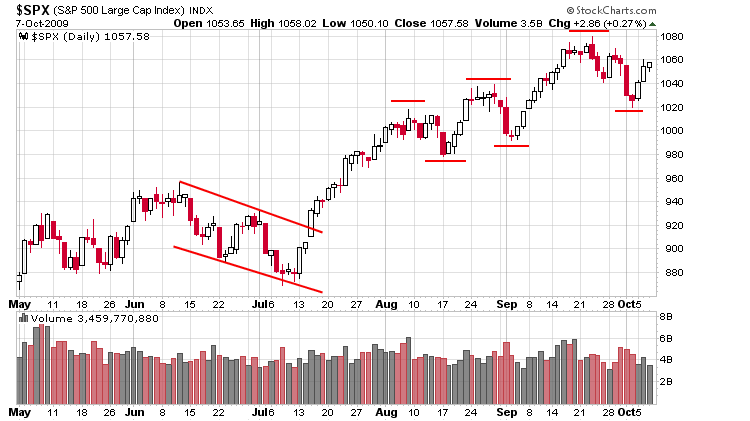

Zooming in on the shorter term, here’s the SPX daily. The ride hasn’t been smooth – in fact there’s been a couple scares for the bulls, but the overall picture remains in tact.

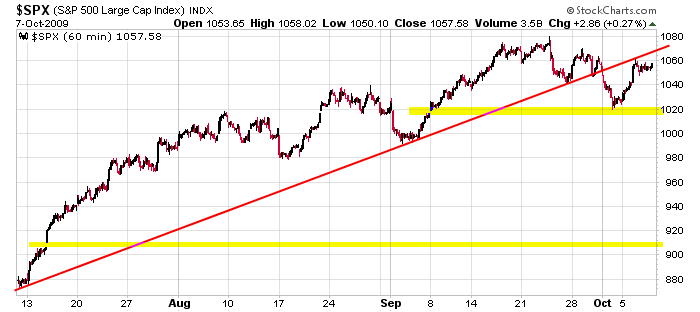

And here’s the 60-min. The trendline drawn is still significant, but it’s not like the market must drop here. There’s about 15 points between yesterday’s close and the next resistance level near 1070.

As I wrote about yesterday, put/call OI says in order to cause the most pain the market should be flat over the next 7 days. A big move in either direction will generate decent profits for one camp. Keep this in mind before you assume the indexes are going to run crazy the next week. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Oct 8)”

Leave a Reply

You must be logged in to post a comment.

if there are over 51,000 Oct call contracts at 100 for GLD, the highest amount, what does that mean for buyers or sellers? Obviously those who hold it long want it over 100 but those who sold it at or below 100, want it at or below 100. who wins and why?

Hi Ron,

There are certainly no guarantees here. When too many traders pile on one side of the market, odds favor them being wrong, but not always.

My put/call analysis is a generalization because we don’t know if the OI is buying or selling or selling as part of a more complex strategy such as doing covered calls.

This said, the call OI is sizable between 97 and 105. High put OI exists between 93 and 99. These two ranges overlap. A close between 97 and 99 would cause the most damage.

Right now GLD is at 103, so those puts are almost worthless and the bottom several call strikes are nicely in the money.

On a side note, I’ve never studied the OI for individual stocks – I’ve only used it as a gauge for the overall market.

Jason

Bull put spreads are credit spreads; they’re sold. When the puts expire worthless the seller keeps the credit. If on the other hand gld would trade through the spread the seller gets the shares put on them yet their basis is lower than if they had just bought.

Gold is a bull market. I see gld with the potential to move to $104.

Easy call I guess. Call me king of the cheap trick.

The Q’z look like they might be headed back to the 41.87 -.79 lines and cross the close of yesterday.

If they do I’d call that quite a daily ride. It used to take 2 or 3 months for some crazy price action like that to happen.

Trading spreads is usually something people with large accounts use. There is less return yet less risk.

I talked with someone a while ago that was looking for a nickle’s difference in bull put spreads in the spx. For every contract he sold he’d clean up with fifty bucks. He’d sell about 500-1000 contracts a month and far away from the market so they’d most likely expire worthless and he’d keep the difference in premiums (the credit)

It takes a good manager to handle that sort of risk and also someone with a somewhat large account.

Gold is in a strong uptrend. People are selling credit spreads like no one’s business. Anyone selling bear calls better be good managers. That’s my humble opinion.

I was looking at the possibility of the Q’z breaking down. If they dropped to fill the gap they left mid July around $35 would that be so bad? It would be a 17.0616% decline. Just horrendous. Yet at that level they’d be up 36.5587% from the March 9th low of 29.63

Now they’re up 64.6508% from March. Heck an equity should move up 65% a year! That’s only right, isn’t it?

Sam Collins wrote an article titled “We Could Be in for a 10% Correction” but now the link seems to be broken. I guess he didn’t want to spook the herd. I found the article and copied it.

I’ve heard insiders are selling quite a bit lately and also heavy traders are loading up on puts. Between the 28th/29th I noticed a huge pessimistic volume that I thought was the next step for a leg up. What I’m thinking now is large investors want to do some selling at these levels and will be expecting quite a dip before they buy back in.

I’m wondering if that dip could be at the 35 dollar level.

Any thoughts?

A. Gene Young

713.294.5240

AGeneYoung@yahoo.com