Good morning. Happy Monday. Hope you had a nice weekend.

Today is Columbus Day. The stock market is open, but fixed income and currency pits at the CME & CBOT are closed. Today will likely be slow. …

As is usually the case, I don’t have much to add to my weekend comments.

The market moved up all 5 days last week. The S&P is within 9 points of a new 52-week high; the Dow is within 140 of 10,000.

Six trading days ago the bears were once again getting excited about a top being in place and a big move down in the beginning stages. Here were are near the highs. When will they learn? There’s a long list of reasons the market should top and fall, but there’s one reason to not bet on the down side – because the market is moving up. Simple as that. End of story. Price action rules, and as long as the trend remains up, as long as the market continues making higher highs and higher lows, why fight it. To succeed as a trader, you have to trade what’s happening, not what you think or should happen.

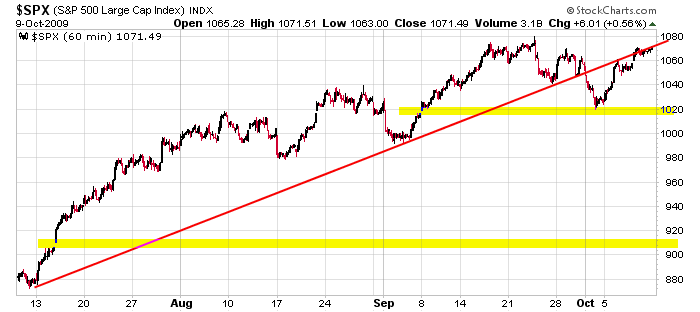

Here’s the SPX 60-min. The trendline drawn is still in play. It’s acted as support and resistance enough times to be considered significant, so let’s keep it in the backs of our minds. And there are still a couple unfilled gaps.

If a top were to be put in place soon, I’m thinking Dow 10,000 has to be taken out first. The media will be all over it, and a round of buying from Joe Public is exactly what Wall St. would love to sell into. It’s another thing to keep in mind. The media is a trader’s friend. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 12)”

Leave a Reply

You must be logged in to post a comment.

The Q’z look as if there’s a strong possibility for them to trade in the next couple weeks @ 39.19635 I don’t know if that’s one of those levels it’s running from or it will head to.

It makes sense for gld to move up and the indication I’m getting is extreme volatility. I’ll have to wait and see. The Q’z also are indicating extreme volatility.

I’m not sure which way either are going but I do know they’re going to move.

11:40 am

The Q’z can be hedged right now for a cheap trick.

.QQQKR 0.67

.QQQWO 0.68

When either option doubles sell it then take the profit off the move back to the other one.

These are Nov 09 Calls (39 days to expiration)

One final note, if they break through the upper bands and you break even on the hedge with calls you’ll end up with puts at no cost. They are not worthless if they’re out of the money there. On a volatility spike down that position can be used to sell or buy a spread, depending on your opinion of the market at that point.

The Q’z look like they’re going to move down . . .

42.14638

.GCZVZ 1.35

These puts have lost 0.55 to day. I think they might be in for a 50% retracement.

If you picked up 10 contracts (1350) you might be able to collect a couple hundred in the next few moments.

. . . if that gap fills today.

gld is developing a potential trading line @ 108.71415

in the next several weeks, maybe after options settle this month.

I’m doing too many things at once. I should be minding the store. I meant . . .

.QQQVQ 0.59 -0.15

here:

42.14638

.GCZVZ 1.35

@ 12:07am

sell those puts! 🙂