Good morning. Happy Thursday.

The world markets are mixed. The Asian/Pacific indexes closed up, but gains are not great. Japan was the big winner with a 1.8% gain. Europe is down across the board, but there are no 1% losers. Futures here in the States suggest a gap down open for the cash market. …

Yesterday was of course a big up day. The Dow closed above 10K, and banking group closed at a new high. So far earnings season is being well received, but many stocks are gapping up and selling off after reporting. AA and INTC did this.

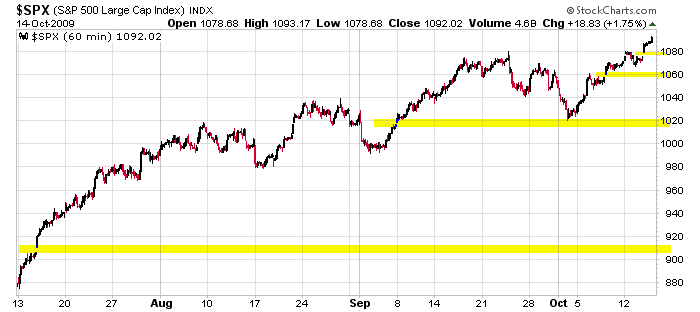

Here’s the daily SPX. I really wanted a rest near resistance because the index had 60 points in 5 days – not a great foundation for building additional gains. A few poor earnings report to cast a little doubt on the trend would have been nice, but no dice. With 7 of 8 up days, how much further can it go? The blue line is drawn parallel to the upsloping red support line. It marks a level I’ll be watching closely.

Yesterday also added another unfilled gap to the mix.

No way do I try and pick a top…but at the same time, with 7 of 8 up days, let’s not get lazy.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Oct 15)”

Leave a Reply

You must be logged in to post a comment.

Question rather than a thought. You keep mentioning “unfilled” gaps. Is the rule that those gaps will be filled, and if so, is there any certain time frame to fill them? You’ve also referenced the very low resistance that is present between the 1000 level and the “pre-Lehman” levels of around 1200. What comes 1st? The fill of the Lehman colapse & then these unfilled gaps we’re seeing now down to the 910 level on your graph above, or how do you see it playing out???

Hal –

Gaps act like magnets…they pull on stocks or the market. Why? I don’t know. It’s just the way it is. Perhaps it’s a self-fulfilling prophecy. Most gaps fill…some soon after they’re created, others months later.

As far as what happens first, a move up or move down, I can’t tell you with any degree of certainty. If I definitely knew the answer, I’d be on the front cover of Forbes as the richest person in the world. All I can do is play the odds. Right now the trend is up, so I’ll sticking with the long side.

Jason