Good morning. Happy Monday. Hope you had a nice weekend.

Every foreign market is up. Asia/Pacific, Middle East, Europe – you name it, it’s posting gains right now. Futures here in the States suggest a large gap up open for the cash market. This comes after 5 consecutive up days last week.

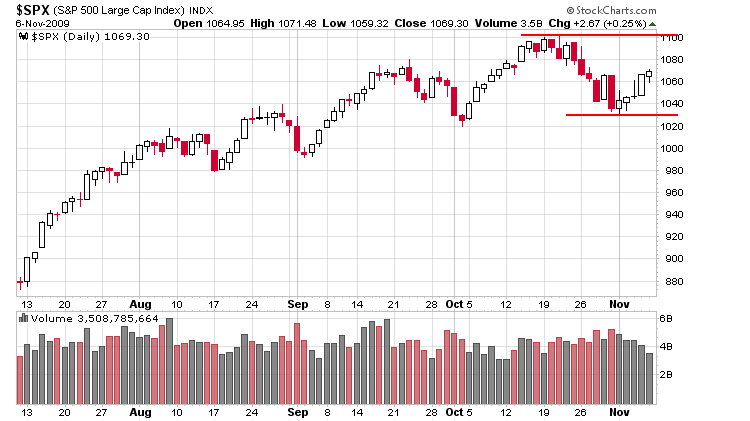

As noted over the weekend, the charts aren’t very telling. The SPX and DOW remain in nice uptrends (higher highs and higher lows remain in place and no technical damage was done on the most recent pull back). The Nas and Russell made lower lows and a few key groups such as the banks and semis traded down to their lowest levels in a couple months. The small caps have underperformed the last month. The market may be rolling over, the uptrend may be nearing an end, but the bulls won’t die easily.

Also as noted over the weekend in The Difference Between Going Long and Going Short, unlike bottoms which often form in a single hysterical day, tops take weeks and sometimes months to form. Even if a top is being put in place right now (there’s no guarantee of this), there will be many false moves up to completely frustrate the bears.

Trade the charts as they unfold. Coming into this week, the charts were not clear to me; I don’t have a strong bias.

Here’s the SPX daily. There’s nothing too telling here. It’s smack in the middle of its most recent high and low.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers