Good morning. Happy Wednesday.

After 6 consecutive up days, the market rested yesterday. Volume remained uncharacteristically light and the range was smaller than the previous week.

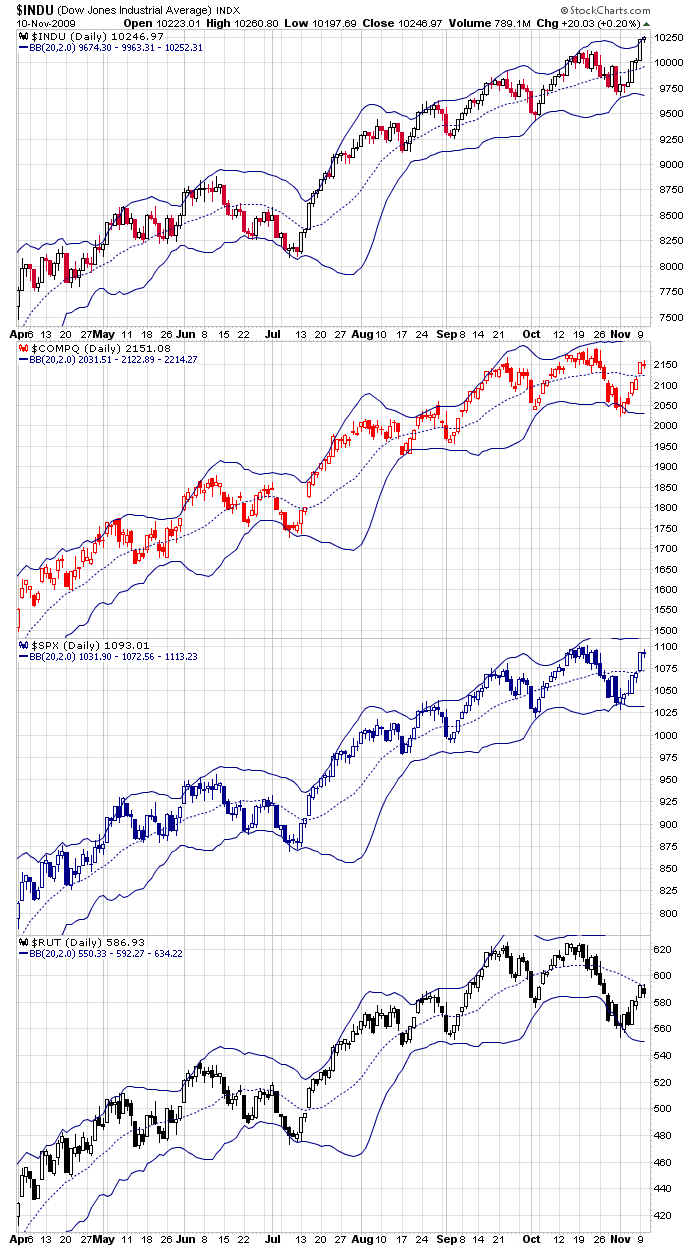

The diverging indexes continue. The Dow is at a new high – easily above 10K; the S&P is very close to its Oct high; the Nas isn’t too far behind the S&P; the Russell has a lot of catching up to do. A move up will not go far without the small caps. Here’s a graphical view of the indexes. The Dow is at its upper Bollinger Band; the S&P and Nas are in the upper half; the Russell is getting rejected by its center band which is the 20-day EMA. Something has to give; this cannot continue.

Today, the Asian/Pacific indexes closed mostly up, and Europe is currently up across the board. Futures here in the States point towards a moderate gap up open for the cash market that will put the S&P near its high. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers