Good morning. Happy Monday. Hope you had a nice weekend.

Side note: I didn’t always have good internet access last week, and when I did, I wasn’t always able to use my own computer. I’m a little behind responding to email etc. Give me a day or so, I’ll catch up.

To the market: The Asian/Pacific markets closed mostly up with big gains – China and Hong Kong gained more than 3%. Europe is currently down across the board – there are several 1% losers. Futures here in the States are flat – they were up a bunch overnight.

As I talked about in the weekend report, there are many possible outcomes to the Dubai news. The best entails large investors stepping up to buy the assets and debt of the troubled fund, and the situation goes away very quickly. The worst is a combination of this being just the tip of the iceberg (there are many other large investors in Dubai and other places that also can’t make payments) and this could cause a ripple effect and again bring down the financials.

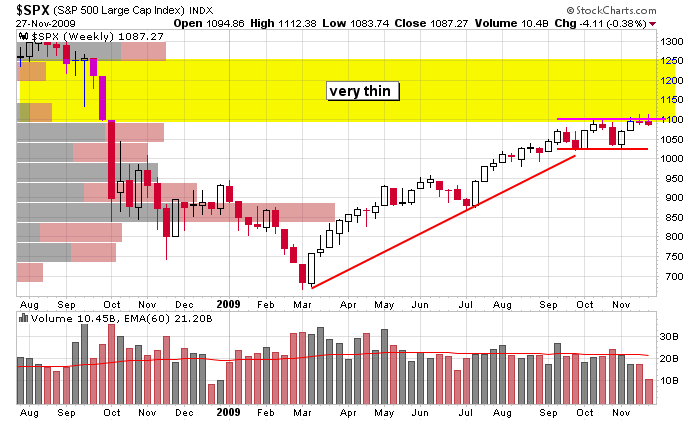

Here’s the SPX daily. The index is consolidating within an uptrend and struggling at the top of its pattern which is also the bottom of its thin trading area.

Research this weekend revealed many more good long set ups than short, so we have stocks to play if the market rebounds. If the market falls apart, stick with the reverse ETFs or inverse ETFs. You get less bang for your buck, but less risk too.

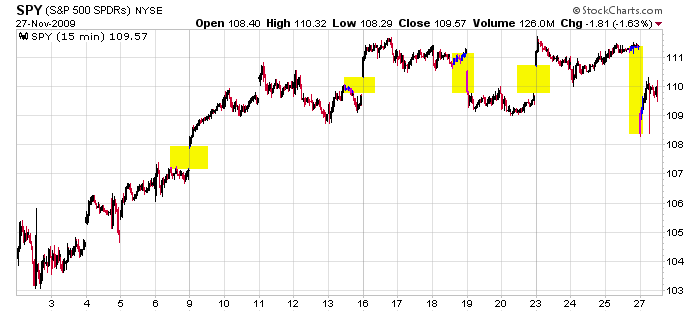

Here’s the 15-min SPY. Every week we have at least one big gap – heaven for a day trader, not fun for a swing trader. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers