Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed – there were a couple 1% movers. Europe is currently up across the board. Futures here in the States are up several points, so for now we’ll get a gap up open for the cash market. Yesterday at this time we were in the same situation, but the market opened flat.

Charts of individual stocks continue to act fairly well while charts of the indexes are stuck in a tight range with lots of gaps and sudden moves.

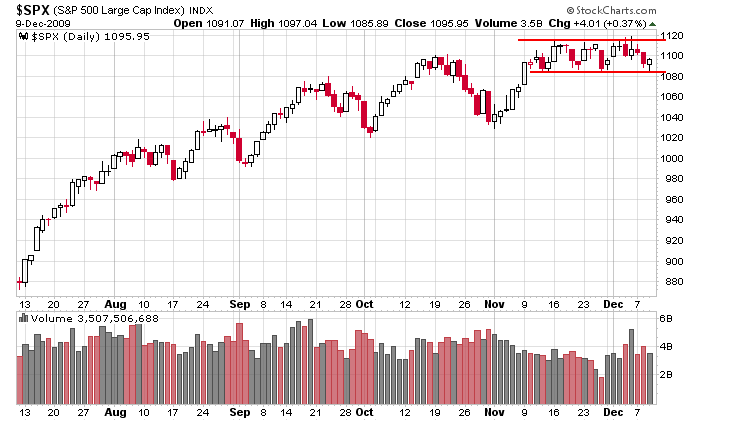

Here’s the daily S&P – nothing wrong with this chart. Steady uptrend now resting in a 5-week consolidation pattern. For now I’d consider the action healthy and constructive and necessary for the bull’s case. But the longer it lasts, the more I dislike it.

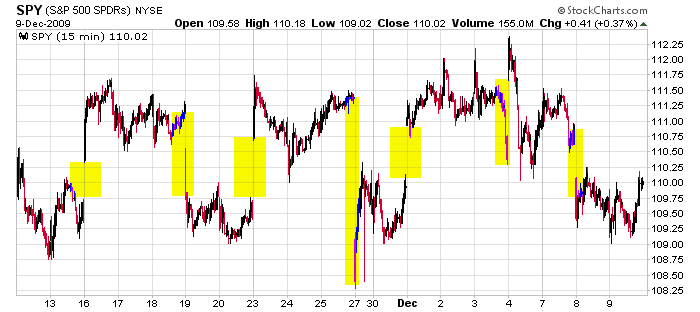

The daily chart looks unassuming, but that’s far from the environment we’ve had to deal with. Here’s the 15-min SPY; it shows gaps much better than the SPX. Getting volatile and sudden moves is perfectly fine, but when most of a move comes in the form of a gap, great set ups can be rendered not playable.

Watch the banks; they’re still lagging…and of course the dollar. And until the market breaks free from the tight range, keep trades shorter term.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers