Good morning. Happy Tuesday.

The Asian/Pacific market closed mostly up – China lost 2.3%. Europe is currently mostly up. Futures here in the States suggests another gap up open for the cash market.

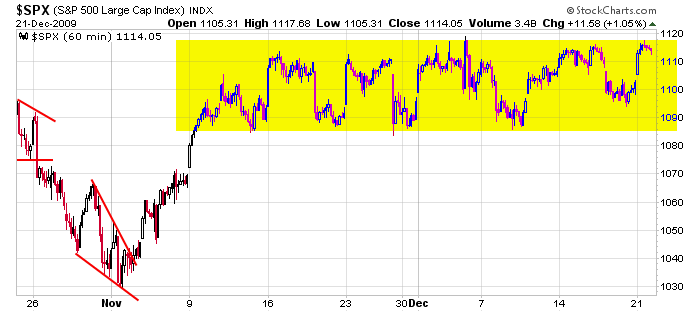

The S&P’s high from earlier this month is 119ish. If the futures market doesn’t change much before the open, that high will be hit. Last week the bears once again got excited and the bulls a little nervous. I stayed the course. The overall trend has been and still is up, and there have been many more very good long set ups than short. I really don’t understand why traders fight the obvious, but I guess that’s what makes a market. Here’s the 15-min S&P. The range continues, and today we’ll see if the market is ready to bust out or not.

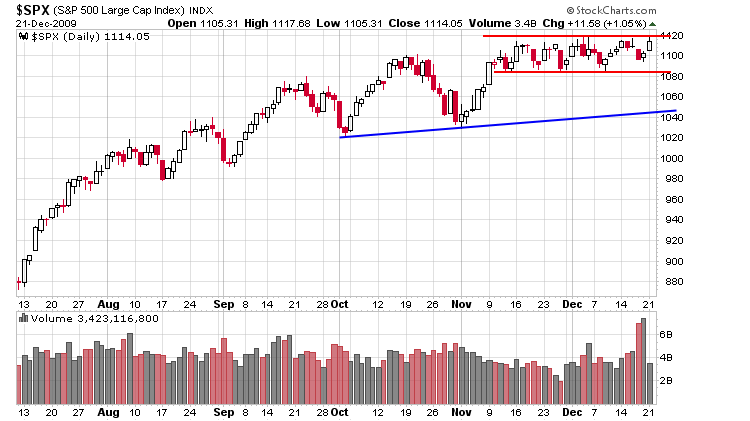

I’ve said all along there was nothing wrong with this daily chart. The gaps might be frustrating. The lack of follow through might be frustrating. But overall the trend remains in place.

We aren’t without warnings. The banks are still lagging, and the small caps have some catching up to do, but let’s not complain. Climbing a “wall of worry” is better than climbing a wall everyone agrees with.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 22)”

Leave a Reply

You must be logged in to post a comment.

‘I really don’t understand why traders fight the obvious’

Well, what a pleasure to know that I’m in the company of the most successful trader in the world who is obviously perfect when it comes to trading. Never thought he’d be one of the Leavitt Brothers though. I am truly amazed.

I used to enjoy reading your summary on the open, but I shan’t bother from now on when your posts are seasoned with such arrogance. To tell you the truth, your summary was really starting to become very, very boring anyway.

John…print a copy of the SPX daily chart above and take it to the local kindergarten. Ask all the kids: “is the line going up or down?”

Stating the obvious – something a 5-year old could identify – is not being arrogant.

As far as being boring…good, that’s the way I want it. Despite all the hoopla created by the media, the market IS very boring. If you think it’s exciting, you’re here for the wrong reasons.

mr john, the reason for this blog and morning market commentary is not to give anybody free advice, it is to promote something. if you think in those terms, you can find more inner peace 😉

keller has a different take on the same picture in his blog. you may want to check it out for a second opinion if you care for it.

I don’t know who Keller is.