Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week (this was written during the day Monday, so it uses data from over the weekend). Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

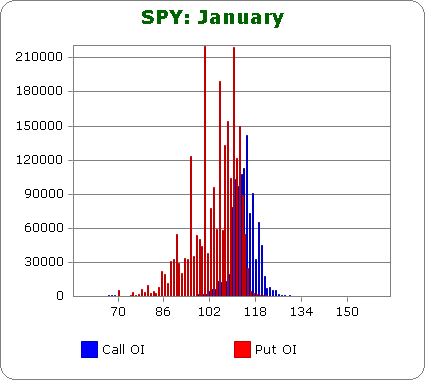

SPY (closed 114.57)

Puts outnumber calls 2.5-to-1.

Call OI biggest between 110-117.

Put OI biggest at 113 and below.

With SPY closing in the mid 114’s, any more upside from here will help generate decent profits for the call buyers, and with the big block of put OI starting at 113, we don’t want to see a drop too far below that. To cause the most pain, a close around 112/113 – about 1.5 points below the weekend close – will do the trick.

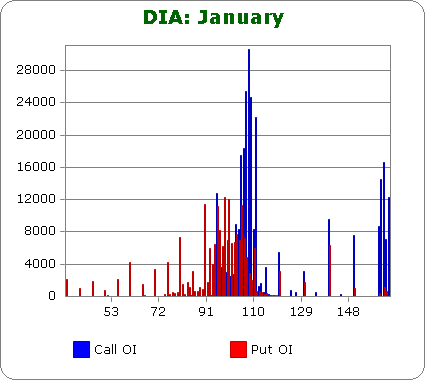

DIA (closed 106.11)

Calls outnumber puts by a small margin.

Call OI biggest between 105-117 and then way over on right edge between 170 & 200.

Put OI is steady between 95-106.

This is the first month in many calls have outnumbered puts for any of these ETFs. There’s some overlap between the call and put OI around 105/106 which is slightly below the closing price (106.11). A flat to slightly down market this week will close most of these options worthless.

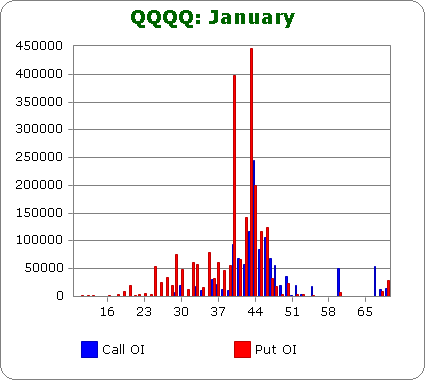

QQQQ (closed 46.55)

Puts outnumber calls 1.75-to-1.0.

Call OI biggest between 40-48.

Put OI is high at 46 and below with a couple huge spikes at 40 & 43.

There’s some overlap between 46 & 48, and with the ETF closing at 46.55, a flat to slightly up market will cause the most pain.

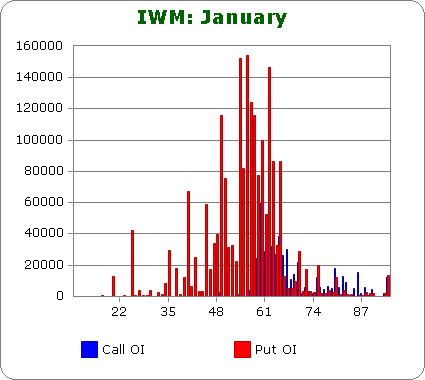

IWM (closed 64.52)

Puts outnumber calls by 4-to-1.

Calls biggest between 59-67.

Puts biggest at 65 and below.

The call OI is almost irrelevant here because the put OI is so big. In fact I’ve never seen it this one-sided. With IWM closing in the mid 64’s, it can’t move down too much or else some of the put buyers will make a few bucks. Flat to slightly up trading is best.

Overall Conclusion: Once again the bears aggressively bet on the downside, and barring a massive sell-off, they’ll once again be wrong. Overall, flat trading would cause the most pain.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Truly an interesting suggestion. How often does it prove to be accurate?

are you taking into consideration futures options and index options? analyzing spy oi without taking a look at spx and es/sp options seems pointless. esp the futures side is quite active.

still, interesting idea. is it your invention mr jase? 😉

mr jayson, please tell mr aaron we are buying bonds at every dip below 115. stocks have been fun while it lasted, but time for some real action. 3% 10y yields on the way. not sure how much longer they will let us buy under 115, we may need to start paying up. but after any gap down and post-auction selloff, we buy at the 10 am (et) dip. for amateurs, tlt calls are not liquid but they will write you as much as you want if you pay up 10 or 15 cents above bid. regards to the bond king 🙂

I’m assuming the pain is on the write side. Could you make a dollar chart showing the break-even point? How much would be lost/gained per point move. That would standardize it into an indicator.

Seems you’d have to have one for PUT’s and another for CALL’s. Don’t see how you could combine them otherwise why not just use the VIX.

I could see this being an outlier indicator looking for big hedge moves that might indicate the writers are worried. Maybe a writer worry indicator, WWI.

I do a lot of covered calls and expiration week is my buy’em, hold’em, or roll’em time. Anything that would give me an edge would be appreciated.

Rich…I like to keep these numbers in the back of my mind, but I never trade off them. If the market is “supposed to” move up while I’m long, I wouldn’t hold under the assumption these numbers will force the market up. IMO it’s good background info, but in the end I’ll chart the charts as they deserve to be traded.

Jason

Sometimes you’ve got to read between the lines on the chart.

Fascinating and humorous. Makes great intuitive sense. Have you quantified the results over time?

Howard…I have not officially tracked the success of these numbers every month, but my sense with loosely following them is they do a pretty good job heading into the OE week. Sometimes we get some crazy movement the last day or so, but by then it’s too late. I don’t trade exactly off the stats (I’d never hold a position assuming the market will act a certain way), but I do like to keep them in the back of my mind.

Guys this is great for doing Butterfly credit spread