Good morning. Happy Friday. The bulls are probably wishing this day came sooner because sometimes, once momentum builds, the only thing that stops it is the end of the week.

The Asian/Pacific markets closed down across the board – most of the markets lost more than 1%. Europe is currently down across the board – several 1% losers there too. Futures here in the States point towards a down open for the cash market.

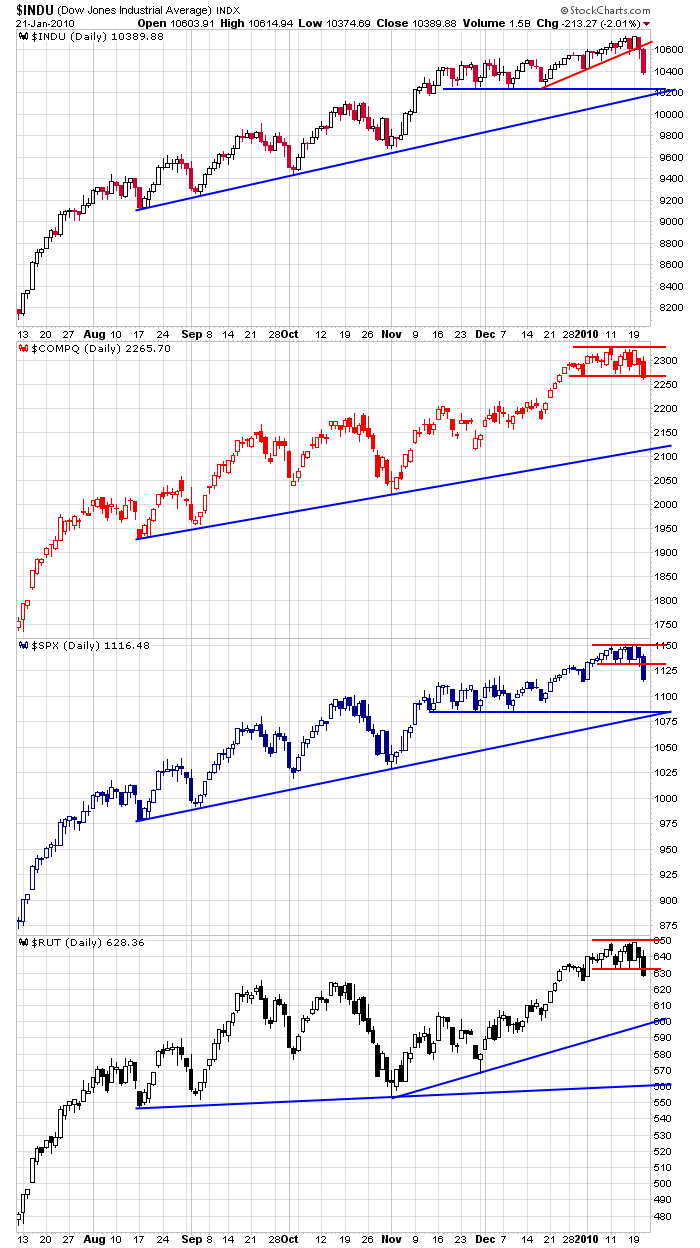

When this shortened weak began, the long and intermediate term trends were up and the short term trend was neutral. Due to the lack of good set ups to trade and several other conditions I talked about in yesterday’s post-market report, I had shifted into conservative mode. This has served me well this week. The S&P has lost more ground the last two days (on huge volume) than it has any two-day period for many months. The long and intermediate term trends are still up, but the short term bias is down.

If yesterday’s action would have played out after two weeks of falling prices, I’d call it a potential washout and look for an oversold bounce to follow. But it didn’t. Instead it occurred near a top and in the process of breaking a support level. This tells me it’s the beginning of at least a mini leg down, not the end of the selling pressure. Here are those daily index charts again with target levels I’m eying.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 22)”

Leave a Reply

You must be logged in to post a comment.

Jason I think you are nailing this one. The question is at this point how far and how long will the markets fall?

mr jayson, please tell mr aaron that we are out of bonds @119. 4 points is enough for this leg. not looking to short, looking to buy dips in fact. q1 will be up, q3 will be up big and the year overall will be up for the bonds. regards to the bond king 🙂