Good morning. Happy Monday. Hope you had a nice weekend.

I’m a little behind with returning email etc. I left LA Saturday afternoon…drove all night (huge snow storm in Utah)…got home late morning yesterday. When I put my 15-month old daughter down to sleep, I fell asleep in her bed with her. Cute? Yes. But not good for catching up on email etc. I’ll get caught up today.

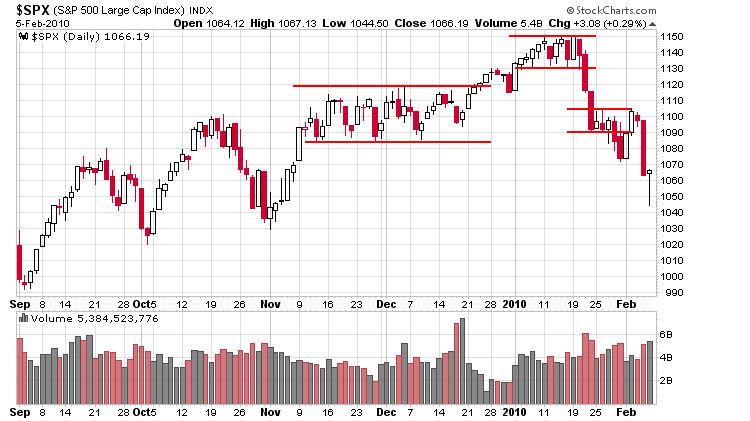

The Asian/Pacific markets closed mixed with a bearish bias. Europe is currently mixed. Futures here in the States point towards a slight positive open for the cash market. This comes off a potential turnaround day last Friday which saw the indexes drop hard early (to follow through the previous day’s selling pressure) and then rally on strong volume to close positive.

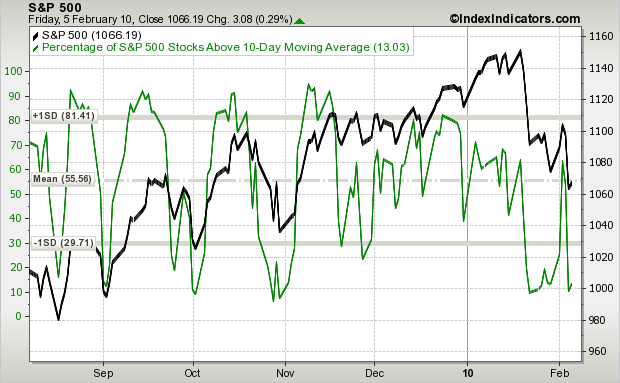

In my opinion, we are in a similar situation as last Monday. There are certain short term breadth indicators that have hit levels that have led to bounces during the 11-month bull run. Many of the indicators are at those levels now, so failure to bounce right now (for at least a couple days) would constitute a change in character for the market.

The % of S&P stocks above their 10-day MA is one such indicator. Each time it’s reached the 10%-ish area (early Sept, early Oct, late Oct) the market bounced. Here’s the chart.

Here’s the S&P daily. What happened last Thursday and Friday may have completely washed out the sellers, but this is hardly a solid base to build on.

The market has some talking to do.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers