Good morning. Happy Tuesday. Hope you had a nice long weekend.

The Asian/Pacific markets closed up – there were a few 1% gainers. Europe is mostly up. Futures here in the States point towards a moderate gap up open. This comes off a week where the indexes grinded higher within a range.

The long term trend remains up (I don’t trade off the long term trend because it takes too long for the trend to change, and I’m not willing to let the market go 10 or 15% against me before I change my trading). The intermediate term trend (since mid January) is down. The short term trend is neutral. The indexes grinded higher last week, but there were enough gaps and sudden moves in both directions for me to hesitate calling the trend up.

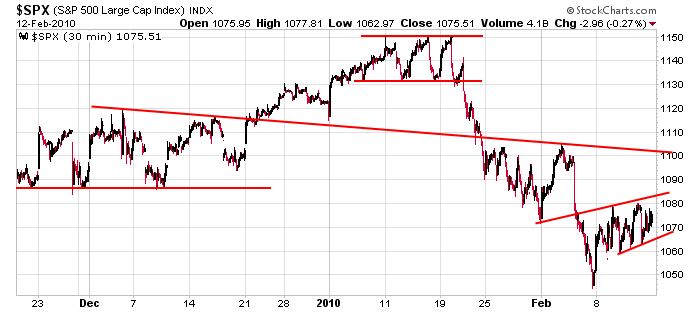

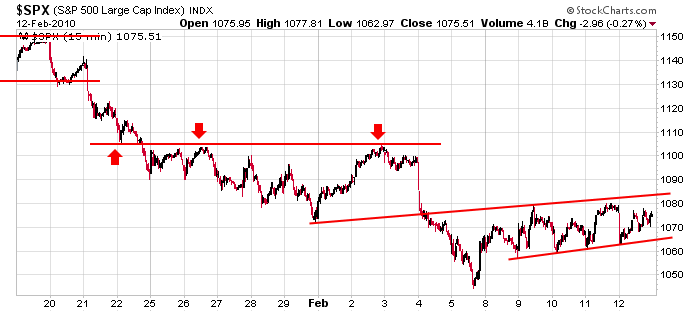

Here are the 30- and 15-min S&P charts I posted last week – both are still relevant and both have trendlines that are describing the action. I’d consider last week’s movement to be a bear flag within an intermediate term downtrend. If the index decides to move up, 1100 is my target.

Otherwise I don’t have anything to add to the weekend report. The breadth indicators still point towards a bounce, but the indexes have some proving to do and there are no doubt many traders would love a chance to set and “get out even” on any decent bounce.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 16)”

Leave a Reply

You must be logged in to post a comment.

do you see the market pegging to option prices this week?

In another post, I wrote about what needs to happen this week in order for the most pain and frustration to be felt by option traders.