When I last covered the newspaper stocks four weeks ago, my conclusion was that they were nicely trending up but were too far gone to chase. Gannett, McClatchy and New York Times has broken out and rallied in the weeks prior; only Lee remained in its pattern. Given the lack of upside potential, there was nothing we could do but wait to enter on a pullback or wait for consolidation patterns to form. Today we’ll review the charts to see if either of these two criteria has been met.

But before we check out an update of the charts, let’s consider a statement I made several times in the last report. In reference to a stock being a decent buy on a pullback, I stated “the overall market must cooperate.”

Research has shown well more than half a stock’s movement is based on the overall market and another 25% is based on the group it belongs. It makes sense a technology company that comes out with a hit new gadget can trade independent the market for several weeks at a time, but the independence doesn’t last long. A group such as publishing is far from a hot tech group. It doesn’t have the ability to buck a market downtrend, so before we ask ourselves whether these newspaper stocks may be good buys, we must first start with the overall market because if the overall market isn’t healthy, I see no reason to invest in the group.

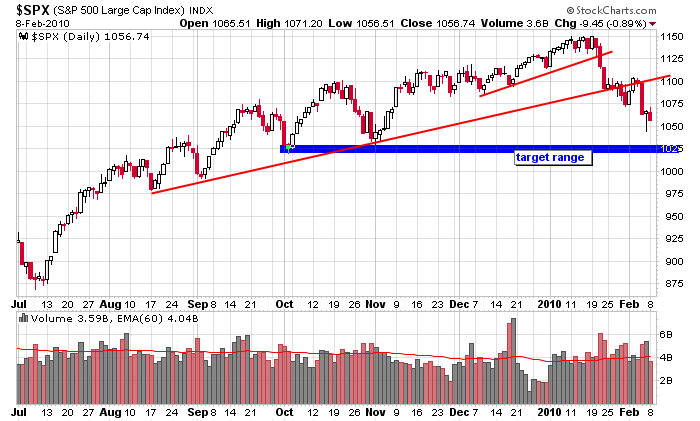

Here’s the S&P 500. Technically the longer term trend is up. It’s made higher highs and higher lows since the March bottom, and although it’s come off its high, the overall trend – especially if you look at the weekly chart – is up. But some damage has been done in the near term. A couple support trendlines have been penetrated, and recently, volume on down days has been much stronger than volume on up days. The long term trend is up, but the short term trend is down and hinting the overall trend may be turning. If you only buy stocks when the overall market cooperates, this chart should make you hesitate. The coast is not clear.

Now let’s review the same four newspaper stocks we discussed in the last report.

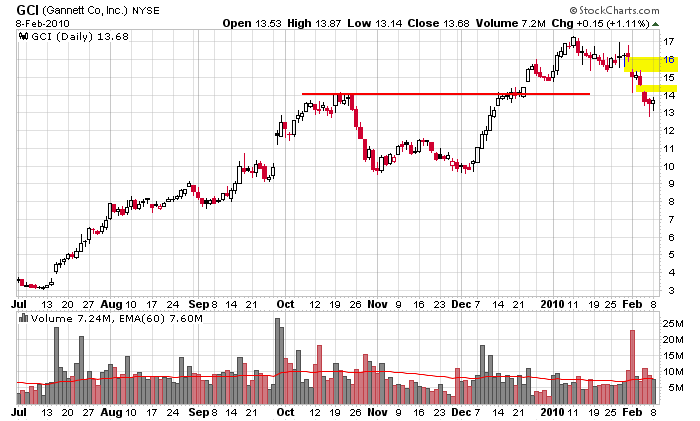

Gannett (GCI): The stock has pulled back off its high and twice gapped down. I’m would not be overly excited to enter long here. Sure it could pop and fill last week’s gap, but there’s hardly a big enough base to support an extended move up. Given the overall market, my preference is to do nothing with this stock. I don’t see a high-probability set up right now.

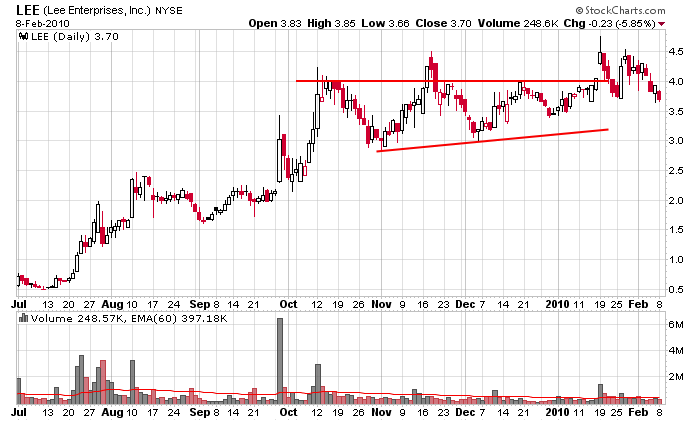

Lee (LEE): The stock was the laggard of the group – it was the only one to have not broken out. It finally did but didn’t follow through much. I see nothing terribly exciting here. If the overall market and the group are responsible for a large part of a stock’s movement, there isn’t a reason to enter here because LEE isn’t the type of stock that can run on its own.

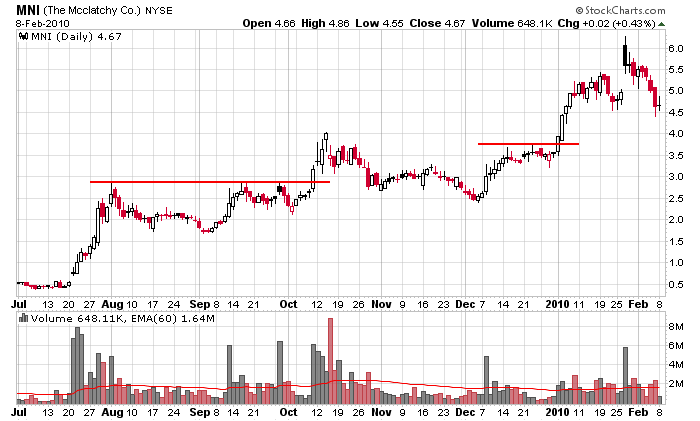

McClatchy (MNI): MNI extended its gains since the last report but gave everything back. Of the four stocks discussed here, MNI looks to have the most promise if it can firm here. For now, I’m in a wait and see mode. If the overall market can move up, this stock should test its high – not a bad percentage move.

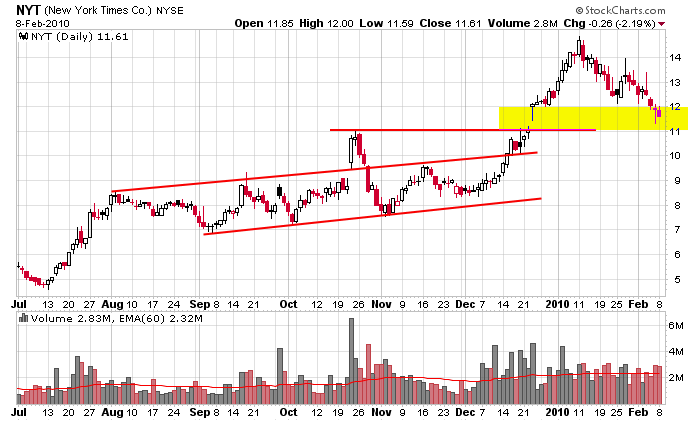

New York Times (NYT): The stock has gone nowhere the last month, but the good news is the overall uptrend remains in tact. If the stock can firm soon, and the overall market can begin another leg up, NYT could be good for a trade back up to its high.

Last week I finished by saying these stocks were buyable on dips as long as the overall market didn’t fall apart. So far the market hasn’t fallen apart, but enough doubt has been cast on it’s uptrend that I would take a “wait and see” approach with the newspaper group. Nothing jumps out as a high-probability trade.