Good morning. Happy Thursday.

The Asian/Pacific markets posted solid across-the-board gains – several index closed up better than 1%. Europe is currently posting similar gains. Futures here in the States point towards a slight up open for the cash market.

Yesterday marked the end of the quarter and month. Today is last trading day of this week. The market is closed tomorrow, and yes, employment numbers will still be released. Then starting next week we’ll have a couple weeks of jockeying for position before the next earnings season begins.

Two weeks ago I turned conservative because many indicators I closely follow were in overbought territory. I was hoping for a pullback to allow the charts to reset for the next leg up, but instead we’ve only gotten sideways trading. Oh well. The indicators have come off their highs and could turn up at any time or continue down because they are not in oversold territory yet. The overall trend remains up. The near term trend is neutral. From a technical standpoint the market is in good shape, so I’d expect new highs to be registered.

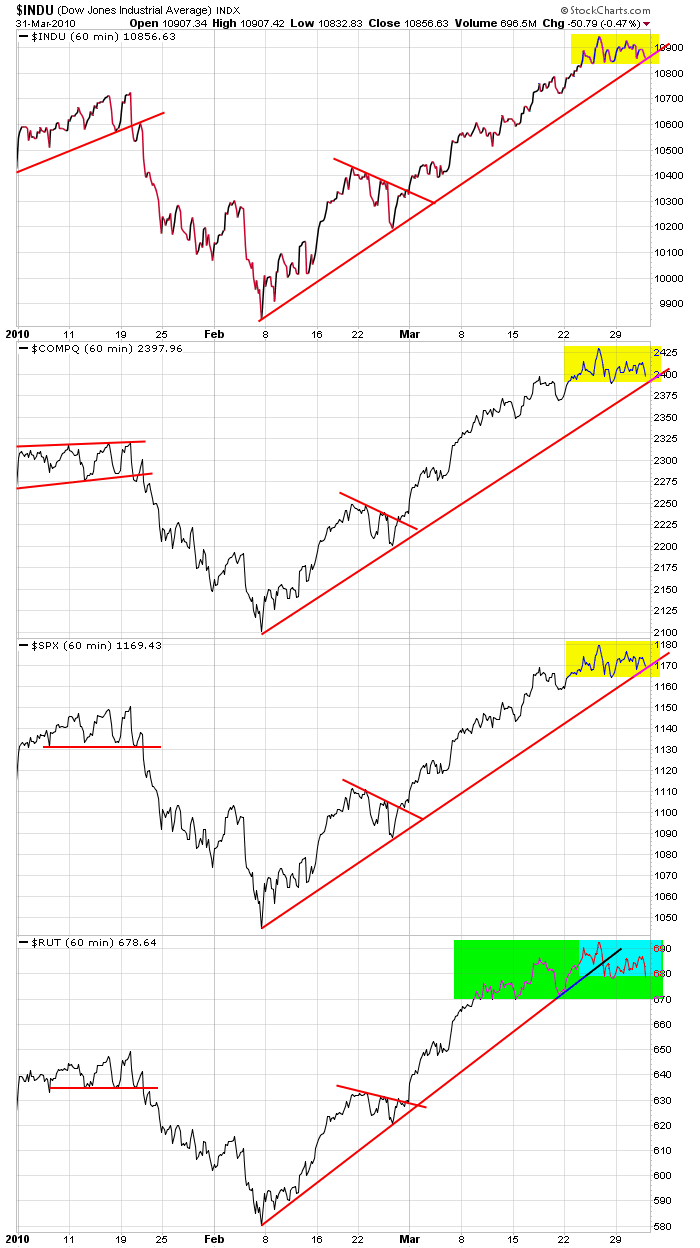

Here are the Dow, Nasdaq, S&P and Russell daily charts with their consolidation periods highlighted. Even thought the Russell made a new high last week, it started to lag in mid March…something to keep an eye on.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 1)”

Leave a Reply

You must be logged in to post a comment.

Just a thought, instead of these indexes why not nine indexes, one for each Morning Star box?

well well, here is a fellow nine box mutual fund investor. traders don’t think that way mr rich, they will track and trade whatever everybody is watching. gotta have liquidity. gotta have future contracts and options and stuff. nobody is watching or trading the mid cap blend index, believe me 🙂