Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down – there were a few 1% losers. Europe is currently down across the board – every market is down at least 1%. Futures here in the States point towards a sizable gap down for the cash market. Today’s open will be near the low of the week.

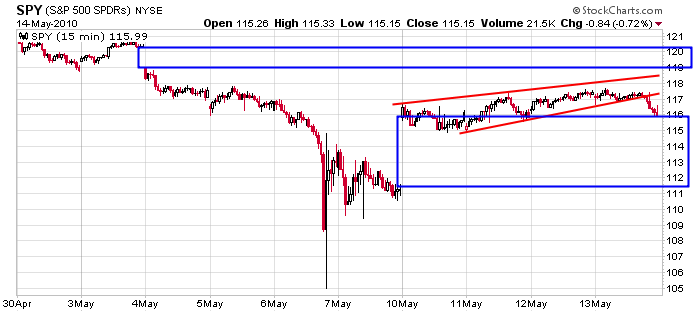

The pattern I posted yesterday did indeed resolve down. The market grinded up on declining volume and was tightening up – it had to let out some air.

Even though you could argue the trend was up, since news of the bailout in Europe was already out, there wasn’t much that could push the market higher, but since the bailout hadn’t been fully approved, there was much risk only a fraction of the $1 trillion proposed would be approved. Hence regardless of the trend, holding anything overnight was risky. We’ve been in a situation where there was limited upside and the potential for big downside.

Because of this I’ve laid low with the stock picks. The market has been great for day trading, but not so great for swing trading. Remember what Jesse Livermore said: “It was the waiting that made me the money.”

Here’s the SPY 15-min chart. According to Jason Geopfert of sentimentrader.com, the 6 other times in history the market has gapped up more than 4% (as it did on Monday), the gap filled.

I’m still of the opinion whatever move we get next will be faded. If the market drops, I’ll be looking to buy. If the market rallies, I’ll be looking to go short. Right now we’re in the middle so it’s a tough call.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 14)”

Leave a Reply

You must be logged in to post a comment.

Hi Jason!

I found today’s chart on the SPY to

be very useful to me.

When I begin trading, everday I write

notes to myself. Sort of a game plan,

if you will.

So today I copied an outline of the box

indicated above and I wrote down to

myself SPY support at 112 to 113. That’s

right about where it is at the moment. HW