Good morning. Happy Friday.

The world markets are up again. Virtually every index in Asia/Pacific closed up and Europe is posting small gains. Futures here in the States point towards a gap up open for the cash market. This comes off an extremely strong day where 1472 of the S&P 1500 advanced while only 25 declined. Check out the following stats…

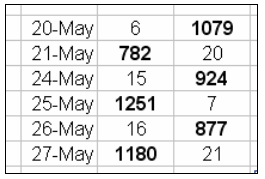

The first column is the number of S&P 1500 stocks closing in the top 20% of their intraday range. The second is the number closing in the bottom 20%. We’ve had a close at an extreme for six consecutive days. This is not common.

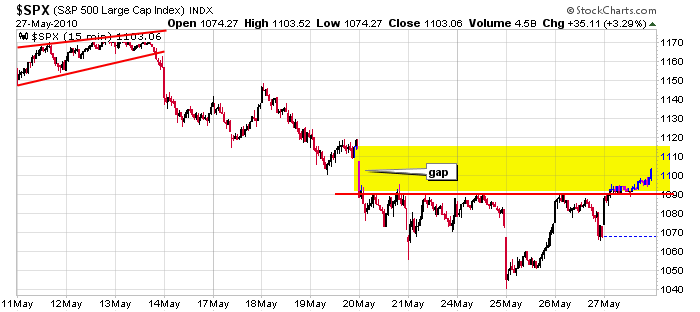

Here’s an update of the 15-min. The S&P is into its May 20 gap down but not exactly surging through it. The next resistance level is somewhere between 1110 & 1120. After that, 1140.

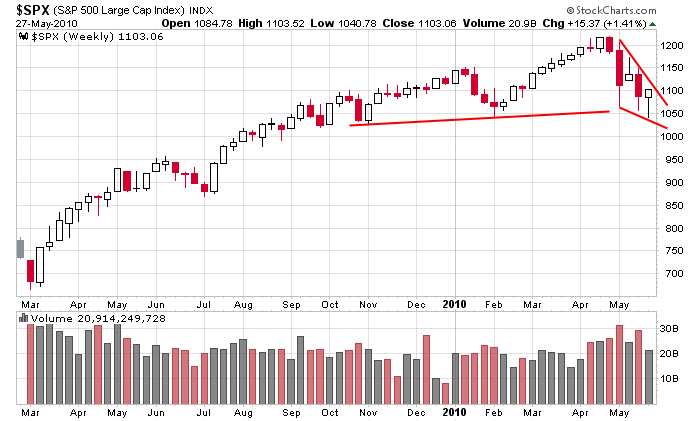

And a quick look at the weekly. It doesn’t look too bad.

The market is closed Monday. Will anyone (shorts or longs) flinch today ahead of the 3-day weekend? We’ll see. Longer term I think the market makes new lows, but in the near term, anything goes.

Go Blackhawks!!!

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 28)”

Leave a Reply

You must be logged in to post a comment.

I didn’t say the market would make a new low tomorrow…just that it would eventually make a new low. If the Dow goes to 12K, great. More meat on the bones for the next leg down.

Jason, you have commented that these volatile markets are great for day traders. I’m not sure about that. The bulk of the moves have been gaps that are unplayable.

Logic tells us that the market should make new lows, but with the PPT (if it exists LOL) and the High Frequency Traders, these things can be distorted for a long, long time.

Run a $5, $3 and $1 zigzag on a 15 minute for the past 90 days. You’ll see what Jason is talking about.

Yes there have been big opening gaps, but the intraday SPX ranges have still been > 20 points. This is heaven for day traders.

Jay looks like you’re going to be in Bend with Matt, Just need to quit the job and go full time trading to attend. That being said looking at the daily here, does this look like a bear wedge here?

I don’t see a bear wedge yet, but if the market moves down one or two more days and then bounce, then yes, we’ll have a bear wedge on the dailies.