Good morning. Happy Tuesday.

The Asian/Pacific markets got hit hard – China dropped over 4%. Europe is currently suffering solid, across-the-board losses – many markets are down more than 2%. Futures here in the States point towards a large gap down open. With the action having tightened up the last couple days, I was looking forward to a trend day which would let out some pent up energy, but unfortunately, the gap diffuses the pressure.

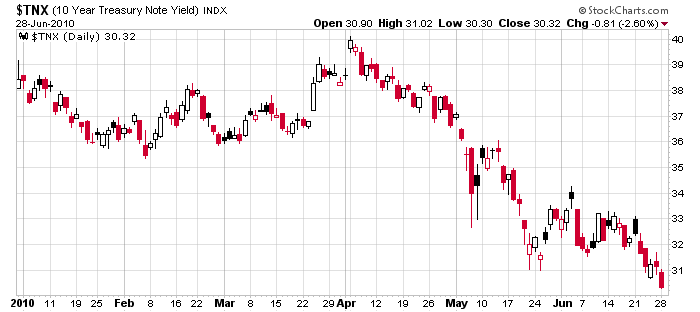

Bonds keep moving up, so yields move down. Investors would rather park their money in a bond making 3% than invest in stocks. Here’s the 10-year yield.

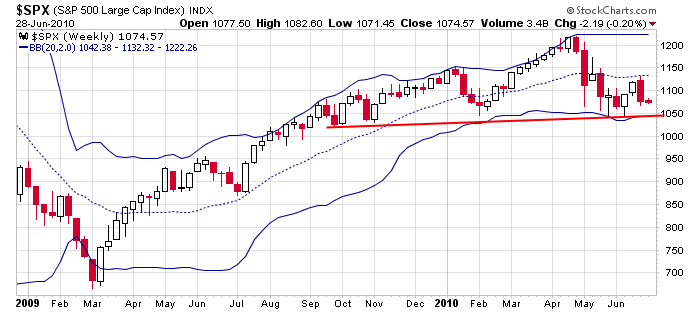

Here’s the SPX weekly. Support is in the 1040-1050 zone. It looks like the S&P is zeroed in on tested support.

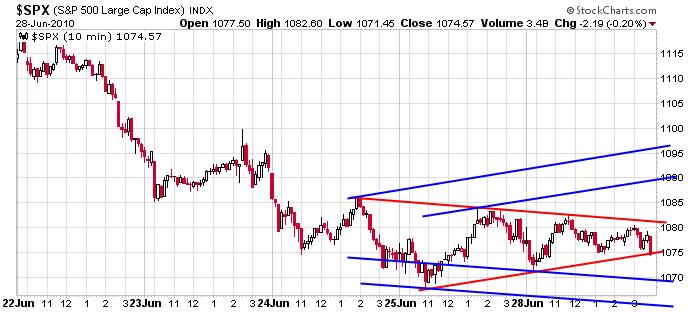

Zooming in, here’s the 10-min chart. The blue lines indicate my upside and downside targets heading into today, but the index is likely to gap below the lowest blue line.

Trades continue to be short term. I see no reason to place big bets. Many indicators have inched towards being oversold. Today’s open may get us all the way there. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

5 thoughts on “Before the Open (Jun 29)”

Leave a Reply

You must be logged in to post a comment.

vooooop voooooooooop 😉

Jason,

Does it look to you like we are completing the right shoulder of a H&S that began back in 11/09?

If it is, the S&P projects down to about 880ish.

Yes but it could easily morph into a falling wedge, so just because the neckline is taken out doesn’t mean the market will completely melt down.