Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed with a bullish bias – there were no standout winners or losers. Europe is currently mixed – also without any standouts. Futures here in the States point towards a flat open for the cash market. This comes off a very positive week where the indexes traded through at least one significant resistance level before closing the week near their highs.

I don’t have much to add to my weekend comments. Last week was a good first step in starting a leg up, but the bulls can hardly rest. There’s still work to do, and earnings season is still front and center. As of now my bias remains to the upside.

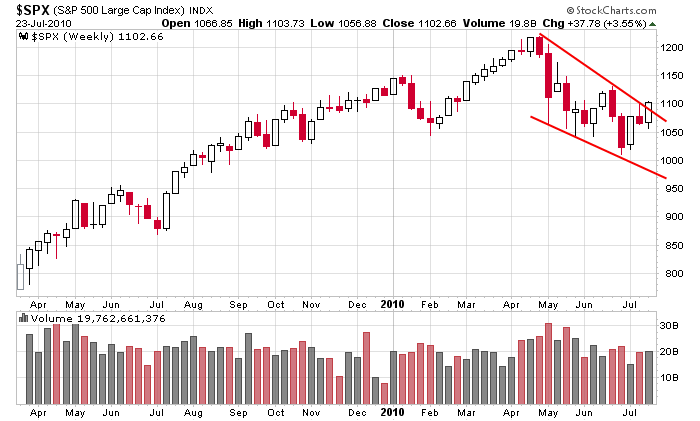

Here’s the weekly SPX. So far so good. The falling bullish wedge remains in place.

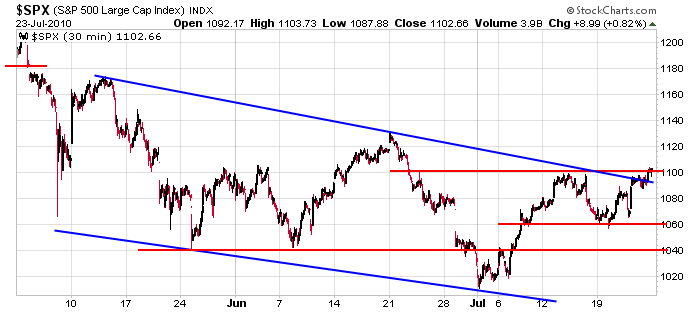

And here’s the 30-min chart. All I can say is the market is in the process of reversing its downtrend, but it’s far from a done deal. The S&P needs to clear itself from 1100 and take out that Jun high before a trend reversal is confirmed.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 26)”

Leave a Reply

You must be logged in to post a comment.

it is not bullish trend. It is break up only in last movement. So watch index. I think, market is breaish

Crox: Do you think they can go from fad to fashion?

GE broke the descending overhead trend line and does look poised for a move higher, but would wait for the usual pullback. maybe we are headed for 12000 Neil.