Good morning. Happy Thursday.

The Asian/Pacific markets closed down across the board. Europe is currently mixed with a bearish lean. Futures here in the States point towards a moderate gap down open for the cash market.

This comes off a big down day where everything fell and nothing was immune.

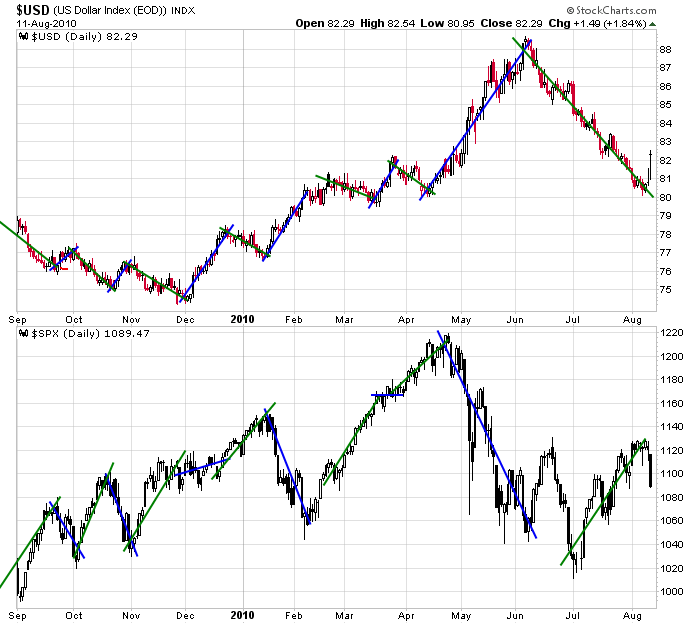

The rally off the July low was mostly fueled by commodities which were greatly helped by a falling US dollar. Now the dollar is showing signs up of life, and commodities are taking hits across the board. The inverse relationship between the dollar and the market remains in place, so if the dollar continues up here, it’ll be another tough hurdle for the market to climb. Here a chart the compares the two:

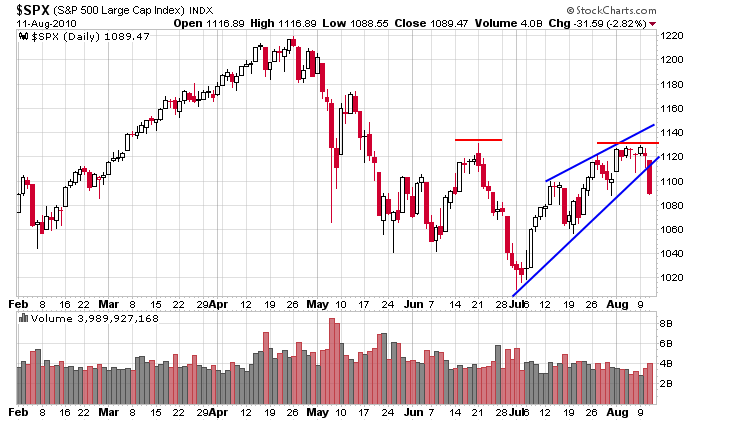

The bearish S&P wedge I’ve profiled off and on for the last couple weeks has resolved down – albeit with a gap, not with a steady sell-off through support. In the near term I expect the selling pressure to continue and push the index to 1060 and possibly 1040. After that I’ll re-evaluate. We’ve had several stiff selling days in the past that got bought up soon after, so one painful day doesn’t change the fact that the market is unchanged over the last 13 weeks.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 12)”

Leave a Reply

You must be logged in to post a comment.

CROX: Looks like EPS is outpacing price. I’d short it.