Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed – China gained 2%. Europe is currently trading with a bearish slant. Futures here in the States point towards a moderate gap down open for the cash market. This comes off a week the market gapped down 4 of 5 days and ended it near term uptrend off the July low. On an intermediate term basis, the market is neutral. It’s been basing for a couple months and although it took a big hit from its June high to July low, it completely recovered those losses. Overall this may be a sign sentiment is turning, but that doesn’t mean I’m going to get long and hold. The swings in both directions are big enough to play – just like the last 10 years have yielded nothing for those who hold, the last 3 months have done the same.

The indexes as well as most indicators turned down last week and are now in no-man’s land. My preference is to see continued selling, so the indicators can cycle down to their previous lows. It would take uncharacteristically strong buying pressure to sustain a rally from the current level.

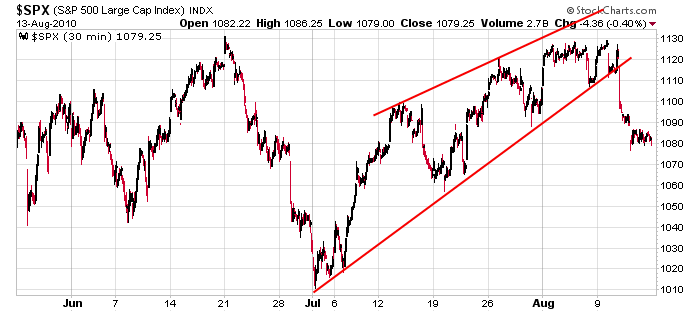

Here’s the 30-min SPX chart. This is what I mean by no-man’s land. The wedge resolved down, and although last week was painful for the bulls, if you back up, you realize the market is unchanged over the last 3 months.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 16)”

Leave a Reply

You must be logged in to post a comment.

Forget about day trading. You can even forget about swing trading. The best way to trade this market is on an intraday basis. But whatever you do ‘do not’ chase the big swings to the upside or to the downside or else you’ll get caught in a trap. I’m sure Neal has a few words to say about this feature. HW

Unchanged over the last 3 months but the pattern that is there is resolving in a negative fashion that leads me to believe july’s lows will be taken out. I saw something similar in May to june of 08. thats how I’m trading it anyway.

Good luck

With China becoming #2, don’t you think there’ll be a surge in that direction?

Which GOLD STOCKS would be the best in a covered-call income strategy?

Covered Calls. Use GOLD as a dividend paying asset. If GOLD wild always have value, always recover it’s price then it should be the perfict underlying. I don’t trade GOLD because I don’t like emotions, but GOLD make work very well as a Covered Call dividend paying asset, the question would be which stocks or ETF’s.