Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed – nothing moved more than 1%. Europe is currently up across the board – there are a couple 1% winners. Futures here in the States point towards a moderate gap up open for the cash market.

This comes off 5 consecutive gap downs…but of those 5 gap downs, the market closed higher than its open 4 times. That’s not too bad…the market reacts negatively to premarket news and the the movement of the foreign markets but then moves up during regular trading hours.

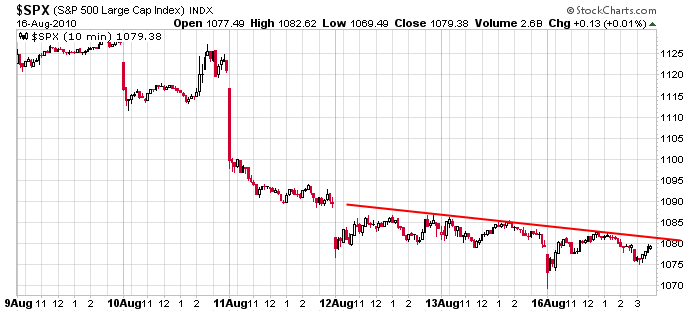

But of those 5 days, only one of them was a nasty down day. The others were relatively small losses. Here’s the 10-min chart…the S&P could easily bounce back to 1100 or higher.

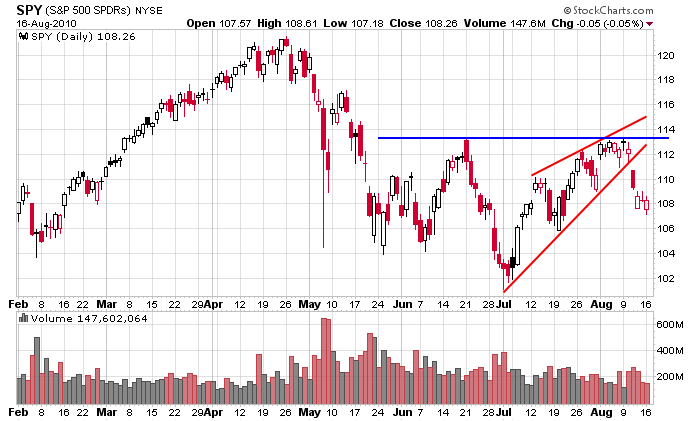

There are a couple unfilled gaps above. Here is the SPY daily…

As pointed out yesterday, if the market conspires to cause as much pain in the options market has possible, it needs to move up this week. Currently put buyers will make some money.

Given how the market has performed intraday and the need to move up to expire more put options worthless, my bias for the next couple days is to the upside. If it happens, I’ll treat it like a bounce within a downtrend because I want to see the indicators cycle down to oversold levels before attempting a sustained rally. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers