Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up – there were a few 1% winners. Europe is currently mixed with little net change. Futures here in the States are flat – this is about 8 points off the high from last night.

The market is coming off a potential reversal day. The market was weak early Friday but then trended up and closed at its intraday high. It was the strongest day we’ve had since mid July.

There are lots of things going against the bulls right now – in fact almost everything is bad. The groups we want to see leading have lagged, the small caps have lagged, news has been bad, the time of year and lots of others, but there are two things in the bulls favor right now. 1) The bull/bear teeter totter has been pushed way too far down on the bear’s side. This can’t last. 2) Three times last week bad news hit the wires, and in each case, the market initially went down but then quickly recovered. Moving up in the face of bad news is a bullish sign – at least in the near term.

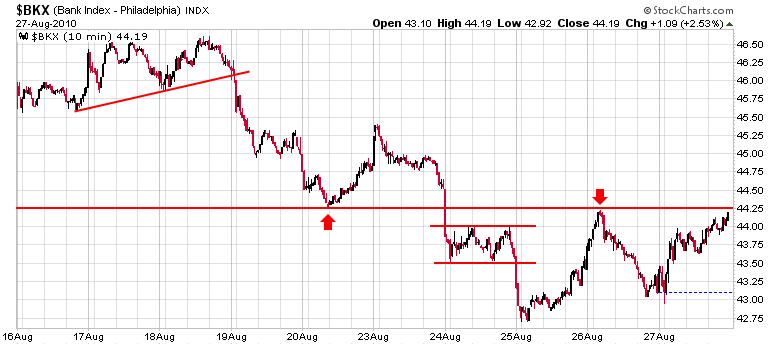

I’ll be looking for several things to confirm a bounce has some staying power. One is the performance of the banks. Here’s the 10-day, 10-min chart of $BKX. It’s close to a level that has both supported prices and turned them down.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before The Open (Aug 30)”

Leave a Reply

You must be logged in to post a comment.

Turn cycle dates are now in effect. The prevailing bullish cycle calls for the last two trading days of each month as well as the first three or four trading days of the next new month. HW

Neal: institutional buying kicks in at the end of the month. That’s why we saw a run up in the Dow last Friday +164 points. HW