Good morning. Happy Friday.

The Asian/Pacific markets closed mixed with an up bias. Europe is currently most up.

Employment numbers are out. Here they are:

unemployment rate: 9.6%

nonfarm payrolls: down 54K (better than expected)

private payrolls: up 67K (better than expected)

average workweek: unchanged at 34.2

hourly earnings: up 0.2%

Futures were flat ahead of the numbers and then surged after the numbers were released.

If you judge the very short term based on the number of stocks trading above their 10-day MA, the market has gone from oversold to overbought in two days. The number of S&P 1500 stocks above their 10 is at its highest level since early March.

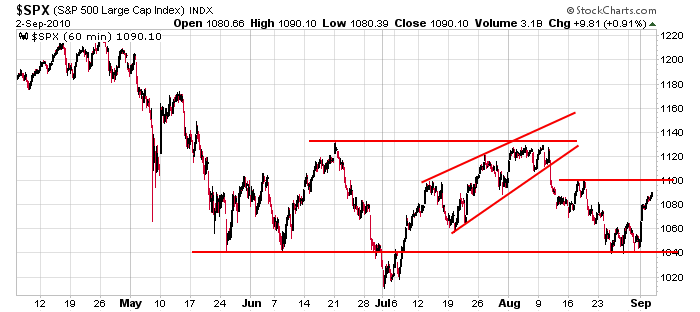

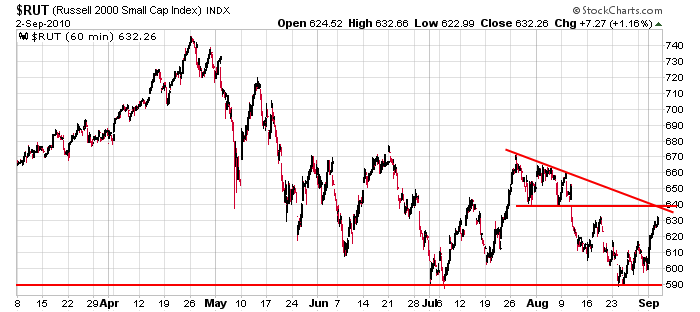

So far the bounce we’ve had off the recent low was easy…the first move is always easy because so many traders are trapped on the wrong side. But for the move to continue, real buying has to take place, and we won’t find that out until next week. There are lots of resistance levels above, so things won’t necessarily be easy. Here are the SPX and Russell charts. The S&P has minor resistance at 1100 and then major resistance at 1130. The Russell has already gotten back to its high from two weeks ago; it’s next resistance level is 640.

Enjoy the extra day off.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 3)”

Leave a Reply

You must be logged in to post a comment.

I’m still not buying in Jason, that pattern off the April highs is still targeting lower, if this bounce wasn’t so programmed and came at the goal line I would be inclined to rethink. have a good weekend

Jason said something very important today. That the first trade is always the easiest, because you’ve got so many traders headed to the exit doors when they find that they

are on the wrong side of the tracks.

One thing that I’ve noticed in particular is that you’ve got quite a few of

these panic up days and panic selling days as well. I’m

not really sure what that means, but Jason brings out a

very good point about the behavior of both day and swing

traders alike. HW